Why in News?

- Multiple wings of the government have begun to criticise the Centre's moves to gradually raise customs tariffs, particularly the more recent targeting imports of Chinese components and inputs.

What’s in Today’s Article?

- India’s Import from China and Blockade Targeting Chinese Imports

- Comparing India’s Tariffs with Other Countries and Adverse Impact of High Tariffs

- Indian Government’s Response to Allegations of High Tariffs

- Need to Gradually Reduce Duties on Imports from China

India’s Import from China and Blockade Targeting Chinese Imports:

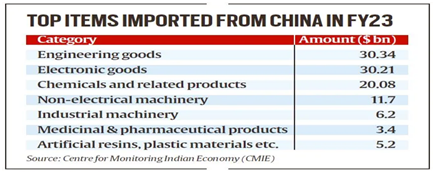

- India accounts for negligible share in China’s total trade (India is home to barely 3% of Chinese exports), but still accounts for 14% of India’s imports with -

- Not just inputs for the domestic industry in sectors ranging from electronics to pharmaceuticals and textiles to leather,

- But also, capital goods, being sourced from China.

- The blockade targeting Chinese imports had gained traction across Central ministries and departments in the aftermath of the Galwan border clash in 2020.

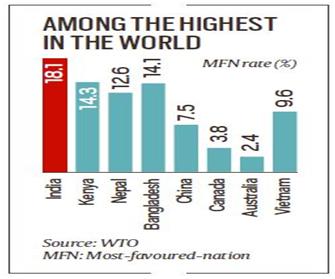

- There is an increase in the average tariffs to 18.1% in 2022 from 13% in 2014.

- Moreover, to check cheap quality imports from China, India imposed Quality Control Orders (QCOs) that restrict MSMEs from getting necessary input material.

- Tariff hikes have been undertaken multiple times covering well over 500 major item categories since 2016.

- Analysts caution that in some cases where customs duty hikes have been proposed, duties are close to or have effectively crossed the WTO-mandated “bound rates”.

- These are the customs duty rates that a country commits to all other members under the most favoured nation (MFN) principle.

Comparing India’s Tariffs with Other Countries and Adverse Impact of High Tariffs:

- Globally there is no country where tariffs are so high (as in India). India’s tariffs are higher than countries in South East Asia and even Africa.

- India is currently negotiating FTAs with developed countries which have maximum tariffs at 60% that too on products such as tobacco. India’s highest tariffs go up to 150%.

- These restrictions are now seen to be impacting sectors such as electronics and pharmaceuticals leading to either a loss of

- Domestic output or

- Competitive advantage (high production cost rendering India’s exports uncompetitive) for Indian manufacturing.

- Industries have warned of the detrimental impact of higher tariffs being used as a protectionism tool.

- India’s high tariffs pose a disincentive to de-risking supply chains beyond China.

- As a result, countries such as Vietnam, Thailand and Mexico are offering lower tariffs on components to grab the space vacated by China.

Indian Government’s Response to Allegations of High Tariffs:

- The Ministry of Commerce denies these duty increases as “protectionist” in nature.

- India’s stance on hiking tariffs mirrored the broader trend globally, and that New Delhi had shown a renewed interest in signing bilateral FTAs over the last 24 months.

- India has chosen to stay out of important mega regional trading arrangements, including the Regional Comprehensive Economic Partnership (RCEP).

Need to Gradually Reduce Duties on Imports from China:

- From the perspective of development economics, it makes sense to gradually decrease duties and integrate better with global markets and then negotiate Free Trade Agreements (FTAs).

- Protectionism is not nationalism. It only brings inefficiency (at the cost of hurting consumers).

- Nearly 8 years of protectionism have not increased India's manufacturing share of GDP (~15%), despite several sops, including extraordinary tax advantages.

- Therefore, an advanced strategy to use tariffs as a diplomatic tool is the need of the hour; otherwise, the achievements of India's manufacturing-focused thrust (including from schemes like PLI) may be in danger.

- The MeitY had pushed for a lowering of duties of about 20% on parts including circuit boards, chargers and fully assembled phones, by at least 5% points.

- This was partly agreed to and the government reduced duty on several IT goods ahead of the Interim Budget 2024.

- These calibrated changes in duty rates will -

- Help the domestic industry in capacity creation,

- Provide a level playing field,

- Easing the raw material supply side constraints and

- Enhance ease of doing business.