Why in the News?

- The markets regulator Securities and Exchange Board of India (SEBI) has warned individuals against fraudulent trading platforms.

- The SEBI has warned that certain trading platforms are falsely claiming or suggesting affiliation with its registered Foreign Portfolio Investors (FPIs).

What’s in Today’s Article?

- About FPI (Basics, Benefits, Comparison with FDI, etc.)

- News Summary

What is Foreign Portfolio Investment (FPI)?

- Foreign Portfolio Investment (FPI) involves an investor buying foreign financial assets. It involves an array of financial assets like fixed deposits, stocks, and mutual funds.

- All the investments are passively held by the investors. Investors who invest in foreign portfolios are known as Foreign Portfolio Investors.

- Foreign Portfolios increase the volatility. As a result, it leads to increased risk.

- The intent of investing in foreign markets is to diversify the portfolio and get good return on investments.

- Investors expect to receive high returns owing to the risk they’re willing to take.

- Securities and Exchange Board of India (SEBI) operates the FPIs.

- Recently, SEBI has introduced the Foreign Portfolio Investors Regulations, 2019.

- FPIs also need to follow the Income-tax Act, 1961 and Foreign Exchange Management Act, 1999.

Benefits of FPI:

- Investment Diversity:

- FPI provides investors an opportunity to diversify their portfolio.

- As an investor, you can diversify your portfolio to achieve high returns.

- Suppose if you incur major losses in investment assets of a Country X, you can accrue profits in investment assets of a country Y.

- In this way, you can experience less volatility in your investments and increase chances of profits.

- International Credit:

- Investors can get access to increased amounts of credit in foreign countries.

- They can broaden their credit base. By expanding their credit base, investors can secure their line of credit.

- In case the domestic credit score is unfavorable, having an international credit score can be beneficial.

- This allows the investor to utilize more leverage and get high returns on equity investment.

- Access to a Bigger Market:

- Sometimes, foreign market can be less competitive than the domestic market.

- Hence, FPI gives you an exposure to a wider market.

- The foreign markets are comparatively less saturated and hence, they may offer higher returns and more diversity as well.

- High Liquidity:

- Foreign Portfolio Investments provides high liquidity.

- An investor can buy and sell foreign portfolios seamlessly.

- This offers buying power for investors to act when good buy opportunities arise.

- Investors can buy and sell trades in a quick and seamless manner.

- Exchange Rate Benefit:

- An investor can leverage the dynamic nature of international currencies.

- Some currencies can drastically rise or fall, and a strong currency can be used in investor's favour.

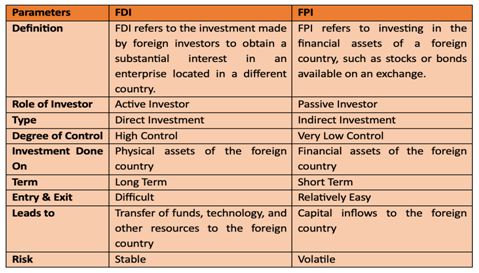

Difference Between FPI and FDI:

News Summary:

- The markets regulator Securities and Exchange Board of India (SEBI) has warned individuals against fraudulent trading platforms falsely claiming or suggesting affiliation with its registered Foreign Portfolio Investors (FPIs).

- These platforms are misleading individuals by claiming to offer them trading opportunities through FPI or Foreign Institutional Investor (FII) sub-accounts or institutional accounts with special privileges.

- The SEBI said it has received many complaints where fraudsters are enticing victims through online trading courses, seminars, and mentorship programmes in the stock market.

- They are leveraging social media platforms like WhatsApp or Telegram, as well as live broadcasts.

- These scamsters are posing as employees or affiliates of SEBI-registered FPIs, and coaxing individuals into downloading applications.

- These applications purportedly allow them to purchase shares, subscribe to IPOs, and enjoy ‘institutional account benefits’—all without the need for an official trading or Demat account.

- These operations often use mobile numbers registered under false names to orchestrate the fraudulent schemes, SEBI, said.

SEBI’s Clarification:

- The market regulator clarified that the FPI investment route is unavailable to resident Indians, with limited exceptions as outlined in the SEBI (Foreign Portfolio Investors) Regulations, 2019.

- SEBI has not granted any relaxations to FPIs regarding securities market investments by Indian investors.