Feb. 29, 2024

Mains Article

29 Feb 2024

Context

- The release of the Household Consumption Expenditure Survey (HCES) for 2022-23 marks a significant milestone after a decade-long hiatus.

- The factsheet offers valuable insights into present patterns of household consumption, but decisive conclusions should not be made due to changes in methodology, survey design, and item coverage.

- Also, it is crucial to understand key takeaways from the factsheet, notable changes, challenges in comparability, and indicators such as rural-urban inequality, inter-caste differences, and shifting consumption patterns.

The HCES for 2022-23 and Difference from Earlier Rounds of Surveys

- A New Survey Structure

- In contrast to earlier survey rounds, the HCES adopts a segmented approach by conducting three separate surveys on food items, consumables and services, and durable goods.

- This departure from the traditional single-questionnaire method aims to enhance the precision of responses by focusing on specific categories.

- While this change aligns with the need to combat respondent fatigue, it raises concerns about comparability with previous rounds that followed a more unified structure.

- Introduction of Multiple Household Visits

- Another notable change in the methodology is the introduction of multiple separate visits to households.

- This adjustment acknowledges the well-documented issue of respondent fatigue associated with lengthy questionnaires conducted in a single sitting.

- Shorter, focused questionnaires are expected to yield more precise answers. However, this modification poses challenges in terms of comparability, potentially resulting in higher expenditure estimates.

- To assess the magnitude and direction of this potential bias, a subset of households could have been subjected to the older single-visit design for comparison.

- Imputed Values for Social Welfare Programs

- The HCES incorporates imputed values for items received or consumed free of cost through various social welfare programs.

- This includes essentials like rice, wheat, footwear, laptops, and motorcycles. However, the validity of these imputed values remains uncertain until unit-level price and quantity data are released.

- Understanding the impact of such imputations on the overall consumption expenditure distribution is crucial for a comprehensive analysis.

- Changes in Item Coverage

- The survey covers 405 items of consumption, compared to 347 in the 2011-12 round.

- Such revisions in item coverage are not uncommon and are reflective of evolving consumption habits over time.

- However, these changes further contribute to the challenge of ensuring comparability across different survey rounds.

An Analysis of HCES Data for Within-Survey Indicators

- Rural-Urban Inequality

- Average all-India urban monthly per capita consumption expenditure (MPCE) at Rs 6,459 in 2022-23, is roughly 72 per cent higher than in rural areas (Rs 3,773).

- The corresponding figure was 84 per cent in 2011-12. This seems to indicate a decline in rural-urban inequality over the decade.

- However, there are two caveats. This does not account for the rural-urban price differential, which can fluctuate.

- Additionally, a longer view reveals that the rural-urban gap tends to fluctuate. From 75.9 per cent in 1999-2000, it rose to 90.8 in 2004-05, and then declined to 83.9 in 2011-12.

- Moreover, there is no indication of whether the ratio increased or decreased in 2017-18.

- Distribution of Consumption Expenditure

- In 2011-12, the ratio of the 10th percentile of the rural expenditure distribution (Rs 710) to the 90th percentile (Rs 2,296) was 0.31.

- This ratio is 0.33 in 2022-23 (Rs 1,782/Rs 5,356). In other words, the consumption expenditure of the bottom 10 per cent of the rural distribution is roughly one-third of the top 10 per cent — a ratio that has not changed substantially over the decade.

- For urban areas, the corresponding ratio was 0.21 in 2011-12, which has risen to 0.27 in 2022-23, indicating a reduction in urban inequality.

- Inter-Caste Differences

- The ratio of average rural Scheduled Caste (SC) MPCE to that of the higher-ranked castes was 0.73 in 2011-12.

- This has remained unchanged at 0.7 in 2022-23. For rural Scheduled Tribes (ST), this ratio has improved marginally from 0.65 to 0.69 and for Other Backward Classes (OBC), from 0.83 to 0.87.

- While rural India does not show a marked narrowing of inter-caste gaps in MPCE, the urban figures suggest a narrowing of inter-group MPCE gaps.

- For SCs, the ratio increased from 0.63 to 0.72; for STs, from 0.68 to 0.74 and for OBCs, from 0.7 to 0.84.

Shifting Consumption Patterns Highlighted by HCES Data

- The factsheet reveals that in rural India, the percentage share of cereals, a food staple, in average MPCE is now 4.91 per cent and 3.64 per cent in urban India, compared to 10.75 per cent and 6.66 per cent respectively in 2011-12.

- This is accompanied by an increase in the share of processed foods and beverages.

- Overall, HCES indicates a decline in the share of food expenditure over the decade, which stands at 46 per cent in rural and 39 per cent in urban India.

- There have been notable shifts which include an increase in the share of medical expenses on hospitalization, conveyance, and durable goods in rural India, and paan, tobacco, intoxicants, conveyance, and durable goods in urban India.

Way Forward: Need to Follow-Up the Survey

- The release of the HCES findings for 2022-23, while limited in scope, represents a welcome development in the pursuit of understanding India's consumption landscape.

- The provided factsheet offers valuable insights into present consumption patterns, rural-urban disparities, and inter-caste differences.

- However, its limited scope necessitates a prompt release of the full price and quantity unit-level data for the surveyed year, 2022-23.

- This complete dataset is crucial for researchers, policymakers, and analysts to delve deeper into the intricacies of the survey and draw more nuanced conclusions.

- A continuous and updated flow of data ensures a more accurate understanding of evolving consumption habits, poverty indicators, and other critical socio-economic parameters.

- Timely follow-up surveys enable policymakers to adapt strategies based on current trends rather than historical data.

Conclusion

- While the changes in HCES survey design aim to improve data collection methodologies, challenges in comparability and potential biases need careful consideration.

- The insights into rural-urban inequality, inter-caste differences, and evolving consumption patterns highlight the complexity of India's socio-economic landscape.

- For a comprehensive understanding, the swift release of full price and quantity unit-level data is imperative, ensuring that future analyses and policy decisions are well-informed and nuanced.

Mains Article

29 Feb 2024

Why in news?

- As per various media reports, the 22nd Law Commission is set to recommend the addition of a new chapter on simultaneous polls in the Constitution.

- The 22nd Law Commission is headed by former Karnataka High Court Chief Justice Ritu Raj Awasthi.

- The commission's term has been extended until August 31, 2024.

What’s in today’s article?

- Law Commission in India

- Simultaneous elections in India: Meaning

- History of Elections in India

- News Summary

Law Commission in India:

- The Law Commission of India is a non-statutory body constituted by the Union government.

- It is a commission established to ensure that the laws formed are just and fair which work towards its proper implementation.

- It can be referred to as an ad hoc body, which is constituted for the fulfilment of a particular purpose.

- Basically, it works as an advisory body to the Ministry of Law and Justice.

- However, it is not defined under the Indian Constitution. It is constituted as part of Article 39A.

- Article 39A guarantees that no citizen is deprived of the opportunity to get justice due to a lack of resources or other impediments.

Simultaneous elections in India: Meaning

- The concept of "One Nation, One Election" envisions a system in which all state and Lok Sabha elections must be held simultaneously.

- This will entail restructuring the Indian election cycle so that elections to the states and the centre coincide.

- This would imply that voters will vote for members of the LS and state assemblies on the same day and at the same time (or in a phased manner as the case may be).

History of Elections in India

- Era of simultaneous elections

- The first general elections of free India held simultaneously to the Lok Sabha and the Legislative Assemblies of the States in 1951.

- The next three cycles of elections also witnessed concurrent Lok Sabha and Legislative Assembly elections barring a few stray cases like:

- Kerala where a mid-term election was held in 1960 on the pre-mature dissolution of the Assembly, and

- in Nagaland and Pondicherry where the Assembly was created only after the 1962 general elections.

- The last occasion when we had near-simultaneous elections was in 1967.

- Beginning of the end of simultaneous elections

- The fourth Lok Sabha constituted in 1967 was dissolved prematurely in 1971. This was the beginning of the end of simultaneous elections.

- Extension of the term of Lok Sabha during the National Emergency declared in 1975 and the dissolution of Assemblies of some States after the 1977 Lok Sabha election further disturbed the cycle of concurrent elections.

- Current status

- After the two pre-mature dissolutions of the Lok Sabha in 1998 and 1999, only four State Assemblies have been going to polls along with the Lok Sabha elections in the last two decades.

- We now have at least two rounds of Assembly general elections every year.

News Summary: Law panel readies report on simultaneous polls

- The 22nd Law Commission is set to recommend the addition of a new chapter on simultaneous polls in the Constitution.

- The law panel has not submitted its report to the government.

- However, it has made detailed presentations of its likely recommendations before the high-level committee.

Key highlights

- Insertion of a new chapter

- Currently, Part XV of the Constitution deals with elections. It prescribes the role of the Election Commission and for elections to be based on adult suffrage among other aspects.

- The Commission is likely to recommend insertion of a new chapter, Part XVA, that would make provisions for simultaneous polls.

- Recommendations will be for 2029 elections

- With 2024 elections round the corner, the recommendations will now be for 2029.

- The Commission’s report is likely to suggest synchronising assembly elections in two stages in the next five years before all states can go to polls simultaneously with the next Lok Sabha elections in 2029.

- Elections for states will have to be held collectively in two election cycles over the next five years.

- The term of some may have to be extended while it may have to be curtailed for others through the Constitutional amendment.

- Then 2029 can be the third election cycle where the Centre, all states, municipal and panchayat elections can be held together.

- Tackling situations where the mandate results in a hung assembly or when a government falls midway

- The Law Commission’s prescription is to first attempt setting up an all-party unity government if a government falls during its five-year tenure.

- If that is not possible, then the alternative would be holding elections only for the term remaining before another cycle of simultaneous polls can be held.

- Contesting elections only to form a government for a short term could be a disincentive for political parties to bring down a government.

- As per the commission, a second Constitutional amendment would deal with sustainability of simultaneous polls.

- Common voter list

- The third Constitutional amendment to be recommended by the law panel would specifically deal with a common voter list.

- Currently in many states, the voter list for the panchayat and municipal elections is different from the one used for Parliament and assembly elections.

- The State Election Commissions (SECs) supervise municipal and panchayat elections.

- On the other hand, the Election Commission conducts polls to the offices of the President and Vice President, and to Parliament, state assemblies and legislative councils.

Mains Article

29 Feb 2024

Why in news?

- Recently, the Supreme Court came down heavily on Baba Ramdev’ Patanjali Ayurved for publishing misleading advertisements.

- The apex court banned it from marketing its products until further orders are passed.

What’s in today’s article?

- Consumer Protection Act

- Allegations against Patanjali

- Legal argument against Patanjali’s actions

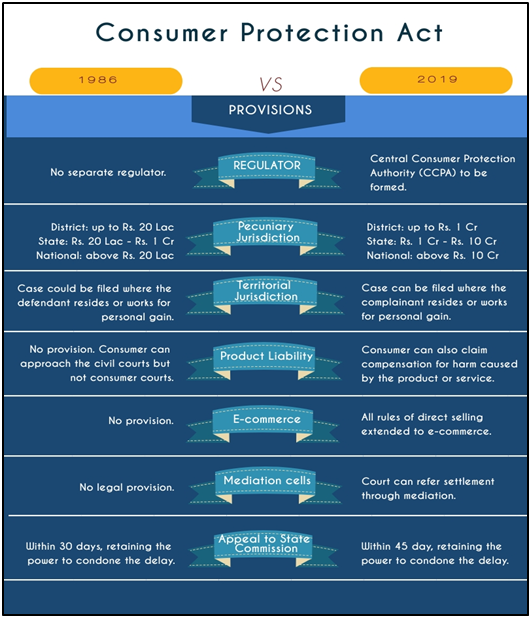

Consumer Protection Act, 2019?

- The Consumer Protection Act, 2019 replaced the Consumer Protection Act, 1986, and seeks to widen its scope in addressing consumer concerns.

- The new Act recognises offences such as providing false information regarding the quality or quantity of a good or service, and misleading advertisements.

- It also specifies action to be taken if goods and services are found “dangerous, hazardous or unsafe”.

- The Act came into force in July 2020 and it will empower consumers and help them in protecting their rights through its various notified rules and provisions.

What is Central Consumer Protection Authority (CCPA)?

- About: The CCPA is a statutory body constituted under Section 10 of the Consumer Protection Act, 2019.

- Mandate: To protect the rights of the consumer by cracking down on unfair trade practices, and false and misleading advertisements that are detrimental to the interests of the public and consumers.

- Concerned Ministry: Ministry of Consumer Affairs, Food and Public Distribution

- Powers & Functions of CCPA: It is empowered to:

- conduct investigations into violation of consumer rights and institute complaints / prosecution,

- order recall of unsafe goods and services,

- order discontinuation of unfair trade practices and misleading advertisements,

- impose penalties on manufacturers/endorsers/publishers of misleading advertisements.

Allegations against Patanjali

- In 2022, Patanjali published an advertisement titled “MISCONCEPTIONS SPREAD BY ALLOPATHY: SAVE YOURSELF AND THE COUNTRY FROM THE MISCONCEPTIONS SPREAD BY PHARMA AND MEDICAL INDUSTRY.”

- After this, the Indian Medical Association (IMA) filed a petition at the apex court.

- The petition details other instances where Baba Ramdev called allopathy a stupid and bankrupt science, and made claims about allopathic medicine being responsible for Covid-19 deaths.

- The IMA also accused Patanjali of contributing to vaccine-hesitancy during the pandemic by spreading false rumours.

- The IMA claims that these attacks against modern medicine come alongside Patanjali’s own efforts to make false and unfounded claims about curing certain diseases through the use of Patanjali products.

Legal argument against Patanjali’s actions

- The IMA claimed that the advertisement was in direct violation of the Drugs & Other Magical Remedies Act, 1954 (DOMA), and the Consumer Protection Act, 2019 (CPA).

- The publishing of false and misleading advertisements is an offence under both statutes.

- Section 4 of the DOMA

- Under Section 4 of the DOMA, there is a prohibition against publishing misleading advertisements relating to a drug.

- Publishing a misleading advertisement under the DOMA is punishable with up to six months imprisonment, and/or a fine for the first offence.

- On the second offence, the period of imprisonment can extend to one year.

- Consumer Protection Act, 2019

- Section 2(28) of the Consumer Protection Act, 2019 deals with the ‘misleading advertisement’.

- Section 89 of the CPA contains more stringent punishments for false or misleading advertisements.

- First time violations may invite penalties up to Rs 10 lakh and imprisonment for a term which may extend to two years.

- Subsequent violations may attract penalties up to Rs 50 lakh and imprisonment for a term which may extend to five years.

- The CPA also provides the definition for a misleading advertisement.

- It includes advertisements which:

- give a false description of the product or service, partakes in unfair trade practices,

- deliberately conceals important information, or is likely to mislead the consumer about the nature, substance, quantity or quality of the product or service.

- It includes advertisements which:

- Violation of MoU signed by the Ministry of AYUSH and the Advertising Standards Council of India

- The IMA has also highlighted the MoU signed by the Ministry of AYUSH and the Advertising Standards Council of India in January 2017.

- AYUSH agreed to identify misleading advertisements that may be in violation of the DOMA, and send complaints to the Council for review.

- The IMA has also highlighted the MoU signed by the Ministry of AYUSH and the Advertising Standards Council of India in January 2017.

Mains Article

29 Feb 2024

What’s in Today’s Article?

- Background (Context of the Article)

- Divisible Pool of Taxes (Shrinking of Taxes, Reasons, Examples, etc.)

- Way Forward

Background:

- Agitations by different State governments in New Delhi have highlighted many disquieting issues in the practice of fiscal federalism in India.

- In light of this, the 16th Finance Commission must take initiative to proceed innovatively to justly address complaints of increasing vertical and horizontal inequalities in devolution.

- Vertical devolution that is the sharing of resources between the Union and States.

- Within the domain of vertical devolution, there are two disturbing trends that need urgent redressal.

- First, the Union government has sought to keep an increasing share of its proceeds out of the divisible pool so that they need not be shared with States.

- Secondly, it has also not been devolving the shares of net proceeds to the States as mandated by successive FCs.

Shrinking of Divisible Pool of Taxes:

- The net divisible pool, or net proceeds, is that part of the gross tax revenue from which a share would have to be vertically devolved by the Union to all States.

- Such shares are assigned by each FC for a five-year period.

- Earlier, all corporation taxes and customs duties were fully absorbed by the Union, and only income taxes and excise duties were shared with the States.

- However, with changes over the years, culminating in a constitutional amendment in 2000, all taxes of the Union were added to the net proceeds.

- But there was a catch — cesses and surcharges under Article 270 and Article 271 were kept out of the net proceeds.

- In the past, such exclusion of cesses and surcharges were based on specific FC recommendations. But the amendment in 2000 provided a constitutional basis for it.

- Presently, the net proceeds consist of the gross tax revenue after the deduction of cesses, surcharges and the cost of collection of taxes.

Cess, Surcharge & GST:

- Over the past decade or more, several cesses and surcharges were introduced by the Union government.

- When the Goods and Services Tax (GST) was initiated in 2017, the expectation was that many cesses and surcharges would be discarded and subsumed into the GST system.

- On the contrary, new cesses and surcharges continued to be introduced, and many old cesses and surcharges remained outside the GST system.

- For instance, the Agriculture Infrastructure and Development Cess was introduced as recent as in 2021-22.

- Similarly, when the Health and Education Cess was introduced in 2017-18, it just replaced the Primary Education and Secondary Education cess on direct taxes.

- The expansion of cesses and surcharges have led to the exclusion of an increasing share of the gross tax revenue from net proceeds.

Rise in Tied Transfers:

- Cesses and surcharges have also been subjected to critical scrutiny by the Comptroller and Auditor General (CAG).

- All cesses must be transferred to a reserve fund in the Public Account of India after their collection.

- In its reports the CAG has uncovered numerous instances of either non-transfer or short transfer of the collected amounts to the respective funds.

- A CAG report in 2023 noted that if ₹52,732 crore was collected towards the Health and Education Cess in 2021-22, only ₹31,788 crore (or 60%) was transferred to the reserve fund of Prarambhik Shikha Kosh.

- The Research and Development Cess must be transferred to the Fund for Technology Development and Application.

- A CAG report in 2019 noted that the total collection of Research and Development Cess between 1996-97 and 2017-18 was ₹8,077 crore, but only ₹779 crore (or 9.6%) was transferred to the Fund.

- The Swatchh Bharat Cess must be transferred to the Rashtriya Swachhata Kosh.

- The extent of short transfer to the Kosh between 2015–16 and 2017–18 was ₹4,891 crore.

- The extent of short transfer between 2010–11 and 2017–18 under the Road Cess was ₹72,726 crore and under the Clean Energy Cess was ₹44,505 crore.

- Non-transfers and short transfers of cesses defeat the logic of their collection.

- It also reaffirms the view that cesses and surcharges are just a ruse to divert increasing quantum of funds away from the divisible pool to meet other financial requirements of the Union government.

Way Forward:

- Sharing of resources from the divisible pool, and the extent of cesses and surcharges, must be matters of critical importance for the 16th FC.

- The FC must take initiative to correct historical wrongs in vertical devolution through compensations to the States.

- It must instruct the Union government to publish accurate estimates of “net proceeds” in the budget documents.

- It must also arrange to provide shortfalls in devolution over the last decade as a lump sum untied grant to States.

- The Union government must legislatively act to have strict limits on the collection of cesses and surcharges.

- Cesses and surcharges should automatically expire after a short period and must not be rechristened under another name.

- Apart from addressing rightful complaints on the inequalities in horizontal devolution, the stance of the 16th FC on vertical devolution would be critical to the survival of fiscal federalism in India.

Mains Article

29 Feb 2024

Why in News?

- Article 371A of the Constitution of India has been the major hurdle in the Nagaland government’s efforts to regulate small-scale illegal coal mining activities in the State.

- The State government has been under pressure to regulate coal mining activities after six miners died in an explosion in a rat-hole mine in the Wokha district.

What’s in Today’s Article?

- What is Article 371A of the Indian Constitution?

- Significance of the Article 371A

- Rat-hole Mining in Nagaland and Challenges in its Regulation

What is Article 371A of the Indian Constitution?

- When Nagaland (erstwhile Naga Hills and Tuensang Area) was given the status of a State by the Constitution (13th Amendment) Act 1962 in the Indian Union, Article 371A was inserted into Part XXI of the Constitution.

- Article 371A allows Special Constitutional Provisions to the State and thus reads:

- Notwithstanding anything in this Constitution, no Act of Parliament in respect of

- Religious or social practices of the Nagas,

- Naga customary law and procedure,

- Administration of civil and criminal justice involving decisions according to Naga customary law,

- Ownership and transfer of land and its resources,

- Shall apply to the State of Nagaland unless the Legislative Assembly of Nagaland by a resolution so decides.

- Notwithstanding anything in this Constitution, no Act of Parliament in respect of

Significance of the Article 371A:

- The Constitution of India is a Federation with a strong unitary bias towards the Centre.

- However, to accommodate the large diversity of the country, its federalism is asymmetrical, and Article 371A is an example of such asymmetry.

- The Article is not only a Constitutional right and legal mechanism but also resonates with a political process - a political barometer that represents the will of the people.

- The Article is seen as one of the recourses that safeguard the collective rights of the Nagas.

- However, there were concerns that Article 371(A) impedes the State’s development.

- Article 371(A) states that land and its resources in the State belong to the people and not the government.

- Due to this provision, the landowners usually do not allow the government to carry out any development activities on their plot.

Rat-hole Mining in Nagaland and Challenges in its Regulation:

- Data from Nagaland’s Geology and Mining Department say the State has 492.68 million tonnes of coal reserves but dispersed erratically and inconsistently in small pockets spread over a large area.

- Nagaland’s coal mining policy, first notified in 2006, allows rat-hole mining as the coal deposits are too scattered for large-scale and coordinated operations.

- Small Pocket Deposit Licence may be granted only to individual landowners for undertaking rat-hole mining and shall not be granted to any company.

- However, rat-hole mining can be undertaken only with the consent of the departments concerned, including that of Forest and Environment.

- Officials claimed the State government awarded several rat-hole mining leases with proper forest and environment clearances and definite mining plans.

- This has not stopped people from operating such mines illegally.

- The unique land rights conferred under Article 371A have made regulating illegal coal mining activities more challenging.

- Therefore, residents in coal-bearing areas depend on illegal mining for sustenance and they need to be educated on the adverse effects of such activities.

Feb. 28, 2024

Mains Article

28 Feb 2024

Context

- The Election Commission of India (ECI) has recently highlighted the environmental risks associated with traditional election materials, urging a transition to eco-friendly practices.

- As the world's most populous democracy, India must prioritise environmental considerations in its electoral processes.

- The government must look into overlooked environmental footprint of elections, successful eco-friendly electoral initiatives in Kerala, Sri Lanka, and Estonia, and a blueprint for a green transition involving various stakeholders.

The Need for a Paradigm Shift in Elections Conduct

- Overlooked Environmental Footprint of Elections

- The emissions from campaign flights during the 2016 US presidential elections illustrate the significant carbon footprint associated with traditional election methods.

- Traditional election practices, including paper-based materials, energy-intensive rallies, and disposable items, contribute to environmental degradation and impact citizens' health.

- The sheer magnitude of India's elections worsens these issues, necessitating a paradigm shift towards green elections.

- Alarming Research Insights

- A research from Estonia (2023) identifies transportation to and from polling booths as the primary source of carbon emissions during elections.

- The secondary source is the operational footprint of polling booths.

- Transitioning to digital voting systems could reduce the overall carbon footprint by up to 40%.

Challenges and Potential Solutions in Implementing Eco-Friendly Elections

- Technological Challenges: Infrastructure Requirements and Security Concerns

- The transition to digital voting systems necessitates a robust technological infrastructure, especially in rural and remote areas where connectivity might be limited.

- Ensuring the security and integrity of digital voting systems is paramount.

- Measures against hacking, fraud, and manipulation must be comprehensive to maintain public trust in the electoral process.

- Financial Challenges: Upfront Costs and Budget Allocation

- The adoption of eco-friendly materials and technology incurs substantial upfront costs.

- Governments facing financial constraints may be hesitant to invest in these initiatives despite the long-term environmental benefits.

- Elections already demand significant financial resources and allocating additional funds for environmentally friendly practices may compete with other essential priorities.

- Behavioural Challenges: Cultural Change and Public Scepticism

- There exists a cultural significance in valuing the physical presence of voters at polling booths as a fundamental aspect of the democratic process.

- Convincing voters of the efficacy and security of digital methods may face resistance.

- Public scepticism towards new approaches, fuelled by concerns about potential compromises to vote security, poses a significant challenge.

- Building trust in the reliability and transparency of new technologies is essential.

- Transparency and Auditing

- The shift towards eco-friendly and digital methods should be accompanied by transparent practices.

- Establishing mechanisms for the effective auditing of new adaptations is crucial to address concerns about accountability and fairness.

- Creating awareness among the public about the transparency and auditability of new electoral practices is essential for overcoming scepticism and building confidence in the electoral system.

- Logistical Challenges

- Implementing large-scale changes in electoral practices requires meticulous planning and coordination.

- From the procurement of eco-friendly materials to the training of officials, the logistical challenges should be addressed systematically.

The Successful Models of Eco-Friendly Electoral Initiatives

- Kerala and Goa Model

- During the 2019 general election, the Kerala State Election Commission urged political parties to avoid single-use plastic materials while campaigning.

- Subsequently, the Kerala High Court imposed a ban on flex and non-biodegradable materials in electioneering and wall graffiti and paper posters emerged as alternatives.

- Government bodies collaborated with the district administration in Thiruvananthapuram to ensure a green election and training sessions were conducted in villages for election workers.

- In 2022, the Goa State Biodiversity Board had eco-friendly election booths for the Assembly elections, using biodegradable materials crafted by local traditional artisans.

- The Sri Lanka Model

- In 2019, the Sri Lanka Podujana Peramuna (SLPP) party launched the world’s first carbon-sensitive environmentally friendly election campaign.

- It measured carbon emissions from vehicles and electricity used during political campaigns and compensated for the emissions by planting trees in each district through public participation.

- This offset the immediate carbon footprint of the campaign and drew awareness about the importance of forest cover.

- Estonian Example

- Estonia laid the foundations for digital voting as an online voting alternative. This method also encouraged voter participation.

- The success of Estonia’s approach suggests that digital voting accompanied by robust security measures is both eco- and electorate-friendly.

A Blueprint for Green Elections

- Political Initiatives and Digital Campaign Platforms

- Political parties must take the lead by enacting legislation that mandates eco-friendly electoral practices.

- This involves incorporating such practices into the Model Code of Conduct, outlining the rules governing election campaigns.

- Encouraging political campaigns to utilise digital platforms for outreach or engage in door-to-door campaigning can significantly reduce the carbon footprint associated with energy-intensive public rallies.

- Incentives for Sustainable Materials and Infrastructure Support

- Providing incentives for political parties to replace plastic and paper-based materials with sustainable alternatives(natural fabrics, recycled paper,etc) for election-related activities, to supportwaste management and local artisans.

- Governments can invest in the necessary infrastructure for digital voting, particularly in rural areas.

- This includes ensuring reliable internet connectivity and accessible digital devices for all voters.

- ECI’s Role with Government Support

- The Election Commission of India can play a pivotal role by advocating for digital voting systems.

- This includes promoting the environmental benefits of digital voting and addressing security concerns through comprehensive measures.

- Public Awareness Campaigns

- Civil society organisations can spearhead public awareness campaigns highlighting the environmental impact of conventional election methods and championing eco-friendly alternatives.

- This creates a groundswell of support for green electoral practices.

- Civil society can actively monitor the implementation of eco-friendly initiatives and advocate for transparency and accountability in the electoral process.

- Media's Role

- Media organisations can play a crucial role in emphasising the environmental impact of traditional election methods.

- Through investigative reporting and highlighting successful green initiatives, the media can encourage a broader understanding of the necessity for change.

- Global Collaboration

- Establishing collaborations with countries that have successfully implemented eco-friendly elections, such as Sri Lanka and Estonia, can provide valuable insights and support.

- Creating platforms for sharing best practices on eco-friendly electoral initiatives at the international level fosters a global commitment to sustainability in democratic processes.

Conclusion

- Embracing eco-conscious electoral practices is not just a necessity for India but an opportunity to set an example for democracies worldwide.

- By integrating top-level directives with grassroots initiatives, involving political parties, Election Commissions, governments, voters, the media, and civil society, India can pave the way for green elections.

- It will also align environmental stewardship with civic participation and democracy's fundamental principles.

Mains Article

28 Feb 2024

Why in news?

- Recently, the ambitious Genome India initiative achieved a significant milestone as researchers completed sequencing 10,000 healthy genomes from different regions of the country, representing 99 distinct populations.

What’s in today’s article?

- Genome sequencing

- Genome India Project

- News Summary

What is genome sequencing?

- Human genome

- The human genome is the entire set of deoxyribonucleic acid (DNA) residing in the nucleus of every cell of each human body.

- It carries the complete genetic information responsible for the development and functioning of the organism.

- The DNA consists of a double-stranded molecule built up by four bases – adenine (A), cytosine (C), guanine (G) and thymine (T).

- Every base on one strand pairs with a complementary base on the other strand (A with T and C with G).

- In all, the genome is made up of approximately 3.05 billion such base pairs.

- Genome sequencing

- While the sequence or order of base pairs is identical in all humans, there are differences in the genome of every human being that makes them unique.

- The process of deciphering the order of base pairs, to decode the genetic fingerprint of a human is called genome sequencing.

- In other words, Genome sequencing is the process of determining the complete DNA sequence of an organism's genome.

- There are several methods of genome sequencing, but the most common is called next-generation sequencing (NGS).

- NGS allows for rapid, accurate, and cost-effective sequencing of large amounts of DNA.

- Human Genome Project (HGP)

- In 1990, a group of scientists began to work on determining the whole sequence of the human genome under the Human Genome Project.

- The project released the latest version of the complete human genome in 2023, with a 0.3% error margin.

- The process of whole-genome sequencing, made possible by the Human Genome Project, now facilitates the reading of a person’s individual genome to identify differences from the average human genome.

- These differences or mutations can tell us about each human’s susceptibility or future vulnerability to a disease, their reaction or sensitivity to a particular stimulus, and so on.

What are the applications of genome sequencing?

- To evaluate rare disorder

- Genome sequencing has been used to evaluate rare disorders, preconditions for disorders, even cancer from the viewpoint of genetics, rather than as diseases of certain organs.

- Nearly 10,000 diseases — including cystic fibrosis and thalassemia — are known to be the result of a single gene malfunctioning.

- Tool for prenatal screening

- It has also been used as a tool for prenatal screening, to investigate whether the foetus has genetic disorders or anomalies.

- Technology Crispr, which relies on sequencing, may potentially allow scientists to repair disease-causing mutations in human genomes.

- In public health

- Sequencing has been used to read the codes of viruses.

- In January 2020, at the start of the Covid-19 pandemic, Chinese scientist sequenced the genome of a novel pathogen causing infections in the city of Wuhan.

- Later, genome sequencing of the virus led to the development of vaccine and the creation of diagnostic PCR machines.

- India also put in place a sequencing framework. The Indian SARS-COV-2 Genomics Consortia (INSACOG) was tasked with scanning coronavirus samples from patients.

- Uses at the population level

- Advanced analytics and AI could be applied to essential datasets created by collecting genomic profiles across the population.

- This would allow to develop greater understanding of causative factors and potential treatments of diseases.

What is Genome India project?

- The Genome India Project is a gene mapping project sanctioned by the Department of Biotechnology.

- It was launched with the goal of creating a comprehensive database of genetic variations among the Indian population.

- The project aims to sequence the genomes of over 10,000 Indians from different regions of the country and establish a reference genome for the Indian population.

What is the significance of the Genome India project?

- To learn about genetic variants unique to the Indian population

- This project allows researchers to learn about genetic variants unique to India’s population groups and use that to customise drugs and therapies.

- E.g., a mutation MYBPC3 that leads to cardiac arrest at a young age is found in 4.5% of the Indian population but is rare globally.

- Or, another mutation called LAMB3 that causes a lethal skin condition is found in nearly 4% of the population near Madurai but it is not seen in global databases.

- Database for 1.3 billion population

- India’s 1.3 billion-strong population consists of over 4,600 population groups, many of which are endogamous.

- Thus, the Indian population harbours distinct variations, with disease-causing mutations often amplified within some of these groups.

- Findings from population-based or disease-based human genetics research from other populations of the world cannot be extrapolated to Indians.

News Summary: 10,000 human genomes sequenced in India

- The Department of Biotechnology announced the completion of the ‘10,000 genome’ project — an attempt to create a reference database of whole-genome sequences out of India.

- This accomplishment has culminated in the creation of a comprehensive genetic map of India, which holds immense potential for clinicians and researchers alike.

- India is the largest genetic lab in the world. This data can help drive the biology sector in the country as well.

- India’s bio-economy has grown 13 folds in the last 10 years from $10 billion in 2014 to over $130 billion in 2024. It will spearhead India’s future growth.

- The entire dataset will be stored at the Indian Biological Data Centre (IBDC) and will be made available as a digital public good or research.

- Inaugurated in 2022, the IBDC is the country’s only databank.

- Prior to that Indian researchers had to host their biological datasets on American or European servers.

Mains Article

28 Feb 2024

Why in news?

- PM Modi has announced the names of the four astronauts, who would fly to low-Earth orbit as part of ISRO’s Gaganyaan.

- The announcement came just days after ISRO said it had successfully tested the human readiness of the cryogenic engine.

- This engine will be used on the LVM3 vehicles for all of the Gaganyaan missions.

What’s in today’s article?

- Gaganyaan

- News Summary

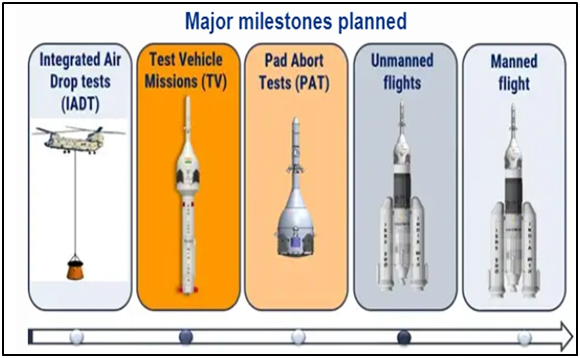

Gaganyaan

- Gaganyaan project envisages demonstration of human spaceflight capability by launching a crew of 3 members to an orbit of 400 km for a 3 days mission and bring them back safely to earth.

- It is part of the Indian Human Spaceflight Programme (IHSP), which was initiated (2007) by the ISRO to develop the technology needed to launch crewed orbital spacecraft into low earth orbit (LEO).

- Launch Vehicle Mark-3 (LVM3/GSLV Mk3) rocket - the well proven and reliable heavy lift launcher of ISRO, is identified as the launch vehicle for Gaganyaan mission.

- India’s heaviest rocket consists of solid stage, liquid stage and cryogenic stage.

- All systems in the LVM3 launch vehicle are re-configured to meet human rating requirements and christened Human Rated LVM3/HLVM3.

News Summary: PM Modi announces 4 astronauts for Gaganyaan

- PM Modi announced the names of the four astronauts, who would fly to low-Earth orbit as part of the ISRO’s Gaganyaan — the first crewed Indian space mission.

- The selected astronauts are:

- Prashanth Balakrishnan Nair, Angad Prathap, Ajit Krishnan, and Shubanshu Shukla.

- They are all either wing commanders or group captains with the Indian Air Force (IAF) and have extensive experience working as test pilots.

Current status of Gaganyaan missions

- The Gaganyaan missions include both manned and unmanned missions.

- The first unmanned Gaganyaan-1 mission, a test flight to check the technology readiness for the final mission, is scheduled to take off by the end of 2024.

- The manned mission, which will fly a three-membered crew into a low earth orbit at an altitude of 400 km for a period of three days, is scheduled later.

- Human rating of the launch vehicle

- ISRO will use its LVM3 rocket for all of the Gaganyaan missions.

- LVM3, earlier called GSLV-MkIII, is the space agency’s most powerful launch vehicle and has flown seven times and never failed.

- For the manned Gaganyaan mission, ISRO has reconfigured all the components of LVM3 to meet human rating requirements.

- Recently, in February 2024, the space agency performed final tests on the rocket’s cryogenic engine, known as CE20, which will power LVM3 during the cryogenic stage of the lift-off.

- The engine successfully passed and was certified for missions that would transport humans into space.

- The ‘Vikas’ engine to be used in the liquid stage and the solid booster, a part of the solid stage, have already qualified for the missions.

- ISRO will use its LVM3 rocket for all of the Gaganyaan missions.

- Development of crew module and crew escape system

- ISRO is also developing technology for the proposed human-space flight mission.

- These include:

- the development of life support systems to provide an earth-like environment to the crew in space,

- crew emergency escape provision, and

- evolving crew management aspects for training, recovery, and rehabilitation of crew.

- In October 2023, the space agency successfully conducted the first test of a basic crew module and crew escape system (CES).

- CES is a part of the module that ensures “the crew is taken to a safe distance in case of any emergency either at launch pad or during ascent phase.

- The next month, the space agency began to experiment with a crew module uprighting system.

- This system is used to ensure that the crew module, making a splashdown in the sea after a space mission, stays upright and does not get inverted in the water.

- Training of astronauts

- The four selected astronauts have completed their generic training at Russia’s Yuri Gagarin Cosmonaut Training Centre.

- Their training took place after ISRO-Glavkosmos (a subsidiary of Russian space agency Roscosmos) signed an MOU in June 2019.

- The astronauts are currently undergoing training at ISRO’s astronaut training facility in Bengaluru.

- One of the four astronauts is also expected to be trained by the American space agency NASA.

- The four selected astronauts have completed their generic training at Russia’s Yuri Gagarin Cosmonaut Training Centre.

Mains Article

28 Feb 2024

Why in News?

- According to the Ministry of Home Affairs (MHA), the rules for implementation of the Citizenship (Amendment) Act (CAA) are likely to be notified before the Model Code of Conduct (MCC) comes into force.

- The CAA was enacted by Parliament in (December) 2019 and sparked protests around the country.

What’s in Today’s Article?

- The Citizenship (Amendment) Act (CAA) 2019

- Why were CAA Rules not Notified?

- Counterclaims in Response to the Petitions Against CAA

- Rules for the CAA

The Citizenship (Amendment) Act (CAA) 2019:

- About:

- The Act seeks to amend the definition of illegal immigrant for Hindu, Sikh, Parsi, Buddhist, Jains and Christian (but not Muslim) immigrants from Pakistan, Afghanistan and Bangladesh, who have lived in India without documentation.

- They will be granted fast track Indian citizenship in 5 years (11 years earlier).

- The Act (which amends the Citizenship Act 1955) also provides for cancellation of Overseas Citizen of India (OCI) registration where the OCI card-holder has violated any provision of the Citizenship Act or any other law in force.

- Who is eligible?

- The CAA 2019 applies to those who were forced or compelled to seek shelter in India due to persecution on the ground of religion. It aims to protect such people from proceedings of illegal migration.

- The cut-off date for citizenship is December 31, 2014, which means the applicant should have entered India on or before that date.

- The act will not apply to areas covered by the Constitution's sixth schedule, which deals with autonomous tribal-dominated regions in Assam, Meghalaya, Tripura, and Mizoram.

- Additionally, the act will not apply to states that have an inner-line permit regime (Arunachal Pradesh, Nagaland and Mizoram).

- Implementation of the law: Despite its enactment four years ago, the CAA could not be implemented because the rules were not notified.

Why were CAA Rules not Notified?

- One of the prime reasons is the vociferous opposition faced by the CAA in several states including Assam and Tripura.

- The protests in Assam were fuelled by fears that the legislation would permanently alter the demographics of the state.

- The CAA is seen in Assam as a violation of the 1985 Assam Accord which allows foreign migrants who came to Assam after January 1, 1966 but before March 25, 1971 to seek citizenship.

- The cut-off date for citizenship under the CAA is December 31, 2014.

- The protests didn’t remain confined to the North-East, but spread to other parts of the country.

- A clutch of petitions, including by the Indian Union Muslim League, are before the Supreme Court, challenging the constitutional validity of the CAA.

- The petitioners have contended that the law is anti-Muslim, violating Article 14 (Right to Equality) of the Indian Constitution.

- It is arbitrary as it leaves out the persecuted Rohingya of Myanmar, Tibetan Buddhists from China and Tamils from Sri Lanka.

Counterclaims in Response to the Petitions Against CAA:

- The Centre said the basis of the “reasonable… classification” made by the 2019 Act was not religion, but “religious discrimination” in neighbouring countries which are “functioning with a state religion”.

- The Parliament, after taking cognizance of the said issues over the course of the past 7 decades, has taken into consideration the acknowledged class of minorities and has enacted the present amendment.

- The CAA is a specific amendment which seeks to tackle a specific problem prevalent in the specified countries.

- The legislation was not meant to be an omnibus solution to issues across the world.

- The Indian Parliament cannot be expected to take note of possible persecutions that may be taking place across various countries in the world.

Rules for the CAA:

- The rules will specify the evidence needed for applicants to prove their credentials and eligibility for citizenship under the new law. For example,

- If someone enrolled his children in a government school, he would have declared the religion.

- If someone acquired Aadhaar before December 31, 2014 and declared his or her religion as one among the six mentioned in the Act, it will be acceptable.

- Likewise, any form of government document declaring religion will be accepted.

- The MHA may also accept a demand from Assam that an application for citizenship under the CAA is time-bound.

- Assam had asked the MHA to limit the time period for applying under CAA to 3 months as keeping it open-ended could accentuate anxieties over the CAA in the state.

- The rules are not likely to ask for evidence of religious persecution but will presume that all those who came to India did so because they either faced persecution or had fear of being persecuted.

Mains Article

28 Feb 2024

What’s in Today’s Article?

- Background (Context of the Article)

- India’s R&D Spending (Statistics, Ways to Improve, Role of Pvt Sector, Sustainable Funding)

Background:

- The 2024 theme for National Science Day, which India celebrates every year on February 28, is “Science for Sustainable Development”.

- Science and technological developments are key drivers of India’s journey towards becoming a developed country by 2047.

- India is committed to making this progress through sustainable means, as evidenced by its commitments under the Paris Agreement.

- The role of science in driving sustainable development doesn’t need emphasis.

- However, any conversation on science is incomplete without setting one key expectation: for science to transform India, it has to be sustainably and consistently funded.

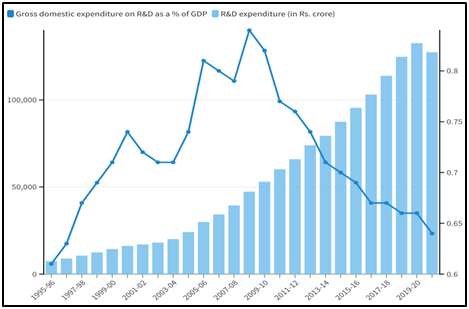

How Much is India Spending on R&D?

- Funding for fundamental research in India is amongst the world’s lowest, particularly for a country with high science and technology ambitions.

- In the recent past, India’s R&D expense has dropped to the current 0.64% of GDP from 0.8% in 2008-2009 and 0.7% in 2017-2018.

- This reduced expenditure is worrying considering government agencies themselves have issued several calls to double this spending.

- The 2013 Science, Technology, and Innovation Policy noted that “Increasing Gross Expenditure on R&D (GERD) to 2% GDP has been a national goal for some time”.

- The 2017-2018 Economic Survey reiterated this in its chapter on science and technology transformation.

- The reasons for the reduction in R&D spending despite the government being cognisant of the need to increase it are not clear.

- However, it may stem from a lack of coordination between government agencies and a need for stronger political will to prioritise R&D expenses.

- Most developed countries spend between 2% and 4% of their respective GDPs on R&D.

- In 2021, member-countries of the Organisation for Economic Co-operation and Development (OECD) on average spent 2.7% of GDP on R&D.

- The U.S. and the U.K. have consistently spent more than 2% of their GDPs on R&D for the past decade.

- So, many experts have called for India to spend at least 1%, but ideally 3%, of its GDP every year until 2047 on R&D for science to have a meaningful impact on development.

How Can India Improve its R&D Spending?

- For India to reach ‘developed nation’ status, it needs to spend more to scale R&D than developed countries spend to maintain that status.

- This is the foundation of the demand to spend at least 3% of the GDP on R&D annually until 2047.

- And beyond the current spending being inadequate, its primary dependence on public money signals an immature financing system and weak domestic market.

- In 2020-2021, private sector industry contributed 36.4% of the GERD whereas the Union government’s share was 43.7%.

- State governments (6.7%), higher education (8.8%), and public sector industry (4.4%) were the other major contributors.

Hesitance of the Private Sector:

- In economically developed countries, a major share – 70% on average – of R&D investment comes from the private sector.

- The hesitancy of private-sector funding may be because of:

- poor capacity to evaluate R&D in India,

- ambiguous regulatory roadmaps that can deter investors,

- lack of clear exit options for investors in sectors such as biotechnology, and

- fears of intellectual property rights theft.

How is the R&D Budget Utilised?

- While the need for India to at least double its R&D investment has been expressed several times, the question of how effectively the allocated money is spent is explored less often.

- The Union Ministry of Science and Technology has consistently under-utilised its budget.

- In 2022-2023, the Department of Biotechnology (DBT), used only 72% of its estimated budget allocation on Centrally Sponsored Schemes/Projects.

- The Department of Science and Technology (DST) used only 61%.

- The Department of Scientific and Industrial Research (DSIR), which receives the lowest allocation for Centrally Sponsored Schemes, spent 69% of its allocation.

Sustainable Funding for R&D is the Way Forward:

- In the latest budget, Finance Minister Nirmala Sitharaman provided many indications that the government would like R&D expenditure to include more contributions from the private sector.

- Against this backdrop, mitigating the under-spending and under-utilisation of funds earmarked for R&D stand out as obvious first steps.

- This in turn requires the political prioritisation of R&D spending and recognition of it as a core, irreplaceable element of India’s growth journey.

- This prioritisation has to happen not only within the concerned Ministries but also at the Ministry of Finance, which disburses the funds.

- Incentives for private investment, including relaxation of foreign direct investments, tax rebates, and clear regulatory roadmaps for products will help build investor confidence.

- Finally, India also needs the bureaucratic capacity to evaluate science projects and, after allocations, monitor utilisation.

- Building such capacity is a prerequisite for India becoming a science power by 2047.

Feb. 27, 2024

Mains Article

27 Feb 2024

Context

- India, known for its rich diversity, displays its complexities at the district level and crafting effective policies for the nation requires a nuanced understanding of the varied socio-economic landscapes across districts.

- Therefore, by examining socio-economic indicators and case studies, it is important to delve into the challenges and successes, emphasising the need for tailored responses to leverage the potential presented by each district.

An Analysis of Progress and Development and Diverse Realities Present at the District Level

- Education as an Indicator

- A recent study examining intergenerational developments in education at the district level, provides insight into the evolving educational landscape.

- Utilising NFHS-5 data, the study highlights a remarkable shift, with the average level of the mother's education equalling or exceeding that of the father's in 195 out of 707 districts studied.

- This points towards a notable intergenerational mobility, reflective of the evolving educational priorities at the district level.

- Metrics of Achievement

- Beyond education, various metrics of achievement underscore the evolving socio-economic landscape at the district level.

- In terms of financial access, over 15% of districts boast more than 90% of women owning and operating savings accounts, showcasing strides in economic inclusivity.

- Similarly, health metrics exhibit visible improvements, with more than 91% of districts reporting over 70% of births in the last five years occurring in health facilities.

- These positive trends, however, coexist with the need for a nuanced understanding of the spatial distribution of progress across different districts.

Disparities Present at the State Level

- Clusters of Development and Disparities

- At the state level, the presence of clusters of districts with similar performance indicators signifies the impact of top-down policies shaping development trajectories.

- These clusters highlight the influence of overarching state-level strategies on socio-economic outcomes.

- Simultaneously, the identification of isolated islands within states signals the need for specific, bottom-up interventions to address localised challenges and opportunities.

- For instance, while certain districts in states like Karnataka, Arunachal Pradesh, and Telangana demonstrate commendable educational outcomes, others within the same state lag, emphasising the importance of targeted policies.

- Income Concentration

- An important dimension of state-level disparities emerges through the lens of income concentration.

- The 'Competitiveness Roadmap for India,' led by Harvard Business School, underscores substantial differences in income distribution across districts.

- Urban districts, constituting 30% of all districts in India, contribute more than 55% of total wages and nearly 45% of all jobs.

- This stark contrast between urban and rural districts unveils a clear economic divide, emphasising the need for nuanced policies that address the diverse economic landscapes existing within states.

Government’s Top-Down and Bottom-Up Policies and Their Impact on Diverse Aspects of Development

- Top-Down Policies Addressing Socio-Economic Issues

- Top-down policies serve as predominant frameworks that address socio-economic challenges on a broader scale.

- Initiatives such as the Swachh Bharat Mission, Ayushman Bharat, POSHAN Abhiyaan, and MGNREGS exemplify how national programs can effectively target and ameliorate critical issues.

- For instance, the Swachh Bharat Mission has resulted in 75% of villages achieving defecation-free status, showcasing the transformative potential of well-designed top-down strategies in areas like sanitation and hygiene.

- The Aspirational Districts Programme as a Bottom-Up Approach

- Contrastingly, the Aspirational Districts Programme, launched in 2018, represents a bottom-up approach that acknowledges the unique challenges faced by specific regions.

- By encouraging collaboration and addressing critical gaps in health, nutrition, education, agriculture, and water resources, this program exemplifies the efficacy of targeted, grassroots interventions.

- The success of the program in transforming lives in 112 districts underscores the importance of a bottom-up approach in achieving meaningful and sustainable development.

- For example, the percentage of pregnant women registered for ante-natal care within the first trimester rose from 68 per cent in 2018 to 89 per cent in 2023.

- And the percentage of underweight children below the age of six years declined from 20.6 per cent in 2018 to 9.2 per cent in 2023.

- Similar progress has been observed in the education sector, where transition rates of school children have improved significantly, and basic infrastructure is nearing saturation.

Challenges Faced in Formulation and Implementation of Effective District-Level Development

- Limited Availability of Timely and High-Quality Data

- The success of any intervention depends on a nuanced understanding of local needs and challenges but the absence of comprehensive and up-to-date data poses a significant barrier.

- This limitation hinders the ability to identify specific segments of the population that urgently require government assistance and constrains the formulation of targeted and impactful policies.

- Lack of Tailored Responses

- India, with its diverse and varied districts, necessitates policies that are tailored to the specific needs of each region.

- However, the challenge lies in crafting responses that are not only localised but also responsive to the unique cultural, economic, and developmental nuances of each district.

- A one-size-fits-all approach is inadequate and may fail to address the intricacies that define the diverse realities across the nation.

Way Forward

- Moving Beyond Conventional Economic Centres

- Traditionally, national value creation in India has been concentrated in a small share of leading districts.

- However, initiatives like ODOP signify a departure from this trend, aiming to decentralise economic activities and promote distributed growth.

- Since its launch in 2020, the programme has seen the development and promotion of 1,000-plus unique products, across 767 districts, encompassing sectors such as textiles, agriculture, food processing and handicrafts.

- By recognising and harnessing the latent potential within each district, policymakers can unlock new avenues of economic prosperity and job creation beyond the conventional economic centres.

- According to academic Michael Porter’s theory of clusters, district-level productivity and value-creation can be catalysed by creating linked industries and institutions in proximity.

- Tailored Responses to Regional Specificities

- A critical element in positioning districts as drivers of growth lies in acknowledging and addressing the regional specificities that characterise India's diverse landscape.

- Healthcare and education priorities in states like Kerala and Tamil Nadu may significantly differ from those in Uttar Pradesh and Bihar.

- Effective administration demands tailored responses that consider the unique cultural, economic, and developmental nuances of each district.

- Empowering Districts through Data and Accountability

- A significant challenge in transforming districts into drivers of growth has been the limited availability of timely and high-quality data at the district level.

- Initiatives like the District Development Index for Maharashtra, by providing transparency and ensuring accountability, play a crucial role in addressing this gap.

- Accessible and accurate data enables policymakers to make informed decisions and design interventions that resonate with the specific needs of each district.

Conclusion

- As India charts its course towards economic prosperity, the paradigm shift from viewing districts as passive entities to active contributors is pivotal.

- Initiatives like ODOP, guided by the principles of regional strengths and clusters, empower districts to play a central role in shaping their economic destinies.

- By nurturing the unique potential within each district, India not only diversifies its economic landscape but also establishes a foundation for inclusive growth and shared prosperity across the nation.

Mains Article

27 Feb 2024

Why in the News?

- The markets regulator Securities and Exchange Board of India (SEBI) has warned individuals against fraudulent trading platforms.

- The SEBI has warned that certain trading platforms are falsely claiming or suggesting affiliation with its registered Foreign Portfolio Investors (FPIs).

What’s in Today’s Article?

- About FPI (Basics, Benefits, Comparison with FDI, etc.)

- News Summary

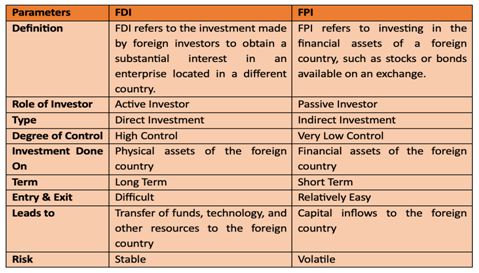

What is Foreign Portfolio Investment (FPI)?

- Foreign Portfolio Investment (FPI) involves an investor buying foreign financial assets. It involves an array of financial assets like fixed deposits, stocks, and mutual funds.

- All the investments are passively held by the investors. Investors who invest in foreign portfolios are known as Foreign Portfolio Investors.

- Foreign Portfolios increase the volatility. As a result, it leads to increased risk.

- The intent of investing in foreign markets is to diversify the portfolio and get good return on investments.

- Investors expect to receive high returns owing to the risk they’re willing to take.

- Securities and Exchange Board of India (SEBI) operates the FPIs.

- Recently, SEBI has introduced the Foreign Portfolio Investors Regulations, 2019.

- FPIs also need to follow the Income-tax Act, 1961 and Foreign Exchange Management Act, 1999.

Benefits of FPI:

- Investment Diversity:

- FPI provides investors an opportunity to diversify their portfolio.

- As an investor, you can diversify your portfolio to achieve high returns.

- Suppose if you incur major losses in investment assets of a Country X, you can accrue profits in investment assets of a country Y.

- In this way, you can experience less volatility in your investments and increase chances of profits.

- International Credit:

- Investors can get access to increased amounts of credit in foreign countries.

- They can broaden their credit base. By expanding their credit base, investors can secure their line of credit.

- In case the domestic credit score is unfavorable, having an international credit score can be beneficial.

- This allows the investor to utilize more leverage and get high returns on equity investment.

- Access to a Bigger Market:

- Sometimes, foreign market can be less competitive than the domestic market.

- Hence, FPI gives you an exposure to a wider market.

- The foreign markets are comparatively less saturated and hence, they may offer higher returns and more diversity as well.

- High Liquidity:

- Foreign Portfolio Investments provides high liquidity.

- An investor can buy and sell foreign portfolios seamlessly.

- This offers buying power for investors to act when good buy opportunities arise.

- Investors can buy and sell trades in a quick and seamless manner.

- Exchange Rate Benefit:

- An investor can leverage the dynamic nature of international currencies.

- Some currencies can drastically rise or fall, and a strong currency can be used in investor's favour.

Difference Between FPI and FDI:

News Summary:

- The markets regulator Securities and Exchange Board of India (SEBI) has warned individuals against fraudulent trading platforms falsely claiming or suggesting affiliation with its registered Foreign Portfolio Investors (FPIs).

- These platforms are misleading individuals by claiming to offer them trading opportunities through FPI or Foreign Institutional Investor (FII) sub-accounts or institutional accounts with special privileges.

- The SEBI said it has received many complaints where fraudsters are enticing victims through online trading courses, seminars, and mentorship programmes in the stock market.

- They are leveraging social media platforms like WhatsApp or Telegram, as well as live broadcasts.

- These scamsters are posing as employees or affiliates of SEBI-registered FPIs, and coaxing individuals into downloading applications.

- These applications purportedly allow them to purchase shares, subscribe to IPOs, and enjoy ‘institutional account benefits’—all without the need for an official trading or Demat account.

- These operations often use mobile numbers registered under false names to orchestrate the fraudulent schemes, SEBI, said.

SEBI’s Clarification:

- The market regulator clarified that the FPI investment route is unavailable to resident Indians, with limited exceptions as outlined in the SEBI (Foreign Portfolio Investors) Regulations, 2019.

- SEBI has not granted any relaxations to FPIs regarding securities market investments by Indian investors.

Mains Article

27 Feb 2024

Why in News?

- Multiple wings of the government have begun to criticise the Centre's moves to gradually raise customs tariffs, particularly the more recent targeting imports of Chinese components and inputs.

What’s in Today’s Article?

- India’s Import from China and Blockade Targeting Chinese Imports

- Comparing India’s Tariffs with Other Countries and Adverse Impact of High Tariffs

- Indian Government’s Response to Allegations of High Tariffs

- Need to Gradually Reduce Duties on Imports from China

India’s Import from China and Blockade Targeting Chinese Imports:

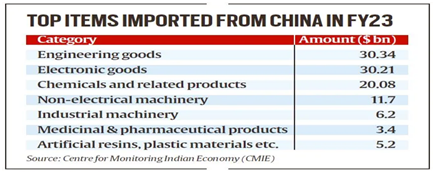

- India accounts for negligible share in China’s total trade (India is home to barely 3% of Chinese exports), but still accounts for 14% of India’s imports with -

- Not just inputs for the domestic industry in sectors ranging from electronics to pharmaceuticals and textiles to leather,

- But also, capital goods, being sourced from China.

- The blockade targeting Chinese imports had gained traction across Central ministries and departments in the aftermath of the Galwan border clash in 2020.

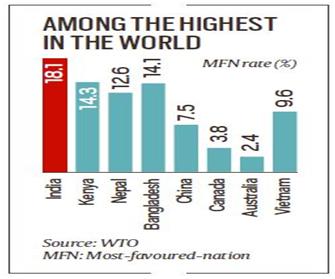

- There is an increase in the average tariffs to 18.1% in 2022 from 13% in 2014.

- Moreover, to check cheap quality imports from China, India imposed Quality Control Orders (QCOs) that restrict MSMEs from getting necessary input material.

- Tariff hikes have been undertaken multiple times covering well over 500 major item categories since 2016.

- Analysts caution that in some cases where customs duty hikes have been proposed, duties are close to or have effectively crossed the WTO-mandated “bound rates”.

- These are the customs duty rates that a country commits to all other members under the most favoured nation (MFN) principle.

Comparing India’s Tariffs with Other Countries and Adverse Impact of High Tariffs:

- Globally there is no country where tariffs are so high (as in India). India’s tariffs are higher than countries in South East Asia and even Africa.

- India is currently negotiating FTAs with developed countries which have maximum tariffs at 60% that too on products such as tobacco. India’s highest tariffs go up to 150%.

- These restrictions are now seen to be impacting sectors such as electronics and pharmaceuticals leading to either a loss of

- Domestic output or

- Competitive advantage (high production cost rendering India’s exports uncompetitive) for Indian manufacturing.

- Industries have warned of the detrimental impact of higher tariffs being used as a protectionism tool.

- India’s high tariffs pose a disincentive to de-risking supply chains beyond China.

- As a result, countries such as Vietnam, Thailand and Mexico are offering lower tariffs on components to grab the space vacated by China.

Indian Government’s Response to Allegations of High Tariffs:

- The Ministry of Commerce denies these duty increases as “protectionist” in nature.

- India’s stance on hiking tariffs mirrored the broader trend globally, and that New Delhi had shown a renewed interest in signing bilateral FTAs over the last 24 months.

- India has chosen to stay out of important mega regional trading arrangements, including the Regional Comprehensive Economic Partnership (RCEP).

Need to Gradually Reduce Duties on Imports from China:

- From the perspective of development economics, it makes sense to gradually decrease duties and integrate better with global markets and then negotiate Free Trade Agreements (FTAs).

- Protectionism is not nationalism. It only brings inefficiency (at the cost of hurting consumers).

- Nearly 8 years of protectionism have not increased India's manufacturing share of GDP (~15%), despite several sops, including extraordinary tax advantages.

- Therefore, an advanced strategy to use tariffs as a diplomatic tool is the need of the hour; otherwise, the achievements of India's manufacturing-focused thrust (including from schemes like PLI) may be in danger.

- The MeitY had pushed for a lowering of duties of about 20% on parts including circuit boards, chargers and fully assembled phones, by at least 5% points.

- This was partly agreed to and the government reduced duty on several IT goods ahead of the Interim Budget 2024.

- These calibrated changes in duty rates will -

- Help the domestic industry in capacity creation,

- Provide a level playing field,

- Easing the raw material supply side constraints and

- Enhance ease of doing business.

Mains Article

27 Feb 2024

Why in news?

- The four-day 13th ministerial conference (MC13) started on February 26 in Abu Dhabi, the United Arab Emirates (UAE).

- The Indian delegation is led by Commerce and Industry Minister Piyush Goyal.

What’s in today’s article?

- WTO

- 13th ministerial conference (MC13) of WTO

- News Summary

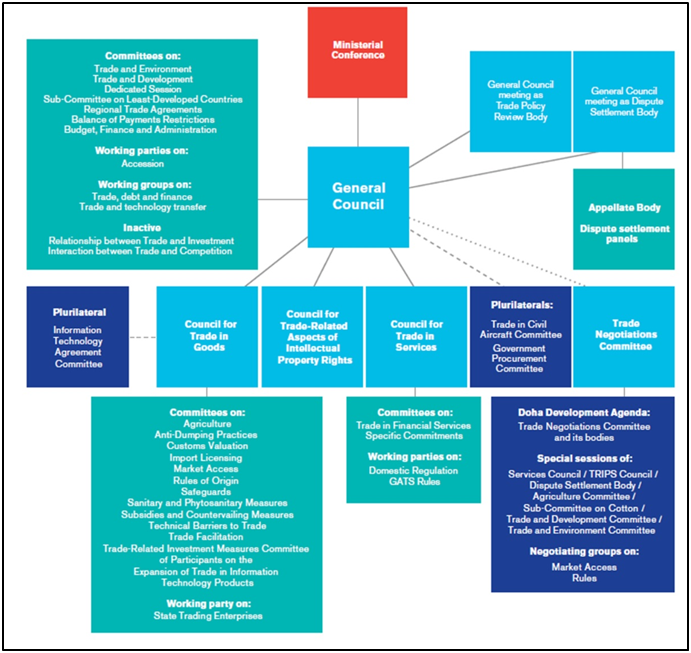

About World Trade Organization (WTO)

- WTO is the only global international organization dealing with the rules of trade between nations.

- The goal is to help producers of goods and services, exporters, and importers conduct their business.

- WTO is a forum for governments to negotiate trade agreements. It is also a place for them to settle trade disputes.

- It was created by Uruguay Round negotiations (1986-94) and is headquartered in Geneva.

Functions of WTO

- Administering trade agreements

- Acting as a forum for trade negotiations

- Settling trade disputes

- Reviewing national trade policies

- Building the trade capacity of developing economies

Structure of WTO

- The WTO has 164 members, accounting for 98% of world trade.

- Accession processes for Comoros and Timor-Leste are nearing completion, paving the way for their WTO entry.

- Decisions are made by the entire membership. This is typically by consensus.

- The WTO’s top-level decision-making body is the Ministerial Conference, which meets usually every two years.

13th ministerial conference (MC13) of WTO

- MC13 of WTO will take place from February 26–29, 2024 in Abu Dhabi, United Arab Emirates.

- The conference will bring together trade ministers from around the world to:

- Review the functioning of the multilateral trading system

- Take action on the future work of the WTO

- Chart the future course of the WTO

News Summary: WTO MC13 - Agenda for India

India's agenda at the meeting

- Food security issues

- Under the public stockholding (PSH) programme, the Government procures crops like rice and wheat from farmers at a minimum support price (MSP), and stores and distributes foodgrains to the poor.

- India stresses the need for PSH for its large, vulnerable population and wants a permanent solution from the MC13.

- Food procurement, stockholding, and distribution are crucial to India's food security strategy.

- MSP is normally higher than the prevailing market rates and sells these at a low price to ensure food security for over 800 million beneficiaries.

- However, the WTO's Agreement on Agriculture limits the ability of a government to purchase food at MSP.

- Under global trade norms, a WTO member country's food subsidy bill should not breach the limit of 10 per cent of the value of production based on the reference price of 1986-88.

- As part of the solution, India has asked for measures like amendments in the formula to calculate the food subsidy cap.

- However, developed nations are of the view that such programmes distort global trade prices of food grains.

- Joint Support Initiatives (JSIs) or plurilateral agreements

- India opposes this move being pushed for certain nations.

- E.g., India is strongly opposing the efforts of a group of countries led by China to push a proposal on investment facilitation for development agreement at the WTO.

- India has maintained that this agenda falls outside the mandate of the global trade body.

- India opposes this move being pushed for certain nations.

- Agricultural reforms

- India's stance is to protect farmer livelihoods and ensure equitable market access.

- However, developed nations are pushing to reduce domestic support and increase market openness irrespective of the fact that they provide large subsidies to their rich farmers.

- WTO reforms

- India supports fair reforms that take into account the needs of developing countries.

- This is in response to proposals from developed nations for easier negotiation processes, moving away from unanimous decision-making, and adding non-trade issues to the WTO without agreement from everyone.