Why in News?

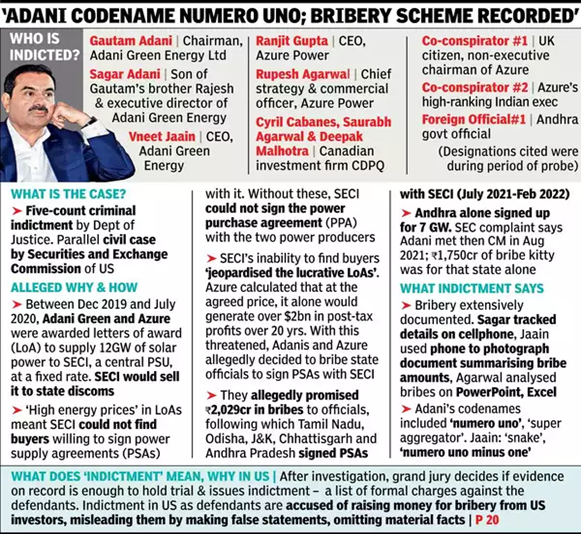

US prosecutors have indicted Gautam Adani, his nephew Sagar Adani, and six others in a $250 million (Rs 2,029 crore) bribery and fraud case.

The charges include offering bribes to Indian government officials to secure lucrative solar energy contracts, misleading investors, and obstructing justice.

What’s in Today’s Article?

- Key Allegations Against Gautam Adani

- Legal Framework and the Adani Group's Response

- Immediate Fallout of the Indictment of Adani Group Chairman

- Conclusion

Key Allegations Against Gautam Adani:

- Defendants named:

- Gautam Adani (Chairman of Adani Group).

- Sagar Adani (Executive Director of Adani Green Energy Ltd).

- Vneet Jaain (CEO, Adani Green Energy Ltd).

- Former Azure Power executives and a Canadian institutional investor’s employees.

- Key allegations:

- Bribery for solar energy contracts:

- The accused allegedly bribed Indian officials to buy solar power from the state-owned Solar Energy Corporation of India (SECI).

- The bribes were linked to contracts projected to generate $2 billion in profits over 20 years.

- Gautam Adani reportedly had direct meetings with government officials to advance the scheme.

- Fraudulent capital raising:

- The defendants are accused of raising funds from US investors under false pretences.

- Misrepresentations were made to hide the bribery scheme while securing billions from international investors.

- Obstruction of justice: The accused allegedly obstructed the investigation into the bribery conspiracy.

Legal Framework and the Adani Group's Response:

- US indictment process:

- An indictment formally accuses individuals of crimes, allowing them to prepare their defence.

- The case falls under US jurisdiction due to the involvement of US investors and markets.

- Adani Group's response:

- The Adani Group denied all allegations, emphasising its commitment to governance and compliance.

- A spokesperson stated that the charges are allegations and do not establish guilt and the company is prepared to seek all possible legal recourse.

Immediate Fallout of the Indictment of Adani Group Chairman:

- Financial impact:

- Adani Group cancelled a $600 million bond offering intended for foreign currency loan repayment.

- Shares of Adani companies dropped significantly, with Adani Green Energy losing 18.76% and Adani Energy Solutions falling by 20%.

- Kenyan President has cancelled $736 million PPP deal with the Adani Group to construct power transmission lines after US indictments.

- Political reactions:

- Leading Opposition Party in India reiterated its demand for a Joint Parliamentary Committee (JPC) investigation into alleged Adani-related scams.

- It also called for the appointment of a credible SEBI chief to oversee investigations.

Conclusion:

- The indictment of Gautam Adani and associates in the US underscores global scrutiny of corporate malpractice

- The case highlights serious allegations of corruption, investor fraud, and regulatory violations, with widespread financial and political repercussions.