Why in news?

- Starting from July 1, the Reserve Bank of India plans to implement a 20% tax on the Liberalised Remittances Scheme (LRS).

- As a result, banks are preparing their systems to monitor expenses made with international cards and collect the applicable tax on outward remittances.

What’s in today’s article?

- Liberalised Remittances Scheme (LRS)

- News Summary

What is Liberalised Remittance Scheme (LRS)?

- It was brought out by the RBI in 2004.

- It allows resident individuals to remit a certain amount of money during a financial year to another country for investment and expenditure.

- According to the prevailing regulations, resident individuals may remit up to $250,000 per financial year.

Background of LRS:

- Resident Indians or people resident in India are allowed to transfer foreign currency under the foreign exchange regulations.

- The transfer of foreign currency outside India is governed by the Foreign Exchange Management Act, 1999 (FEMA).

- Hence, to regulate transferring of funds within a specified limit, RBI brought the LRS.

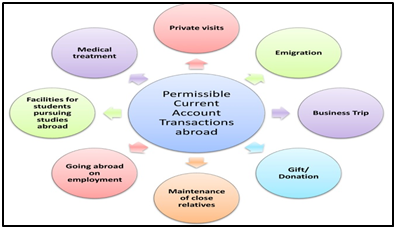

Which transactions are allowed under the LRS?

- Apart from the areas highlighted in the above diagram, the remitted amount can also be invested in shares, debt instruments, and be used to buy immovable properties in overseas market.

- Individuals can also open, maintain and hold foreign currency accounts with banks outside India for carrying out transactions permitted under the scheme.

What are the Restrictions under LRS?

- LRS restricts

- buying and selling of foreign exchange abroad, or purchase of lottery tickets or sweep stakes, proscribed magazines and so on,

- or any items that are restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- Also, one cannot make remittances directly or indirectly to countries identified by the Financial Action Task Force as non-co-operative countries and territories.

Recent Changes in LRS

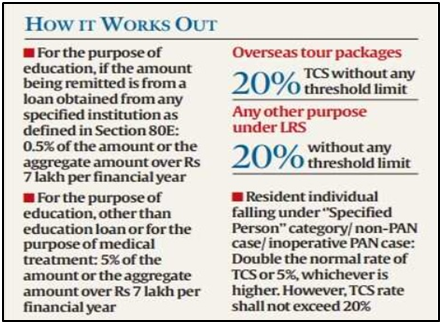

- Announcement in Budget 2023-24

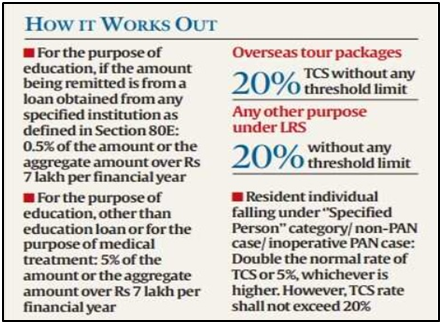

- Budget had proposed hiking the TCS rate to 20 per cent from 5 per cent above Rs 7 lakh threshold for all purposes other than education and medical treatment.

- Also, for overseas tour packages, the government had proposed hiking the TCS rate to 20 per cent from 5 per cent, without any threshold.

- Changes made

- May 2023, the Government amended rules under the FEMA to bring in international credit card spends outside India under the LRS.

- As a consequence, spending on international credit cards would have then attracted a higher rate of TCS (tax collected at source) at 20% from July 1.

- However, later, the government clarified that any payments by an individual using their international debit or credit cards up to Rs 7 lakh per financial year will be excluded from the LRS limits and hence, will not attract any TCS.

- TCS is a direct tax levy, which is collected by the seller of specified goods from the buyer and deposited to the government.

- TCS can be adjusted against the overall tax liability. It can be claimed as an income tax refund or a person can avail of credit while filing the ITR or calculating the advance taxes.

- It will not apply on the payments for purchase of foreign goods and services from India.

- Rationale behind new system

- Indians are now increasingly using credit and debit cards abroad instead of taking travellers cheques or forex cards.

- Until now, there is no estimate of money spent through cards abroad.

- The new system will enable the government to track high-value overseas transactions.

News Summary: Banks readying systems to track spends on outward remittances

Challenges faced by Banks in new regime

- Banks are facing difficulties in evaluating and collecting TCS exemptions for credit and debit card transactions conducted outside India.

- RBI has decided to leave it up to the banks to handle the collection of the tax imposed by the government in the FY23-24 budget.

- Deducting TCS is not a hassle. The hassle is to take into account certain exemptions into the system.

- The exemption of up to Rs 7 lakh created some confusion.

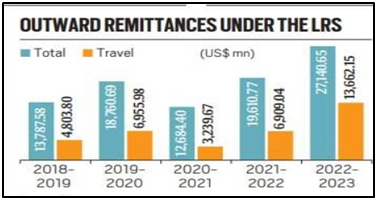

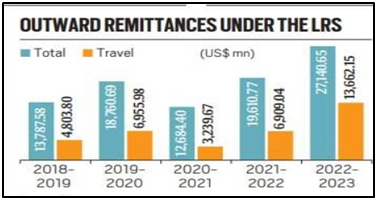

Outward remittances under LRS

- There was an outflow of $ 27.14 billion (over Rs 2.22 lakh crore) under the LRS route in FY23.