Why in news?

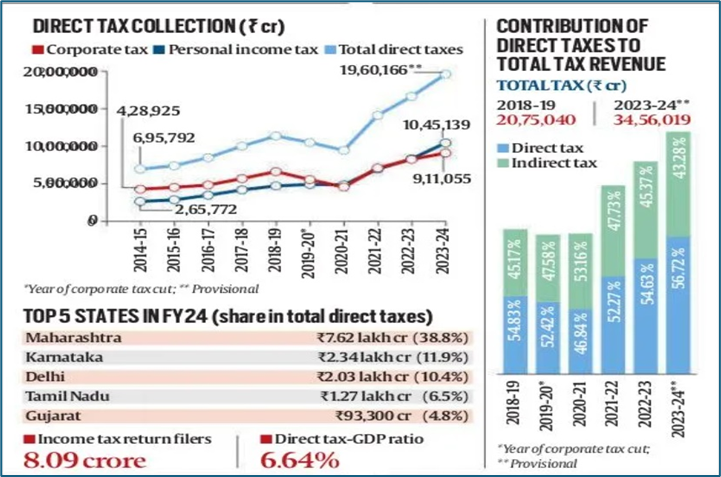

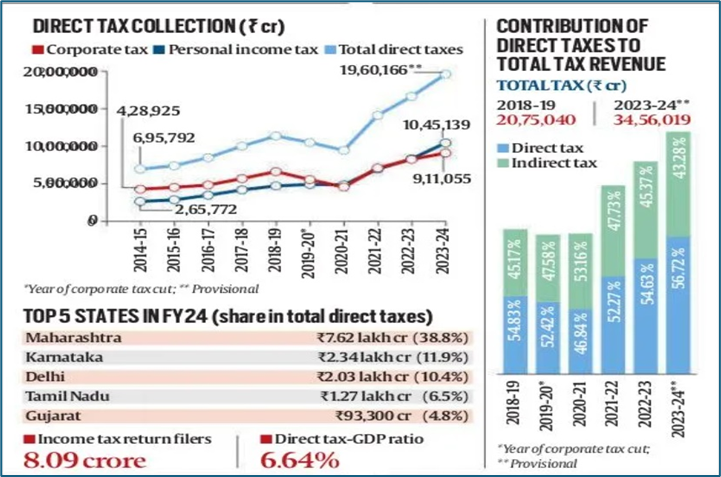

According to data released by the Central Board of Direct Taxes (CBDT), the contribution of direct taxes to total tax revenue climbed to 56.72 per cent in 2023-24, the highest in 14 years.

What’s in today’s article?

- Direct tax

- Key highlights of the data released by the CBDT

- Analysis

Direct tax

- About

- Direct tax is a tax paid directly by the taxpayer to the government and cannot be shifted.

- This is the opposite of indirect tax, which is a tax levied on goods and services and can be passed on to another entity or individual.

- The direct rules are framed such that taxes turn out to be a method to redistribute money in the country.

- Examples

- The more common types of direct tax are: Individual income tax; Corporate income tax; Capital gains tax; Estate tax; Property tax etc.

Key highlights of the data released by the CBDT

- Record Contribution of Direct Taxes in 2023-24

- In FY24, the contribution of direct taxes to total tax revenue reached 56.72%, the highest in 14 years.

- This marks an increase from 54.63% in FY23, reducing the share of indirect taxes to 43.28%.

- Direct tax-to-GDP ratio

- The direct tax-to-GDP ratio also hit a two-decade high of 6.64%.

- A "direct tax-to-GDP ratio" is an economic indicator that measures the proportion of a country's total direct tax revenue relative to its Gross Domestic Product (GDP).

- It essentially shows how much direct tax is collected compared to the overall size of the economy.

- A higher ratio indicates the government is effectively collecting more direct taxes from its citizens, allowing for greater funding of public services and investments.

- It signifies a potentially stronger tax administration and better compliance within the economy.

- Surge in Personal Income Tax Collections

- For the second consecutive year, personal income tax collections exceeded corporate tax collections.

- Corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation.

- Unlike individual income tax, which is levied on personal earnings, corporate tax is specifically targeted at business entities, including both domestic and multinational companies.

- In FY24, personal income tax collections stood at ₹10.45 lakh crore, surpassing corporate tax collections of ₹9.11 lakh crore.

- This shift began after the corporate tax rate cut in September 2019.

- Tax rates for corporates were cut in September 2019 in India, with the rate for existing companies reducing from 30 to 22%, and that of new companies from 25 to 15%.

- Tax Buoyancy Growth

- Tax buoyancy, indicating the growth rate of taxes relative to the nominal economic growth, increased to 2.12 in FY24, compared to 1.18 in FY23.

- Tax buoyancy is a ratio of change in tax revenue in relation to change in gross domestic product or GDP of an economy.

- It measures how responsive a taxation policy is to growth in economic activities.

- This marked the highest level since FY22 (2.52).

- Cost of Tax Collection at a Record Low

- The cost of tax collection dropped to 0.44% of total tax collections, the lowest since 2000-01.

- However, in absolute terms, the cost increased to ₹8,634 crore.

- Increase in Tax Filers and Taxpayers

- Income tax return filers grew from 7.4 crore in FY23 to 8.09 crore in FY24.

- Taxpayers, defined as those filing returns or having tax deducted at source, increased from 9.37 crore to 10.41 crore.

- State-Wise Direct Tax Contributions

- Maharashtra contributed 39% of the total direct tax revenue (₹7.6 lakh crore), followed by Karnataka (12% or ₹2.34 lakh crore) and Delhi (10.4% or ₹2.03 lakh crore).

Analysis

- Sign of Progressive Taxation and Equity

- A higher share of direct taxes, linked to income levels, is considered progressive as it reduces the burden on the poor compared to indirect taxes.

- The last time the share of direct taxes exceeded FY24 levels was in FY10, at 60.78%.

- Signals a growth phase of the Indian economy

- As per the experts, the increasing share of direct tax collections and significant jump in direct tax-to-GDP ratio signal a growth phase of the Indian economy.

- Increased formalization of the economy

- The government has steadily increased its data collection as well as its IT prowess, in addition to expanding the scope of taxes collected or deducted at source.

- The increased formalization of the economy too has helped.

- Credit to the government’s efforts

- A fair share of credit can be given to the government’s efforts in rationalizing direct tax provisions and in bringing tax certainty among the investor community.

- Key steps such as dispute resolution schemes and digitization of tax compliance procedures have played a key role in boosting direct tax collections.

- The cost of collection has also gone down which is likely the result of use of technology and artificial intelligence tools by tax department in its operations