Why in News?

While some sectors have shown encouraging results under the Production-Linked Incentive (PLI) scheme, others lag in meeting targets, prompting reviews and potential adjustments.

What’s in Today’s Article?

- What is the PLI Scheme?

- Evaluating Progress, Challenges and Potential of the PLI Scheme

- Conclusion

What is the PLI Scheme?

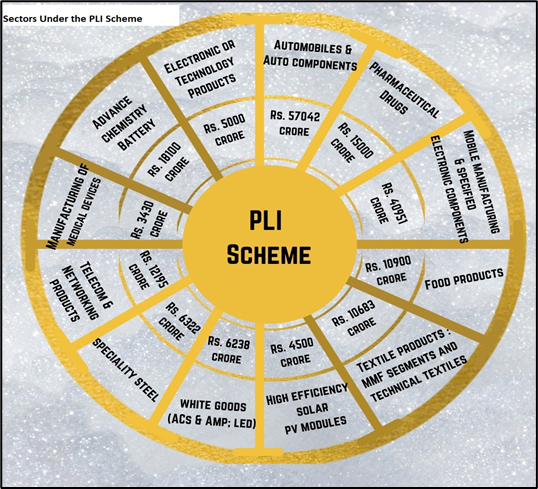

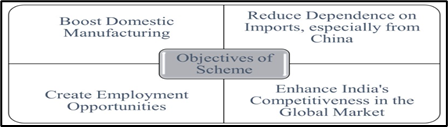

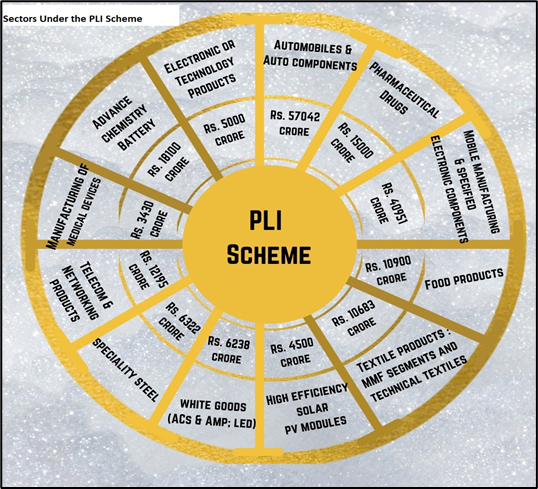

- About: The PLI scheme was launched (in March, 2020) to boost India’s domestic manufacturing base and enhance its global supply chain contribution.

- Objective: Covering 14 sectors, the scheme aims to create significant employment opportunities and drive industrial capital expenditure (capex).

- How does it work?

- Under the PLI scheme, eligible companies receive financial incentives based on their incremental sales from products manufactured in India.

- These incentives encourage companies to invest in upgrading their manufacturing capabilities, adopting modern technologies, and expanding their production capacities.

- How is PLI different from other traditional subsidies?

- Only limited sectors are eligible: The scheme has the potential to attract maximum investments and scale rapidly to provide the maximum returns in terms of incremental production, employment, and export.

- Time-bound pre-committed levels of investment and productions: Hence, cannot be called a subsidy scheme.

- Focus on supporting upcoming technologies: That can be commercialised at a large scale like advanced chemistry cell batteries, electronic and technology products.

Evaluating Progress, Challenges and Potential of the PLI Scheme:

- Mixed progress across sectors:

- Sectors lagging in employment generation:

- Textiles, solar modules, IT hardware, automobiles, advanced chemical cells (ACC), and specialty steel have seen relatively slow progress in creating jobs.

- Initial challenges stem from the need to build domestic manufacturing capabilities from scratch.

- Successful sectors:

- Food processing and mobile phone manufacturing have exceeded expectations.

- For instance, smartphone exports reached $15 billion in 2023-24, driven by companies like Apple expanding assembly operations in India.

- Initial challenges and emerging benefits:

- Challenges:

- Developing manufacturing industries from scratch in certain sectors.

- Stringent eligibility criteria, reliance on imported machinery, and high tariffs have been deterrents.

- Time-consuming commissioning processes in sectors like solar modules and ACC, which require 1.5–3 years to set up.

- Emerging benefits:

- Sectors like mobile manufacturing show a ripple effect, with large companies like Apple spurring ancillary industries and creating opportunities for smaller suppliers.

- For instance, Apple now sources components from 14 Indian suppliers compared to none prior to the PLI scheme.

- Economic potential: According to CRISIL, the PLI scheme could drive ₹3-3.5 lakh crore in industrial capital expenditure over its duration, contributing 8–10% of total capex in key sectors over the next 3–4 years.

- Critical perspectives: Critics argue that the PLI scheme may function as a subsidy without guaranteeing long-term competitiveness once incentives end.

- Way ahead:

- Sectoral adjustments: IT hardware recently received an upgraded outlay. Renewals or adjustments are under consideration for sectors like textiles and drones.

- Potential revisions: Revising eligibility criteria and increasing support in underperforming sectors. Emphasising employment-linked outcomes in sectors with slow initial traction.

Conclusion:

- Challenges in underperforming sectors highlight the need for fine-tuning policies to achieve long-term goals of industrial growth, employment, and competitiveness.

- As the government recalibrates the framework, sustained engagement with stakeholders and addressing structural bottlenecks will be key to realising the scheme’s full potential.