In News:

- The Ministry of Home Affairs (MHA) has cancelled the FCRA registration of Commonwealth Human Rights Initiative (CHRI).

- CHRI is an international NGO that works for human rights in Commonwealth countries.

- Nearly 6,000 NGOs had ceased to operate from January 1 as MHA refused to renew their application or the NGOs did not apply for one.

- There are 16,888 FCRA registered NGOs as on 25 April 2022, down from over 22,000 on December 31.

What’s in Today’s Article:

- The Foreign Contribution (Regulation) Act (FCRA), 2010 (About, background, key highlights of 2010 act and 2020 amendments)

- November 2020 Rules, January 2021 guidelines

In Focus: The Foreign Contribution (Regulation) Act (FCRA), 2010

About

- The FCRA regulates foreign contributions/donations and ensures that such contributions do not adversely affect internal security.

- The FCRA is applicable to all associations, groups and NGOs which intend to receive foreign donations.

- It is mandatory for all such NGOs to register themselves under the FCRA.

- Registered associations can receive foreign contribution for following purposes:

- Social; Educational; Religious; Economic, and Cultural.

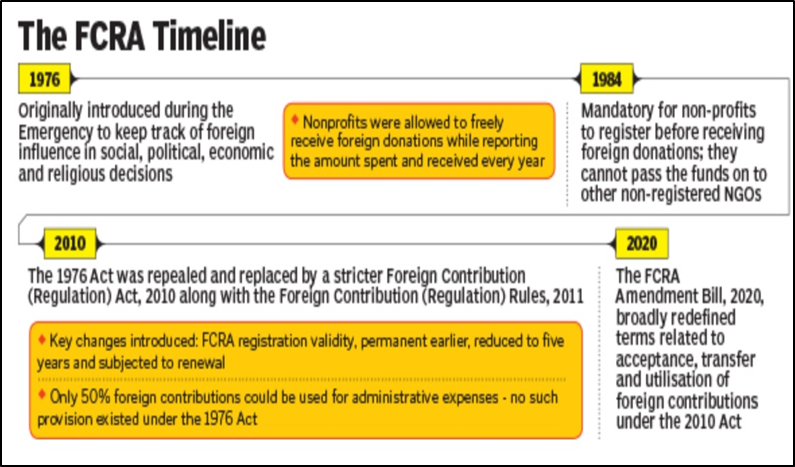

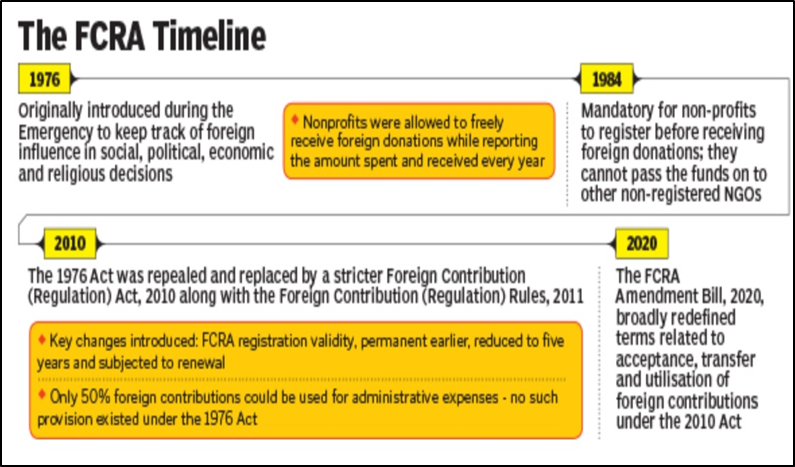

Timeline:

- In 2015, the MHA notified new rules under the act. These new rules required:

- NGOs to give an undertaking that the acceptance of foreign funds is not likely to prejudicially affect the sovereignty and integrity of India or impact friendly relations with any foreign state and does not disrupt communal harmony.

- Again, the Foreign Contribution (Regulation) Amendment Bill, 2020 was introduced in Lok Sabha on September 20, 2020.

- The bill received Presidential assent on 28 September 2020 & thus became an Act.

Key Highlights of the 2010 act & amendment made in 2020

- Prohibition to accept foreign contribution

- Under the Act, certain persons are prohibited to accept any foreign contribution.

- These include: election candidates, editor or publisher of a newspaper, judges, government servants, members of any legislature, and political parties, among others.

- In 2017 the MHA, through the Finance Bill route, paved the way for political parties to receive funds from the Indian subsidiary of a foreign company or a foreign company in which an Indian holds 50% or more shares.

- The 2020 amendment added public servants (as defined under the Indian Penal Code) to this list.

- Transfer of foreign contribution

- Under the Act, foreign contribution cannot be transferred to any other person unless such person is also registered to accept foreign contribution, or has obtained prior permission under the Act to obtain foreign contribution.

- The 2020 amendment prohibited the transfer of foreign contribution to any other person.

- Aadhaar for registration

- 2020 amendment mandated that any person seeking prior permission, registration or renewal of registration must provide the Aadhaar number.

- In case of a foreigner, they must provide a copy of the passport or the Overseas Citizen of India card for identification.

- However, in April 2022, Supreme Court read down this section and held that producing Indian Passport for the purpose of their identification would be enough.

- Now it is not mandatory for all office-bearers of NGOs to provide Aadhaar number.

- FCRA account

- Under the Act, a registered person must accept foreign contribution only in a single branch of a scheduled bank specified by them.

- However, they may open more accounts in other banks for utilisation of the contribution.

- 2020 amendment stipulated that foreign contribution must be received only in an account designated by the bank as “FCRA account” in such branch of the State Bank of India, New Delhi, as notified by the central government.

- No funds other than the foreign contribution should be received or deposited in this account.

- Renewal of license:

- Under the Act, every person who has been given a certificate of registration must renew the certificate within six months of expiration.

- The 2020 amendment provides that the government may conduct an inquiry before renewing the certificate.

- Use of foreign contribution for administrative purposes

- Under the Act, a person who receives foreign contribution must use it only for the purpose for which the contribution is received.

- Further, they must not use more than 50% of the contribution for meeting administrative expenses. 2020 amendment reduced this limit to 20%.

- Suspension of registration

- Under the Act, the government may suspend the registration of a person for a period not exceeding 180 days.

- 2020 amendment added that such suspension may be extended up to an additional 180 days.

Government has come up with new rules in Nov’ 2020

- The new rules made new FCRA registrations more stringent. Any organisation that wants to register itself under FCRA shall be in existence for three years.

- Further, it should have spent a minimum amount of ₹15 lakh on its core activities for the benefit of society during the last three financial years.

- However, the rules for declaring an organisation as a “political organisation” have been relaxed, with student, farmer, worker and youth organisations being exempted unless they participate in “active politics or party politics”. Political organisations can’t receive foreign funds.

- Any organisation seeking prior permission for receiving a specific amount from a specific donor for carrying out specific activities or projects will have to submit a specific commitment letter from the donor indicating the amount of foreign contribution & the purpose for which it is proposed to be given.

- If the value of foreign contribution is over Rs 1 crore, it may be given in installments. However, the second and subsequent installment shall be released after submission of proof of utilisation of 75% of the foreign contribution received in the previous installment and after field inquiry of the utilisation of foreign contribution.

MHA in January 2021 again laid out a series of guidelines and charter to make NGOs and banks comply with new provisions of the amended FCRA

- The charter for banks says that “donations received in Indian rupees” by NGOs from “any foreign source even if that source is located in India at the time of such donation” should be treated as “foreign contribution”.

- Also, it stated foreign contribution has to be received only through banking channels and any violation by the NGO or by the bank may invite penal provisions of FCRA.