Why in News?

- The Delhi high court's ruling that US online gateway PayPal is a "reporting entity" under the anti-money laundering law may help India during the FATF review of its anti-black money regime.

What’s in Today’s Article?

- What is the Financial Action Task Force (FATF)?

- What is the Delhi HC’s Verdict?

- How will the Delhi HC Verdict help India during FATF Review?

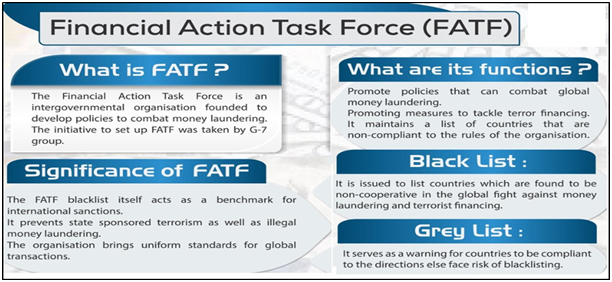

What is the Financial Action Task Force (FATF)?

- It is an intergovernmental organisation founded in 1989 to develop policies to combat money laundering and its mandate was expanded to include terror financing in 2001.

- It operates from Organisation for Economic Cooperation and Development (OECD) headquarters in Paris and its plenary/ decision-making body meets three times per year.

- It has 39 members including India (became observer in 2006 and a full-time member in 2010) and two regional organisations - the EU and GCC (Gulf cooperation council).

- FATF’s mandate -

- Recognises the need to continue to lead decisive, coordinated and effective global action to counter the threats of the abuse of the financial system by criminals and terrorists, and

- Strengthens its capacity to respond to these threats that all countries face.

- The FATF conducts peer reviews of each member on an ongoing basis to assess levels of implementation of the FATF Recommendations.

- It provides an in-depth description and analysis of each country's system for preventing criminal abuse of the financial system.

- India is currently under the FATF review. It last underwent a similar review in 2013 where it was found that India had reached a satisfactory level of compliance with all of the core and key recommendations of the watchdog.

What is the Delhi HC’s Verdict?

- It had set aside a penalty of Rs 96 lakh imposed on PayPal by the Financial Intelligence Unit (FIU) - India for alleged non-compliance with the reporting obligations under the law against money laundering.

- However, it ruled that PayPal was liable to be viewed as a payment system operator under the Prevention of Money Laundering Act (PMLA) and so has to comply with reporting obligations under the law.

- The categorisation of PayPal as a reporting entity under the PMLA will ensure that -

- All such big payment gateways and platforms are regulated and

- They share the stipulated suspicious transaction reports (STRs) and cross-border wire transfer reports with the FIU under the PMLA.

- The FIU disseminates these reports to various probe agencies which investigate money laundering, tax evasion, and other serious financial frauds.

How will the Delhi HC Verdict help India during FATF Review?

- The judgement will help FIU bring operations of about a dozen more such payment gateways under the 'reporting entity' regime even as a number of payment gateways operating in the country are already reporting STRs to the FIU.

- While the judgement may not give India additional points during the FATF review, it will surely underline that -

- Indian anti-money laundering agencies are leaving no stone unturned.

- The country's economic channels are clean and the risks of financial crimes are minimal.