In News:

- Recently, the Confederation of Indian Industry (CII) President T.V. Narendran said in an interview that the Government should consider offering some relief to Indian consumers by paring (reduce) excise duties on petroleum products, if global crude oil prices remain above USD 100 per barrel.

What’s in today’s article:

- Fuel Pricing Mechanism (Working, TPP, Taxes, Dealer’s commission, etc.)

- Oil Bonds (Purpose, How it works, Benefits/Disadvantages, etc.)

- Limitations on Reducing Taxes on Fuel

Fuel Pricing Mechanism in India:

- Petrol prices were deregulated in 2010 and Diesel prices were deregulated in 2014 i.e. now Oil Marketing Companies (OMCs) determine the prices of these products.

- These prices are not determined by the actual costs incurred by the OMCs such as Indian Oil, HPCL and BPCL on crude oil sourcing, refining and marketing.

- Rather, a formula — Trade Parity Price (TPP) — is used to price these products.

- TPP Formula:

- TPP is based on the calculation that 80 per cent of petrol and diesel is imported into India and 20 per cent is exported.

- So, petrol and diesel prices in India are determined based on prices of these fuels in the international market — and not on the basis of crude oil prices.

- While international petrol and diesel prices generally move in line with crude oil prices, it need not always be the case, given that demand and supply dynamics could be different.

- From June 2017, the pricing of petrol and diesel is done through a daily pricing mechanism, based on a 15-day rolling average international rate.

Why are Fuel Prices Different in Each State:

- Apart from TPP, there are three other factors that determine the price of petrol and diesel in India:

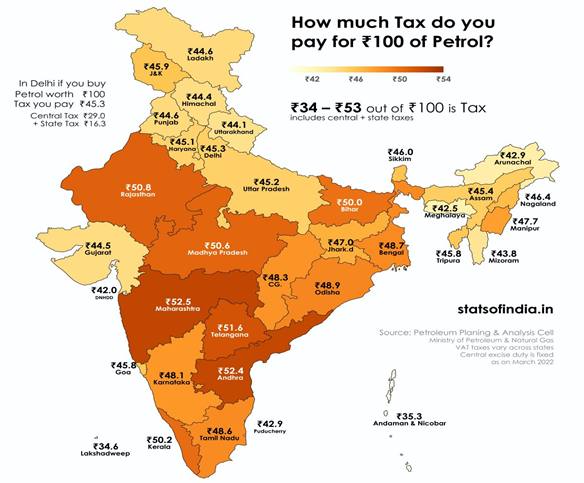

- Excise duty charged by the Central Government

- Value-Added Tax (VAT) charged by the State Governments

- Dealer commission to the gas stations

- While excise duty rates are uniform across the country, states levy sales tax/Value Added Tax (VAT) which varies across states.

Excise Duty Component:

- The excise duty levied on petrol and diesel consists of two broad components:

- Tax component (i.e., basic excise duty), and

- Cess and surcharge component.

- Of this, only the revenue generated from the tax component is devolved to states.

- Revenue generated by the centre from any cess or surcharge is not devolved to states.

- Currently, the Agriculture Infrastructure and Development Cess, and the Road and Infrastructure Cess are levied on the sale of petrol and diesel in addition to the surcharge.

Why are Fuel Prices so High?

- Recently, the Finance Minister of India, Nirmala Sitharaman, pointed out two factors due to which the fuel prices are high in India:

- The ongoing Ukraine-Russia Conflict

- Oil Bonds offered by the earlier Government

What are Oil Bonds?

- Oil bonds are issued by the government to compensate OMCs to offset losses that they suffer to shield consumers from rising crude prices.

- These bonds do not qualify as statutory liquidity ratio securities, making them less liquid when compared to other government securities.

- An oil bond says the government will pay the oil marketing company the sum of, say, Rs 1,000 crore in 10 years.

- And to compensate the OMC for not having this money straightaway, the government will pay it, say, 8% (or Rs 80 crore) as interest each year until the bond matures.

- Thus, by issuing such oil bonds, the government of the day is able to protect/subsidise the consumers without either ruining the profitability of the OMC or running a huge budget deficit itself.

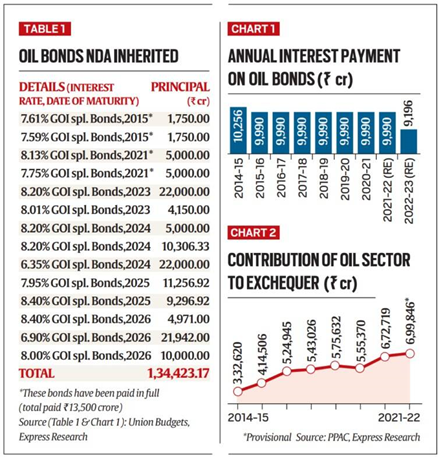

How much Oil Bonds Issued by the Previous Government have been paid off?

- As discussed earlier, there are two components of oil bonds that need to be paid off:

- Annual interest payment, and

- Final payment at the end of the bond’s tenure.

- Table 1 shows that between 2015 and 2021, the Union government has fully paid off four sets of oil bonds — a total of Rs 13,500 crore.

- Between 2014 and 2022, the government has spent a total of Rs 93,686 crore towards interest as well as the principal.

Limitations on tax reduction on fuel

- There are three ways to check whether the payout on oil bonds is large enough to restrict a reduction in taxes.

- The first is to observe that total payout was just 7% of the total revenues in 2014-15. As the years progressed, this percentage has come down because taxes generated from this sector have increased significantly.

- Moreover, the total revenue earned by the government (both Centre and states) between 2014 and 2022 from taxing petroleum products is more than Rs 43 lakh crore.

- That means the total payout by the current government till date on account of oil bonds is just 2.2% of the total revenues earned during this period.

- Furthermore, the total amount of revenue earned by the Centre from just one kind of tax— excise tax — in just 2014-15 — was more than Rs 99, 000 crore.

- In other words, the payout is not big compared to revenues earned in this sector.

Evaluation of bond issuance

- Former PM Manmohan Singh was correct in noting that issuing bonds just pushed the liability to a future generation.

- But to a great extent, most of the government’s borrowing is in the form of bonds. This is why each year the fiscal deficit (which is essentially the level of government’s borrowing from the market) is so keenly tracked.

- Further, in a relatively poor country like India, all governments are forced to use bonds of some kind.

- The current government itself, has issued bonds worth Rs 2.79 lakh crore (twice the amount of oil bonds) to recapitalize public sector banks. These bonds will be paid by governments till 2036.

- Thus, the main idea while issuing bonds is for a government to employ this tool towards increasing the productive capacity of the economy.