In News:

- The International Monetary Fund lifted the Chinese currency yuan’s weighting in the Special Drawing Rights currency basket, prompting the Chinese central bank to pledge to push for a further opening of its financial markets.

What’s in today’s article:

- About IMF (Origin, Purpose, Structure, Working, Members, Quota, SDR, etc.)

- News Summary

About International Monetary Fund (IMF):

- The IMF was originally created in 1945 as part of the Bretton Woods Agreement, which attempted to encourage international financial cooperation by introducing a system of convertible currencies at fixed exchange rates.

- The dollar was redeemable for gold at $35 per ounce at the time.

- Other currencies in the system were then pegged to the U.S. dollar’s value.

- The planners wanted to avoid the trade barriers and high-interest rates that helped cause the Great Depression (1929).

- Mission:

- Furthering international monetary cooperation,

- Encouraging the expansion of trade and economic growth,

- Discouraging policies that would harm prosperity.

- To fulfil these missions, IMF member countries work collaboratively with each other and with other international bodies.

Structure of IMF:

- The Board of Governors is the highest decision-making body of the IMF.

- It consists of one governor and one alternate governor for each member country.

- The governor is appointed by the member country and is usually the minister of finance or the head of the central bank.

- The board has the right to approve quota increases, special drawing right (SDR) allocations, the admittance of new members, compulsory withdrawal of members, and amendments to the Articles of Agreement and By-Laws.

Working of IMF:

- The IMF fosters international financial stability by:

- Policy Advice:

- Monitoring economic and financial developments and advising countries.

- Financial Assistance:

- Loans and other financial aid to member countries.

- Since the Bretton Woods system collapsed in the 1970s, the IMF has promoted the system of floating exchange rates, meaning that market forces determine the value of currencies relative to one another.

About IMF Quota:

- Quota subscriptions are central to the IMF’s financial resources.

- Each member country of the IMF is assigned a quota, based broadly on its relative position in the world economy.

- A member country’s quota determines its maximum financial commitment to the IMF, its voting power, and has a bearing on its access to IMF financing.

- Quotas are denominated in Special Drawing Rights (SDRs), the IMF’s unit of account.

About SDRs:

- The Special Drawing Right is an interest-bearing international reserve asset created by the IMF in 1969 to supplement other reserve assets of member countries.

- The SDR is based on a basket of international currencies comprising the S. dollar, Japanese yen, euro, pound sterling and Chinese Renminbi.

- It is not a currency, nor a claim on the IMF, but is potentially a claim on freely usable currencies of IMF members.

- The value of the SDR is set daily by the IMF on the basis of fixed currency amounts of the currencies included in the SDR basket and the daily market exchange rates between the currencies included in the SDR basket.

- The SDR basket is reviewed every five years to ensure that the basket reflects the relative importance of currencies in the world’s trading and financial systems.

How many SDRs have been allocated so far?

- The Fund has allocated a total of SDR 660.7 billion (equivalent to about US$935.7 billion).

India’s quota in IMF:

- In 2016, IMF’s quota and governance reforms took place.

- According to which, India’s voting rights increased by 0.3% from then 2.3% to 2.6% and China’s voting rights increased by 2.2% from then 3.8% to 6%.

- Presently, India holds 2.75% of SDR quota, and 2.63% of votes in the IMF.

Reports published by IMF:

- World Economic Outlook

- Global Financial Stability Report

- Fiscal Monitor

- Regional Economic Outlook

News Summary:

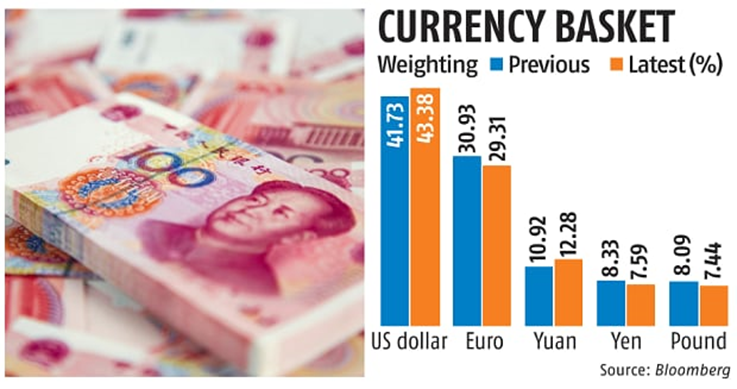

- In its first regular review of the SDR evaluation since 2016, the IMF raised the yuan’s weighting to 12.28 per cent from 10.92.

- Also, the weighting of the US dollar rose to 43.38 per cent from 41.73 per cent, while those of euro, Japanese yen and British pound declined.

- The ranking of the currencies’ weighting remains the same after the review, with the yuan continuing to be in third place.

- The change will be effective Aug 1 2022, and the next review will take place in 2027.

- IMF’s executive directors concurred that neither the pandemic nor developments in financial technology have had any major impact on the relative role of currencies in the SDR basket so far.