Why in the News?

The Ministry of Statistics and Programme Implementation (MoSPI) is modifying the Consumer Price Index (CPI) base year by updating CPI weights and baskets.

What’s in Today’s Article?

- About CPI (Meaning, Components, Types, Calculation Method, Purpose, etc.)

- Changes in CPI (Proposal, Rational Behind Changes, Implications, etc.)

Consumer Price Index (CPI):

- The CPI measures the average change in prices of a fixed basket of goods and services that households typically consume.

- It reflects how the purchasing power of money changes over time due to inflation.

- Components: CPI includes various categories, such as:

- Food and Beverages: Items like cereals, pulses, vegetables, milk, meat, and beverages.

- Housing: Rent or imputed rent for self-occupied houses.

- Clothing and Footwear: Costs of garments, footwear, and other related items.

- Fuel and Light: Includes LPG, kerosene, firewood, and electricity.

- Miscellaneous: Education, healthcare, transport, communication, and recreation expenses.

- Publishing Authority: The Ministry of Statistics and Programme Implementation (MoSPI) is responsible for compiling and releasing CPI data.

Types of CPI:

- CPI for Industrial Workers (CPI-IW):

- Tracks price changes for industrial workers.

- Base Year: 2016

- Used for wage adjustments in organized labor.

- CPI for Agricultural Labourers (CPI-AL) and Rural Labourers (CPI-RL):

- Measures inflation for rural and agricultural laborers.

- Base Year: 1986-87

- CPI (Urban), CPI (Rural), and CPI Combined:

- Measures retail inflation at a national level.

- Base Year: 2012

- CPI Combined is widely used as the official retail inflation rate in India.

How CPI Is Calculated?

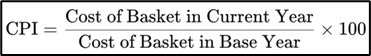

- CPI is calculated using the following formula:

- Here:

- The basket of goods and services represents typical household consumption.

- The base year serves as a reference point for comparison (currently 2012, likely to be revised to 2024).

Purpose of CPI:

- Tracking Inflation: CPI helps monitor the rate at which prices are rising or falling.

- Policy Formulation: RBI uses CPI as the primary metric for inflation targeting, maintaining it at 4% ± 2%.

- Wage and Pension Adjustments: CPI is used to revise salaries and pensions, especially in government sectors.

- Economic Analysis: It provides insights into consumption trends and economic health.

Key Issues in the Current CPI:

- Exclusion of Free PDS Items:

- Free goods distributed under the Public Distribution System are currently excluded as they do not involve direct monetary transactions.

- This aligns with international practices and recommendations, such as those by the International Monetary Fund (IMF), which suggest excluding non-monetary transactions from CPI.

- Challenges with PDS Inclusion:

- Redistribution of weights for free items has occasionally caused inflation spikes.

- Free items complicate inflation calculation as their inclusion may distort the measure of consumer expenditure.

Proposed Changes in the New CPI Series:

- The MoSPI is revising the CPI methodology with 2024 as the new base year. Key changes under consideration include:

- Inclusion of PDS Items:

- Reflecting free PDS items at a zero price, with future adjustments as weights change.

- This could lower headline inflation figures but requires significant adjustments to the CPI calculation process.

- Redistribution of Weights:

- Restrict redistribution to the same category (current practice).

- Broader redistribution across the entire CPI basket for greater accuracy.

- Stakeholder Consultation:

- The new CPI series is expected to roll out by the final quarter of FY26, post stakeholder consultations and technical adjustments.

- MoSPI has invited inputs from experts, academicians, and the public on the proposed treatment of free PDS items, with the deadline set for January 15, 2025.

Rationale Behind the Proposed Changes:

- Economic Representation:

- The Chief Economic Advisor (CEA) and other experts argue that excluding free PDS items undermines the true representation of market conditions.

- With increased free food grain distribution during economic crises, including these items may provide a more accurate inflation measure.

- Alignment with Household Expenditure:

- The updated CPI will derive weights from the 2022–23 Household Consumption Expenditure Survey (HCES), ensuring the basket reflects current consumption patterns.

Methodological Challenges:

- Compliance with International Norms:

- Global practices recommend limiting CPI to monetary transactions, complicating the inclusion of free PDS items.

- Mid-Series Adjustments:

- Adapting ongoing CPI series to account for changes in PDS pricing—such as shifting from zero to positive prices—presents statistical challenges.

- Impact on Headline Inflation:

- Including free items may lower inflation figures, but it risks skewing the index’s purpose of capturing monetary price movements.

Broader Implications:

- Policy Decisions:

- The revised CPI will serve as a critical input for monetary policy, helping the RBI frame more accurate inflation-targeting measures.

- Global Trade Considerations:

- As India aims to align its statistical practices with international standards, changes in CPI methodology may affect global investor perceptions.

Conclusion:

- The ongoing deliberations on including free PDS items in CPI aim to enhance the index’s robustness and accuracy.

- While aligning with international best practices, India’s revised CPI could better capture the dynamics of consumer expenditure and inflation in a rapidly evolving economic landscape.

- Stakeholder feedback and meticulous planning will be crucial to navigating the statistical and policy complexities of these changes.