In News:

- The 47th Goods and Services Tax (GST) Council meeting is currently underway to discuss rate rationalisation measures, exemption reviews, system reforms and other topics.

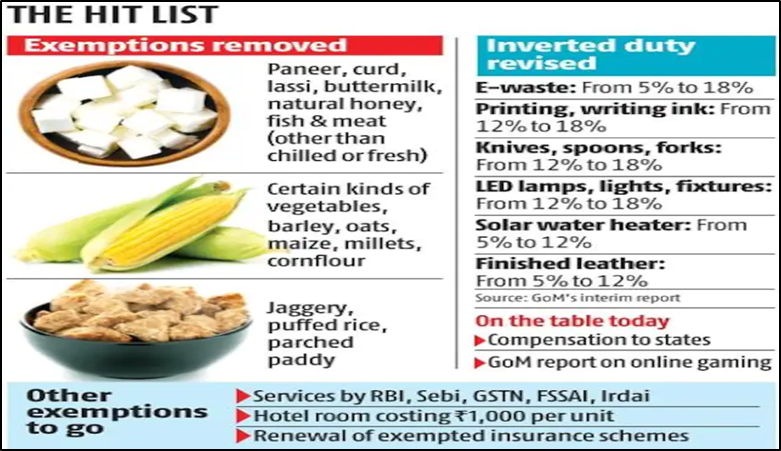

- The Council approved bringing pre-packaged and labelled food items such as wheat flour, puffed rice, curd/lassi/buttermilk and paneer under the GST net on the first day of its 47th meeting.

- The contentious issue of extending compensation for states beyond June 2022, as well as the 28% GST rate on casinos, online gaming, and horse racing, will be debated on the second day.

What’s in today’s article:

- About the GST council

- News Summary

- What has changed this time?

- What’s on the table at the 47th meeting?

- Decisions approved on the first day of the meeting

About the Goods and Services Tax (GST) Council:

- The GST regime came into force with the enactment of the Constitutional (101st Amendment) Act, 2017.

- The GST Council - a joint forum of the Centre and the states, was set up by the President of India as per Article 279A (1) of the amended Indian Constitution. It consists of the -

- Union Finance Minister - Chairperson

- The Union Minister of State, in-charge of Revenue of finance - Member

- The Minister in-charge of finance or taxation or any other Minister nominated by each State Government - Members

- The GST Council is an apex committee to modify, reconcile or to make recommendations to the Union and the States on GST, like the goods and services that may be subjected or exempted from GST, model GST laws, etc.

- The GST Council meets to discuss and lay GST laws. Decisions in the GST Council are taken by a majority of not less than three-fourth of weighted votes cast.

- Centre has one-third weightage of the total votes cast and all the states taken together have two-third of weightage of the total votes cast.

- All decisions taken by the GST Council have been arrived at through consensus.

News Summary:

What has changed this time?

- The current (47th) meeting is the first since the Supreme Court of India (SC) ruled that GST Council recommendations are not binding.

- According to the court, Article 246A of the Constitution grants both Parliament and state legislatures simultaneous power to legislate on GST, and the Council's recommendations are the result of a collaborative dialogue involving the Union and States.

- Some states, such as Kerala and Tamil Nadu, applauded this, believing that states can be more flexible in accepting recommendations that are tailored to their needs.

- The council meeting is also expected to address the issue of extending the GST compensation regime beyond June 2022.

- Previously, the Council agreed to extend the compensation cess levy until 2026, but only for repayment of borrowings made in the aftermath of the pandemic to compensate states.

What’s on the table at the 47th meeting?

- Demand of states:

- States (especially Opposition-ruled) are expected to raise demand for an extension of the compensation regime to bridge revenue shortfall beyond June 2022.

- Some states have also suggested tweaking the revenue sharing formula between the Centre and states under the indirect tax regime.

- For example, the Finance Minister of Chhattisgarh stated that if the protective revenue provision is not maintained, the 50:50 formula for central GST (CGST) and state GST (SGST) should be tweaked, with the share of states at 70-80% and CGST at 20-30%.

- Ministerial panels’ recommendations:

- The Council is also expected to discuss:

- interim recommendations of a ministerial panel on rate rationalisation including levying a tax of 12% on hotel rooms costing below Rs 1,000/day which are presently exempt;

- bringing in pre-packaged food items (including rice, atta, curd, lassi, puffed rice) at par with branded food items with a tax rate of 5%, etc.

- Another ministerial panel’s recommendation is to levy 28% GST on online gaming, casinos and horse racing.

- Additionally, it will discuss the Fitment Committee’s proposal to levy tax on the margins made by tour operators at a suitable rate, etc.

- Decisions approved on the first day of the meeting: