In News:

- Following the restrictions imposed on non-bank buy now pay later (BNPL) companies, the Reserve Bank of India (RBI) is expected to issue guidelines for the BNPL segment.

- These BNPL companies were using pre-paid instruments (PPIs) to extend short-term, interest-free loans to customers for online purchases.

What’s in today’s article:

- What is BNPL? (About, prevalence in India, how do they operate, difference between credit card payment and BNPL, advantages, challenges)

- News Summary

Buy Now, Pay Later (BNPL)

- BNPL is a financing option (or simply a short-term loan product) which allows one to buy a product or avail a service without having to worry about paying for it immediately.

Prevalence in India:

- The market for BNPL is booming in India.

- This is due to the rise of e-commerce and digital payments, low credit card penetration and rapid increase in the number of fintechs who are disrupting the traditional methods of accessing credit.

- According to RazorPay’s ‘The Covid Era of Rising Fintech’ report, the India BNPL market grew more than 637% in 2021 (569% in 2020).

- According to estimates, the BNPL market will grow from current $3-3.5 billion to $45-50 billion by 2026.

- The ease of access to credit has made BNPL the most preferred product among young millennials, new credit borrowers, who were often overlooked by traditional banks.

BNPL players in India

- There are around a dozen BNPL players in India including ZestMoney, LazyPay, MobiKwik, Paytm Postpaid, Amazon Pay Later, Flipkart Pay Later, etc.

- Even traditional banks (HDFC Bank’s FlexiPay and ICICI Bank’s ICICI PayLater) are jumping into the BNPL bandwagon.

How do they operate?

- Customers with BNPL cards or accounts can use the 'Buy now, pay later' option when making a purchase at a participating retailer.

- Following the purchase, the customer can repay the BNPL firm in a series of interest-free EMIs spread over three months or as a lump sum amount.

- If it is not paid by the due date, interest will be charged.

- The BNPL company will immediately pay the merchant.

- However, for a purchase of Rs 500, instead of paying the full Rs 500 for a purchase, they would pay something like Rs 450/470 and pocket the difference.

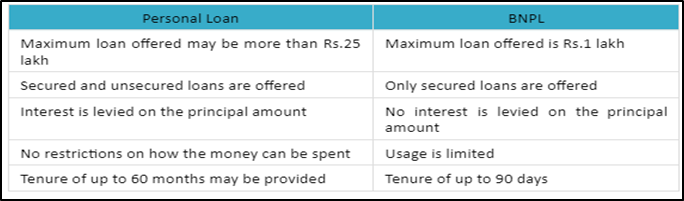

Difference between personal loan and BNPL

Difference between credit card payment and BNPL:

- Both credit cards and BNPL are similar in a sense that both offer deferred repayment options to the borrower.

- However, there are certain key differences between these two credit products.

- Ease of access: While availing a credit card requires a good credit history and involves stringent verification process, BNPL provides hassle-free access to credit.

- Interest-free credit: Credit cards typically offer interest free credit periods up to 45 days while BNPL often comes with interest-free loans with a shorter credit period (say 15 days to one month).

- Charges included: Credit cards come with charges like joining fee, recurring annual fee etc., which can be higher for premium cards. On the other hand, BNPL comes with no such charges.

Advantages of BNPL:

- Increases affordability, instant access to credit, safe and secure transaction, can choose repayment tenure, no cost EMI, simple and transparent process.

Challenges:

- Regulatory issues:

- Regulators around the world are cracking down on the BNPL industry, citing excessive, unregulated and illegal lending; a lack of credit history; data privacy; etc.

- In India, the RBI is keeping a close tab on the digital lenders.

- A working group (focused on making the digital lending ecosystem safe) constituted by the RBI (last year) found that 600 out of 1,100 lending apps on Indian app stores were illegal.

- Some of the key suggestions of the working group report include -

- Subjecting the digital lending apps to a verification process by a nodal agency and setting up of a Self-Regulatory Organisation (SRO).

- Treating BNPL arrangements as balance sheet lending, mandating knowing your customer (KYC) and credit score checks before extending BNPL options to borrowers.

- Recently, RBI has unveiled the Payments Vision 2025

- The vision document recommended that the BNPL method be examined and that appropriate guidelines on BNPL payments be developed.

- Debt trap: Such easy access to credit, which are mainly for discretionary purchases, may lead borrowers to a debt trap.

- Affects the credit culture: Though small in size, availing multiple loans from different lenders at the same time will impact the borrower’s repayment ability, affecting the credit culture.

- Risk of higher non-performing assets (NPAs): Since BNPL primarily focused on first time borrowers with no credit history, the lenders also run the risk of higher non-performing assets (NPAs) if the borrowers default.

- Insecure reporting mechanism: It is still early days of BNPL and the reporting mechanism is not as structured and fool-proof as in case of credit cards.

News Summary:

- The RBI had recently communicated to BNPL companies to stop issuing cards where the funds are loaded through a credit line from NBFCs, sending tremors in the segment.

- According to banking observers, the RBI is not happy with fintech companies using PPIs as a credit instrument, circumventing the regulatory oversight.

- While BNPL services have developed into a new payment mode alongside the existing payment modes (like cards, UPI and net banking), it has remained outside the direct RBI regulation.

- BNPL channel uses an existing nodal account (escrow account after authorization) to route payments between a BNPL customer and a merchant.

- Another major source of concern for the RBI is the high level of delinquency (defaulters) in the BNPL segment.

- According to data, delinquencies in the BNPL segment are 9%, while delinquencies in the non-BNPL segment are 10.1%.

- The banking regulator is in discussion with fintech players to find a way out and bring the segment under a regulatory framework so that PPIs are used as a payment instrument and not as a credit avenue.

- This will bring more transparency in the fintech lending space.