Why in news?

In its first meeting after the Union Budget, the Reserve Bank of India’s Monetary Policy Committee (MPC) decided to keep the policy repo rate unchanged at 6.50% for the ninth consecutive time.

Of the six members of the MPC, four voted in favour of the decision, which is aimed at taming inflation.

What’s in today’s article?

- Monetary Policy Committee (MPC)

- Key outcomes of MPC 2024

- Other announcements made during MPC 2024

Monetary Policy Committee (MPC)

- The Committee

- Under Section 45ZB of the amended RBI Act, 1934, the central government is empowered to constitute a six-member Monetary Policy Committee (MPC).

- MPC will determine the policy interest rate required to achieve the inflation target. The first such MPC was constituted in September 2016.

- Members of MPC

- the RBI Governor as its ex officio chairperson,

- the Deputy Governor in charge of monetary policy,

- an officer of the Bank to be nominated by the Central Board, and

- three persons to be appointed by the central government.

- Functions of MPC

- Setting Policy Interest Rates: The primary function of the MPC is to determine the policy interest rates, specifically the repo rate.

- Inflation Targeting: The current inflation target set by the government is a Consumer Price Index (CPI) inflation target of 4% with a tolerance band of +/- 2%.

- Economic Analysis and Forecasting: The MPC conducts thorough analysis and forecasting of various economic indicators, including inflation, GDP growth, employment, fiscal conditions, and global economic developments.

- Decision-Making: The MPC meets at least four times a year to review the monetary policy stance.

Key outcomes of MPC 2024

- Policy rates remained unchanged

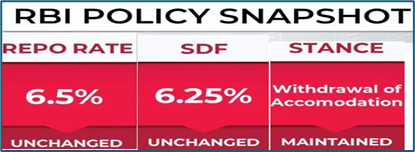

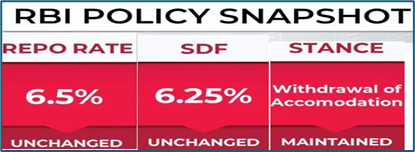

- MPC decided to keep the policy repo rate unchanged at 6.50%.

- Repo rate is the rate at which the Reserve Bank of India lends money to commercial banks in the event of any shortfall of funds.

- The standing deposit facility (SDF) rate remains at 6.25%, while the marginal standing facility (MSF) rate and the bank rate stand at 6.75%.

- The SDF is a liquidity window through which the RBI will give banks an option to park excess liquidity with it.

- It is different from the reverse repo facility in that it does not require banks to provide collateral while parking funds.

- MSF is a window for banks to borrow from the central bank in an emergency situation when inter-bank liquidity dries up completely.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

- An accommodative stance means the central bank is prepared to expand the money supply to boost economic growth.

- Withdrawal of accommodation means reducing the money supply in the system which will rein in inflation further.

- Food prices drive inflation

- The headline inflation, after remaining steady at 4.8% during April and May, had increased to 5.1% in June.

- The headline inflation, primarily driven by food inflation, remains stubborn.

- Core inflation (CPI excluding food and fuel) moderated, while the fuel group remained in deflation.

- Inflation is moderating but the pace of disinflation is uneven and slow. Still there is distance to cover to align inflation with target.

- GDP forecast

- Real GDP growth for 2024-25 has been projected at 7.2%, with the first quarter (Q1) projection at 7.1%; Q2 at 7.2%; Q3 at 7.3%; and Q4 at 7.2%.

- Real GDP growth for the first quarter of 2025-26 is projected at 7.2%.

Other announcements made during MPC 2024

- Transaction limit for tax payments via UPI hiked from Rs 1 lakh to Rs 5 lakh

- RBI announced to increase the transaction limit for tax payment through Unified Payments Interface (UPI) from Rs 1 lakh to Rs 5 lakh per transaction.

- The move will further ease tax payments by consumers through UPI, which has become the most preferred mode of digital payments.

- The enhancement of the UPI limit for tax payments will strengthen the tax-collection system, reduce the cost of tax collection, and make tax payments more convenient for taxpayers.

- Creation of repository of digital lending apps

- In a bid to protect customers from fraudulent players in the financial services sector, the Reserve Bank of India is creating a public repository of digital lending applications which will be available on its website.

- This measure will put some check on the digitalized loan shark business.

- Aim of RBI is to sensitise the public about unauthorized digital lending App’s and to prevent them from falling prey to digital fraud.

- Focus more on deposit mobilisation via innovative product

- RBI Governor Shaktikanta Das has expressed concern over the shift of household savings from banks to alternative investment avenues, leading to slower deposit growth compared to credit growth.

- While deposits grew by 11.7%, credit growth increased by 15.5% as of July 12.

- RBI Governor urged banks to attract deposits by offering innovative products and leveraging their branch networks to avoid potential liquidity issues.

- Can’t ignore food inflation pressures

- The Economic Survey for 2023-24 suggested excluding food prices from headline inflation.

- It argued that food prices were keeping the CPI-based inflation high and delaying interest rate cuts by the RBI.

- However, RBI Governor disagreed, emphasizing that food inflation, which constitutes about 46% of the CPI basket, cannot be ignored due to its significant impact on the public and overall inflation.

- He acknowledged that while the MPC might overlook temporary food inflation spikes, it must remain vigilant against persistent food inflation to prevent spillovers into other areas of the economy.

- The governor mentioned that the National Statistical Office (NSO) is conducting a survey to reassess the CPI basket, which may influence future decisions on the weight of food, fuel, and core components in headline inflation.