In News:

- Recently, the Reserve Bank of India (RBI) established a mechanism to settle international trade in rupees in order to promote global trade growth with a focus on Indian exports.

- The move by the central bank follows increased pressure on the Indian currency as a result of Russia's invasion of Ukraine and sanctions imposed by the US and the EU.

What’s in today’s article:

- Overview of the current scenario

- News Summary

Overview of the current scenario:

Background:

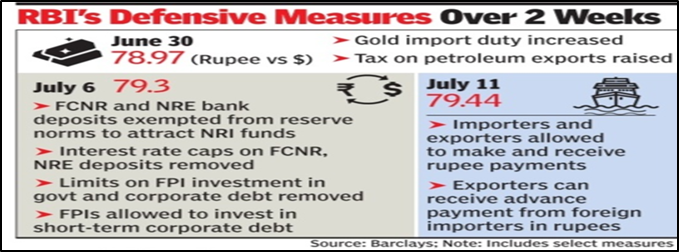

- Recently, the Indian rupee fell to a new low (lost almost 6% during the current year) against the US dollar, as domestic stock markets fell and foreign investors continued to sell Indian equities.

- The Indian rupee breached for the first time the Rs 79/$ level in post-market trade.

- Among Asian currencies, the rupee has outperformed during the current year.

- However, the recent decline has caused it to underperform in comparison to the currencies of Singapore, Indonesia, Thailand, China and Malaysia.

What does this fall signify?

- The exchange rate is frequently used to gauge an economy's relative strength.

- The majority of developing economies run trade and current account deficits.

- The ultimate impact of a fall is determined by a number of factors. A fall in the rupee, for example, can benefit India's exporters - unless they import raw materials, which would become more expensive.

- Furthermore, India is the only major emerging market with a large current account deficit and unlike other emerging markets, does not benefit significantly from currency depreciation.

- Oil prices and overall dollar strength will determine whether the rupee remains above 79 or recovers. There is no reason for the rupee to reverse its course unless oil prices fall significantly.

Role played by RBI to check this fall:

- To slow down the rupee's fall, the RBI would sell some of the dollars in its forex reserves in the market.

- This will absorb a large number of rupees from the market, narrowing the demand-supply gap between the rupee and the dollar.

- By selling billions of dollars from its reserves, the RBI has ensured that there are no wild swings in the exchange rate.

- This is why the RBI's forex reserves have plummeted since the start of the Ukrainian conflict.

Recent steps taken by the RBI to address the situation

News Summary:

About the new mechanism:

- The Reserve Bank of India (RBI) has put in place a mechanism - an additional arrangement for invoicing, payment and settlement of exports or imports in rupees (INR).

- This step has been taken to facilitate international trade in INR, with immediate effect.

- In a circular issued to commercial banks, the RBI said all exports and imports under this arrangement may be denominated and invoiced in INR.

- Exchange rate between the currencies of the two trading partner countries may be market determined.

- Authorised dealer (AD) banks in India have been permitted to open rupee Vostro accounts.

- A vostro account is an account a correspondent bank holds on behalf of another bank.

- Accordingly, for settlement of trade transactions with any country, AD banks in India may open special rupee vostro accounts of correspondent banks of the partner trading country.

- However, banks acting as authorised dealers for such transactions would have to take prior approval from the Foreign Exchange Department of RBI, Central Office at Mumbai, to facilitate this.

How will it work?

- Indian importers using this mechanism must pay in INR, which must be credited to the special vostro account of the partner country's correspondent bank, against invoices for the supply of goods or services from the overseas seller or supplier.

- Indian exporters who use this mechanism to export goods and services should be paid in INR from the balances in the designated special vostro account of the partner country's correspondent bank.

- The issue of bank guarantee for trade transactions (undertaken through this arrangement) is permitted subject to adherence to provisions of Foreign Exchange Management Act (FEMA) notification.

Significance:

- The RBI mechanism is expected to facilitate importers and exporters to avoid rules that prevent the use of a global currency such as the US dollar for trade with certain countries.

- After Russia attacked Ukraine, several countries had imposed sanctions on Russia. Indian companies which were looking for alternative modes of payment for imports can make use of the new mechanism.

- This will promote global trade growth, with an emphasis on Indian exports and will support the growing interest of the global trading community in INR.