In News:

- The Reserve Bank of India’s first pilot for a retail e-rupee, its version of the central bank digital currency (CBDC), will be launched on December 1.

- The pilot will cover select locations in a closed user group comprising participating customers and merchants.

What’s in today’s article:

- Central bank digital currency (CBDC) – About, India’s approach towards CBDC, rationale

- News Summary

Central bank digital currency (CBDC)

About

- CBDC is the legal tender issued by a central bank in a digital form.

- The digital rupee (e-Rupee) is the digital currency launched by Reserve Bank of India.

- It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency, only its form is different.

India’s approach to CBDC

- Budget 2022-23 announcements

- In her 2022-23 Budget speech, the Finance Minister announced the launch of the Digital Rupee, the name of the CBDC in India, from 2022-23

- The Reserve Bank of India (RBI) will issue these in 2022-23.

- Regulatory Framework

- Currently, there is no regulation or any ban on the use of cryptocurrencies in the country.

- The Indian government is expected to introduce the Crypto currency and Regulation of Official Digital Currency Bill.

- It is expected to regulate the role of investment, transaction and use of private crypto currencies in the country, including working of CBDC.

- Launch of Digital Rupee

- Based on the usage and the functions performed by the digital rupee and considering the different levels of accessibility RBI has demarcated the digital rupee into two broad categories: general purpose (retail) and wholesale.

- From November 1, 2022, RBI launched its first pilot project to use digital rupee in the wholesale market for secondary trade in government securities (G-secs).

- Wholesale CBDC has the potential to transform the settlement systems for financial transactions undertaken by banks in the government securities (G-Sec) segment, inter-bank market and capital market more efficient and secure in terms of operational costs, use of collateral and liquidity management.

- From December 1, retail digital rupee (e-R) pilot will be launched.

- In effect, the retail e-rupee will be an electronic version of cash, and will be primarily meant for retail transactions.

- It will be potentially available for use by all — the private sector, non-financial consumers and businesses.

- It will be distributed through intermediaries, i.e., banks.

- Transactions can be both person to person (P2P) and person to merchant (P2M) using QR codes displayed at merchant’s locations.

- It will not earn any interest and can be converted to other forms of money, like deposits with banks.

Why RBI is launching e-Rupee?

- The key motivations for exploring the issuance of CBDC include

- Reduction in operational costs involved in physical cash management,

- Fostering financial inclusion,

- Bringing resilience, efficiency and innovation in the payments system.

- It will add efficiency to the settlement system and boost innovation in cross-border payments space.

- Introducing its own CBDC has been seen as a way to bridge the advantages and risks of digital currency.

- Specially, concerns over money laundering, terror financing, tax evasion, etc. with private crypto currencies like Bitcoin, Ether, etc.

- Being interoperable with other payment systems, it will complement existing techniques like UPI, thus completing the mobile payments ecosystem.

News Summary:

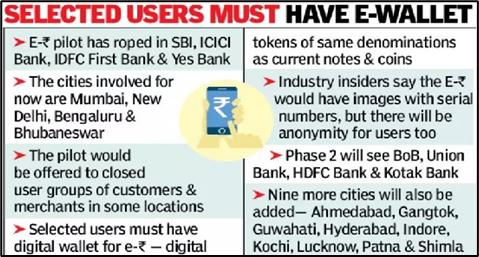

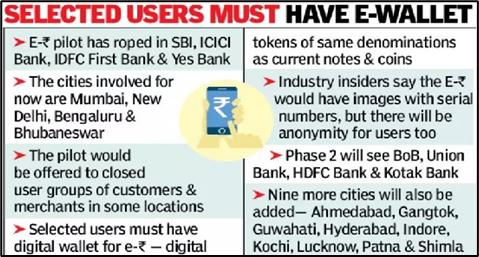

- The RBI has announced that the retail digital rupee (e-R) pilot will launch on December 1 with four banks - State Bank of India, ICICI Bank, IDFC First Bank and Yes Bank.

Key highlights

- The e-R would be in the form of a digital token that represents legal tender. It would be issued in the same denominations that paper currency and coins are currently issued.

- Like in the case of paper currency, the digital rupee would be distributed through banks.

- Users must use a digital wallet through a participating bank and store it on their mobile phone or device.

- Payments to merchants can be made using QR codes displayed at merchant locations.

- The pilot will test the robustness of the entire process of digital rupee creation, distribution and retail usage in real time.