In News:

- Sri Lanka has reached a preliminary agreement with the International Monetary Fund (IMF) for a loan of about $2.9 billion.

- Sri Lanka is facing the worst economic crisis in decades and is currently seeking a way out of this crisis.

What’s in today’s article:

- Economic Crisis of Sri Lanka

- News Summary

In Focus: Economic Crisis in Sri Lanka

Background:

- Sri Lanka is facing the double whammy of rising prices and high debt, and its people are bearing the brunt of it as the domestic situation turns increasingly grim.

- In September 2021, Sri Lanka declared a state of Economic Emergency for the Supply of Essential Foods.

- It allowed the government to take control of the supply of basic food items, and set prices to control rising inflation.

- The crisis left Sri Lanka in political turmoil forcing the then President, Gotabaya Rajapaksa to resign.

- The current inflation in the country is now at almost 65% year-on-year. It owes more than $51 billion in foreign debt, of which $28 billion has to be repaid by 2028.

- According to the IMF, the country’s economy will shrink by 8.7 per cent in 2022 while inflation rises to above 60 per cent.

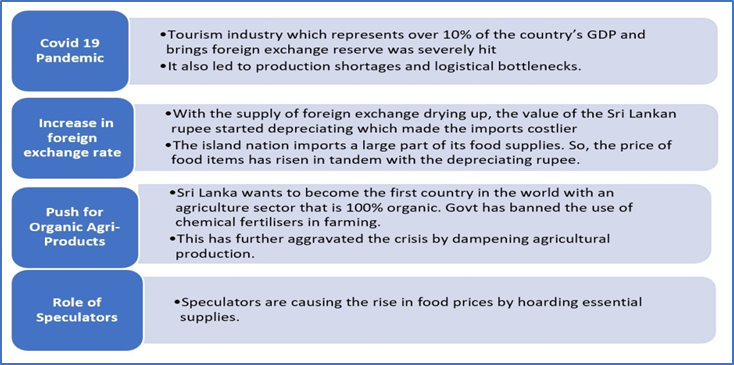

Factors Responsible for the Economic Crisis of Sri Lanka

- Besides the above factors, domestic factors such as years of mismanagement and corruption are also responsible for the current mess.

- Also, the 2019 Easter suicide bombings at churches and hotels devastated tourism. It was further aggravated by the Covid 19 Pandemic.

News Summary

- IMF has announced that it has reached a staff-level provisional agreement for a $2.9 billion package to bail Sri Lanka out of its worst economic crisis.

- The agreement is only preliminary, and has to be approved by the IMF management and its executive board.

- The approval is contingent on Sri Lanka’s international creditors agreeing to restructure its debt.

- International creditors include commercial lenders such as banks and asset managers, multilateral agencies, as well as bilateral creditors including China, Japan, and India.

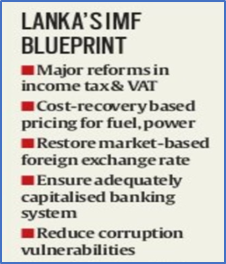

- It will also go through only if Sri Lankan authorities carry out previously agreed measures.

- Sri Lanka is expected to take tough measures, through its budget, aimed at increasing revenue and reducing public debt while initiating sectoral reform.

IMF funds will help Sri Lanka

- The funds will be disbursed over four years to help stabilise the economy and boost growth.

- The package will help raise government revenue to support fiscal consolidation, introduce new pricing for fuel and electricity, hike social spending, bolster central bank autonomy and rebuild depleted foreign reserves.

- Starting from one of the lowest revenue levels in the world, the bailout programme will implement major tax reforms.

- These reforms include making personal income tax more progressive and broadening the tax base for corporate income tax and VAT.

- The programme aims to reach a primary surplus of 2.3% of GDP by 2024.

- The IMF package, to be paid in tranches over the next four years, is less than what India provided to Sri Lanka over four months.

- However, an IMF loan will boost the receiving country’s credit ratings, and the confidence of international creditors and investors.