What’s in today’s article?

- Key highlights of Union Budget 2024-2025 – Part II

Key highlights of Union Budget 2024-2025 – Part II

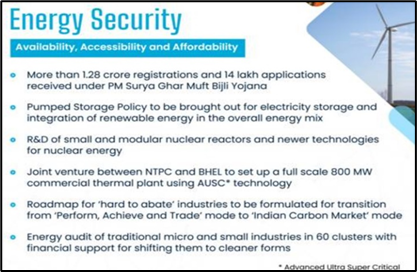

- Priority 6: Energy Security

- In line with the announcement in the interim budget, PM Surya Ghar Muft Bijli Yojana has been launched to install rooftop solar plants to enable 1 crore households obtain free electricity up to 300 units every month.

- The scheme has generated remarkable response with more than 1.28 crore registrations and 14 lakh applications.

- Priority 7: Infrastructure

- Improving infrastructure has had a strong multiplier effect on the economy.

- Priority 8: Innovation, R&D

- The govt will operationalize the Anusandhan National Research Fund for basic research and prototype development.

- It will also set up a mechanism for spurring private sector-driven research and innovation at commercial scale with a financing pool of ₹1 lakh crore in line with the announcement in the interim budget.

- Space Economy: For emphasis on expanding the space economy by 5 times in the next 10 years, a venture capital fund of ₹1,000 crore will be set up.

- Priority 9: Next Generation Reforms

Other highlights of the budget

- Labour related reforms

- A comprehensive integration of e-shram portal with other portals will facilitate such one-stop solution.

- It will include mechanism to connect job seekers with potential employers and skill providers.

- Shram Suvidha and Samadhan portals will be revamped to enhance ease of compliance for industry and trade.

- Government will develop a taxonomy for climate finance for enhancing the availability of capital for climate adaptation and mitigation.

- Foreign Direct Investment and Overseas Investment

- The rules and regulations for FDI and Overseas Investments will be simplified to:

- facilitate FDI,

- nudge prioritization, and

- promote opportunities for using Indian Rupee as a currency for overseas investments.

- NPS Vatsalya

- NPS-Vatsalya, a plan for contribution by parents and guardians for minors will be started.

- On attaining the age of majority, the plan can be converted seamlessly into a normal NPS account.

- New Pension Scheme (NPS)

- The Committee to review the NPS has made considerable progress in its work and a solution will be evolved which addresses the relevant issues while maintaining fiscal prudence to protect the common citizens.

- Taxation in Budget 2024-25

- Budget Estimates 2024-25

- For the year 2024-25, the total receipts other than borrowings and the total expenditure are estimated at ₹32.07 lakh crore and ₹48.21 lakh crore respectively.

- The net tax receipts are estimated at ₹25.83 lakh crore and the fiscal deficit is estimated at 4.9 per cent of GDP.

- The gross and net market borrowings through dated securities during 2024-25 are estimated at ₹14.01 lakh crore and ₹11.63 lakh crore respectively.

- The government will aim to reach a deficit below 4.5 per cent next year.

- Angel Tax abolished

- Budget has given boost to entrepreneurial spirit and start-up ecosystem by abolishing angel tax for all classes of investors.

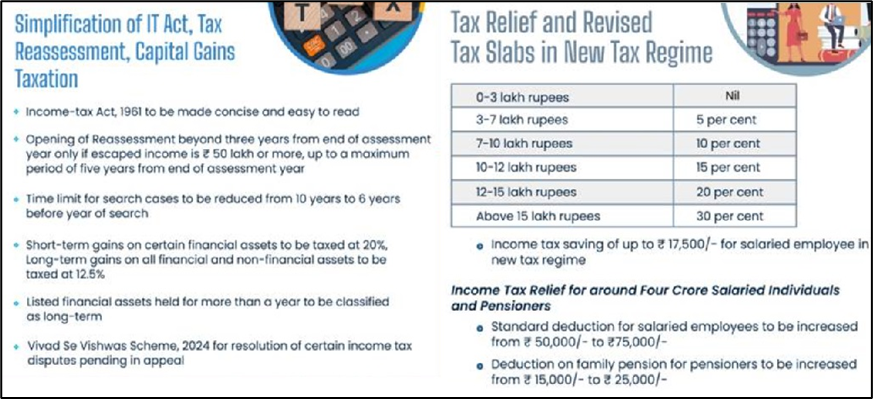

- Capital Gain Tax

- Short term gains shall henceforth attract a rate of 20% on certain financial assets.

- Long term gains on all financial & non-financial assets to attract 12.5 per cent rate.

- Listed financial assets held for more than a year and unlisted assets (financial and non-financial) held for more than two years to be classified as long-term assets.

- Limit of exemption of capital gains has been increased to ₹1.25 Lakh per year to benefit lower and middle-income classes.

- Vivad se Vishwas Scheme 2024

- For dispute resolution and dispose-off backlogs, Union Finance Minister proposed Vivad se Vishwas Scheme, 2024 for resolution of certain income tax disputes pending in appeal.

- The monetary limits for filing appeals related to direct taxes, excise and service tax in High Courts, Supreme Courts and tribunals has been increased to ₹ 60 Lakh, ₹ 2 Crore and ₹ 5 Crore, respectively.