In News:

- Recently, the Reserve Bank of India (RBI) has unveiled the Payments Vision 2025

- The document proposes a host of innovative payment systems and regulation of BigTechs, fintechs, buy-now-pay-later (BNPL) systems, introduction of a central bank digital currency (CBDC), etc.

What’s in today’s article:

- Background

- The Payments Vision 2025 document (Key highlights, objectives)

Background:

- Payment systems foster economic development and financial stability as well as support financial inclusion.

- Ensuring safe, secure, reliable, accessible, affordable and efficient payment systems has been one of the important strategic objectives and goals of the RBI.

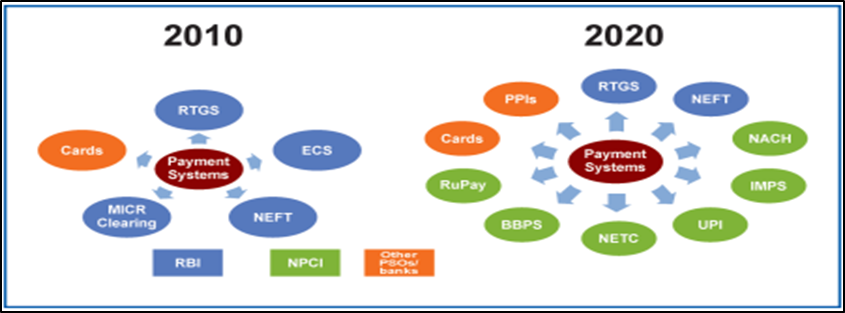

- Over the last decade, India has developed one of the most modern payment systems in the world.

- g., UPI recorded more than 595 Cr transactions worth INR 10.4 Lakh Cr in May 2022.

- The role of RBI has transformed from being a regulator, operator and facilitator to creator of an environment for the structured development of the payments ecosystem in India.

- The Payments Vision documents of RBI have been providing the strategic direction and implementation plan for this development since 2001.

- The current Vision document builds on the Payments Vision 2019-21 document and outlines the thought process for the period up to December 2025.

The Payments Vision 2025 document:

Key highlights:

- 5 key themes

- The vision document has five key themes - 5Is - integrity, inclusion, innovation, institutionalisation and internationalisation.

- Core theme:

- It is based on the core theme of E-Payments for Everyone, Everywhere, Everytime (4 Es).

- The document envisages to provide users with safe, secure, fast, convenient, accessible and affordable e-payment options.

- Big push for E-Payments:

- The RBI will undertake initiatives to streamline the e-payments infrastructure in the country as it prepares for the next evolution of the space.

- These include the incorporation of alternative authentication mechanisms, such as biometrics and digital tokens, in addition to OTPs, to authenticate users.

- The central bank will also take initiatives to promote the usage of legal entity identifiers (LEIs) to promote cross-border payments and screen sanctioned entities.

- LEI is an alpha-numeric code that is used to uniquely identify parties involved in a financial transaction and faster tracking of payments.

- The RBI also said that it will undertake a study on the feasibility of digital payments protection fund (DPPF).

- DPPF is aimed at providing a security cover to defrauded customers and issuers of payment instruments.

- The RBI will also enable a framework for geo-tagging of payment system touch points across the country.

- Use of technology:

- The Vision 2025 document also includes a provision that calls for developing a framework for an internet of things (IoT)-based payments systems.

- It would enable customers to pay via connected devices apart from users’ phones and tablets.

- The RBI also intends to create a new system for processing payments done via internet and mobile banking services.

- Currently, these services are routed through payment gateways and other aggregators.

- Reviewing legal-institutional infrastructure:

- The RBI will also undertake a comprehensive review of the payment and settlement systems (PSS) Act.

- The central bank will also constitute a payments advisory council (PAC) to assist the board for regulation and supervision of payment and settlement systems (BPSS).

- The PAC will comprise representatives from start-ups, consumer groups, digital payments companies, etc.

- Introduction of a central bank digital currency (CBDC):

- The RBI also said that it is working towards the introduction of a CBDC in the country.

- It went on to say that various use cases would be investigated in order to increase efficiencies in domestic and cross-border payment processing and settlement using CBDCs.

- Other proposals:

- Bringing in enhancements to Cheque Truncation System (CTS), including One Nation One Grid clearing and settlement perspective.

- It also proposed regulation of BigTechs and FinTechs in the payments space.

- The vision document recommended that the BNPL method be examined and that appropriate guidelines on BNPL payments be developed.

- BNPL services have evolved into a new payment mode in addition to existing payment methods such as cards, UPI and net banking.

- This channel, which is facilitated by a few payment aggregators, uses an existing nodal account (escrow account after authorization) to route payments between BNPL customers and merchants.

Objectives:

- As part of the initiative, the RBI aims to enhance the scalability of payments systems.

- The central bank aims to

- increase the number of digital payment transactions by more than three times by 2025 and

- to curb the volume of cheque-based payments to less than 0.25% of the total retail payments.

- The document also envisages an annualised growth of 50% for UPI payments and 20% for Immediate Payment Service (IMPS) and National Electronic Funds Transfer (NEFT).

- In a further push for digital payments, the RBI will work towards reduction of cash in circulation as a percentage of GDP.

- It will also target increasing the number of registered users for mobile-based transactions at a compounded annual growth rate (CAGR) of 50% by 2025.

- It aims to increase debit card transactions at point of sale (PoS) by 20% and expand card acceptance infrastructure across the country to 250 lakh touchpoints by 2025.

- This is to ensure that debit card usage outnumbers credit card usage in terms of value.