Oct. 29, 2024

Mains Article

29 Oct 2024

Context

- The lack of gender diversity within India’s judiciary is a persistent issue that has significant implications on the fairness and inclusivity of the justice delivery system.

- Despite initiatives to increase women’s participation at entry levels, their representation at higher levels of the judiciary remains disappointingly low.

- Therefore, it is important to analyse the multifaceted nature of the gender gap in India's judiciary, including issues of entry, retention, structural inadequacies, and policy gaps.

An Analysis of Gender Disparity in Judicial Representation

- The gender imbalance within India’s judiciary begins at entry-level positions, although some improvements are evident.

- According to the Supreme Court of India’s State of the Judiciary report in 2023, women account for 36.3% of the district judiciary, and in 14 states, more than half of the new civil judges (junior division) are women.

- However, this progress fades at higher judicial levels, where, as of January 2024, only 13.4% of High Court judges and a mere 9.3% of Supreme Court judges are women.

- Moreover, this disparity is accentuated in certain states, such as Bihar, Chhattisgarh, and Tripura, where women’s representation is minimal or non-existent.

- Such skewed representation creates a funnel effect, restricting the pool of women qualified for elevation to higher courts and exacerbating the gender imbalance.

Reasons Behind Gender Imbalance in Judiciary

- Entry Level Barriers

- Requirement for Continuous Practice

- One significant regulatory obstacle is the requirement for continuous practice in some states for eligibility for judicial service positions.

- Many states' Judicial Service Rules mandate that advocates must have a specific period of continuous, uninterrupted practice before being considered for elevation to the Bench.

- This rule disproportionately impacts women, particularly those who may need to take career breaks due to family obligations, maternity, or childcare.

- Unlike their male counterparts, women often struggle to meet this threshold due to a lack of systemic support for their family responsibilities.

- Absence of Maternity Benefits and Minimum Stipends

- Maternity Benefits and Minimum Stipends; vital support systems for women in demanding professions are often absent or inadequate in the legal field.

- Without paid maternity leave or financial support, many women are forced to choose between career advancement and family responsibilities.

- This causes a significant drop-off in female representation before they even reach judicial roles.

- For example, female advocates balancing family duties may struggle to maintain the continuity required by Judicial Service Rules, making the entry point into judicial positions a significant barrier in their career trajectory.

- Work Culture and Social Expectations

- Apart from structural barriers, workplace culture and social expectations play a crucial role in shaping the experience of women in the judiciary.

- The legal profession has historically been male-dominated, with deeply ingrained biases and cultural norms that are often unfavourable to women.

- This is evident in everyday interactions within courts, where women frequently encounter subtle biases and, at times, overt discrimination.

- For instance, in courtroom settings and professional gatherings, women judges, advocates, and staff may face challenges to their authority, unequal treatment, and stereotyping.

- These issues make it harder for women to establish themselves as equals and earn the respect of their male peers.

Another Major Reason for Women’s Low Representation in Judiciary: Retention Challenges

- Unsupportive Policies

- A key issue here is the unsupportive work environment, which fails to accommodate the needs of women, especially those with caregiving responsibilities.

- Policies such as harsh transfer requirements illustrate how judiciary regulations often overlook the personal circumstances of female judges, making it difficult for them to maintain long-term stability in their roles.

- Transfer policies are typically rigid, lacking any flexibility or consideration of family obligations.

- Since women are still primarily responsible for family care in many cases, these policies add a heavy burden and deter many from continuing in the judiciary.

- Lack of Supportive Infrastructure

- Another factor that complicates retention is the lack of supportive infrastructure within court premises, which negatively impacts women at all levels of the judiciary.

- Court complexes across the country often lack basic amenities specifically designed for women.

- For instance, according to a 2019 survey by the Vidhi Centre for Legal Policy, nearly 100 district courts had no dedicated washrooms for women.

- In higher courts as well, even women judge often face difficulties accessing adequate washroom facilities, let alone other female staff, lawyers, or litigants.

- The absence of essentials like sanitary facilities and hygienic waste disposal systems not only affects physical comfort but also communicates a lack of consideration for women’s needs, reinforcing their sense of marginalization in the profession.

- Lack of Family-Friendly Amenities

- Moreover, the lack of family-friendly amenities, such as feeding rooms and crèches, exacerbates the struggle for women balancing work and family life.

- While some courts, such as the Delhi HC, have taken initial steps in providing a crèche facility, such resources are severely limited and often come with restrictive age limits, like catering only to children under six years.

- This renders such amenities ineffective for many women with older children, who still require dependable childcare.

Ways Ahead to Address the Underrepresentation of Women in Judiciary

- Adoption of ‘Female Gaze’ in Policies

- Adopting a female gaze in policymaking could bridge this gap, ensuring that women’s unique needs are prioritized.

- Implementing a female gaze involves examining the judiciary’s policies and infrastructure through a feminist lens that recognises how ostensibly neutral regulations can inadvertently disadvantage women.

- This approach challenges the male-centric perspective often inherent in judiciary committees and Bar Councils, which may lack female representation.

- By using this lens, the judiciary can better address the gendered impact of policies and create a more inclusive environment for women.

- Prioritising Women’s Needs through Inclusive Policy

- For effective inclusion of women in the judiciary, policies must be crafted with women’s specific challenges in mind.

- Greater participation requires a shift towards women-centric perspectives that identify barriers to career growth.

- For example, former Supreme Court Judge Justice Hima Kohli noted that unconscious gender biases in courts often sideline women in administrative duties.

- Analysing High Court Building Committees reveals that only three HCs (Delhi, Allahabad, and Himachal Pradesh) have female members, highlighting the lack of representation in infrastructure-related decision-making.

- Increase Female Recruitment in Judicial Administration

- Beyond infrastructure, a lack of representation in HC Registries and judicial academies worsens the neglect of gender-sensitive policies.

- As a result, women’s experiences and needs are insufficiently reflected in policies or training programs designed to counter gender bias.

- Implementing policies that are informed by women’s lived experiences; such as gender-sensitive recruitment, transfer protocols, and support for familial responsibilities, could prevent the marginalization of women in the judiciary.

Conclusion

- The underrepresentation of women in India’s judiciary reflects deeper systemic issues that extend beyond entry-level recruitment.

- Bridging this gap requires a comprehensive overhaul of the judiciary’s policies, infrastructure, and culture to be more inclusive and gender-sensitive.

- Recognising and addressing women’s unique needs through the female gaze would mitigate the unintended impacts of neutral policies and foster an equitable work environment.

Mains Article

29 Oct 2024

Why in news?

The estimated total expenditure for the upcoming U.S. presidential and Congressional elections in November 2024 is approximately $16 billion (around ₹1,36,000 crores).

In contrast, the total expenditure by various political parties for the recent general election to the Lok Sabha in India was about ₹1,00,000 crores, according to the Centre for Media Studies (CMS). This raises various debates surrounding campaign finance (election expenditure) in India.

What’s in today’s article?

- Legislations Governing Campaign Finance in India

- Election expenditure limit in India

- Associated challenges

- Way forward

Legislations Governing Campaign Finance in India

- Background

- The issue of election funding was not specifically addressed during the Constituent Assembly debates (1946-1950).

- The first significant laws governing election funding were the Representation of People Act, 1950, and Representation of People Act, 1951.

- Representation of People Act, 1951

- It does not impose limits on expenditure for political party leaders in disseminating messages.

- Candidates must maintain accounts of their election expenditures, but political parties are not required to maintain such accounts for promoting official programs.

- However, parties must disclose contributions over ₹20,000 to income tax authorities and cannot accept donations from government companies or foreign sources.

- Election and Other Related Laws (Amendment) Act, 2003

- The 2003 Amendment introduced Section 29C, requiring political party treasurers to prepare annual financial reports detailing donations over ₹20,000.

- These reports must be submitted to the Election Commission before submitting audited accounts to the Income Tax authorities.

- Non-compliance leads to disqualification from tax relief under the Income Tax Act.

- Companies Act, 1956

- Under Section 293-A of the Companies Act, 1956, corporate contributions to political parties are limited to five percent of the company's average net profits over the last three years.

- Foreign Contribution (Regulation) Act, 1976

- FCRA prohibits political organizations from receiving foreign contributions.

- Income Tax Act, 1961

- Under the Income Tax Act, 1961, contributions to political parties are deductible from income tax calculations.

- Section 13A mandates that political parties submit annual audited accounts to the Income Tax authorities by a specified date.

Election expenditure limit in India

- Existing limit

- The election expenditure limit for candidates is ₹95 lakh per Lok Sabha constituency in larger States and ₹75 lakh in smaller States.

- With respect to Legislative Assemblies, they are ₹40 lakh and ₹28 lakh for larger and smaller States respectively.

- These limits are set, from time to time, by the Election Commission (EC). There are no limits on the expenditure of political parties during elections.

- Purpose and Reality of Expenditure Limits

- While limits aim to minimize the influence of wealth in elections and ensure a level playing field, the effectiveness is questionable.

- The Representation of the People Act mandates candidates keep accurate spending records within these limits and submit affidavits post-election.

- However, analysis from the Association for Democratic Reforms (ADR) shows most candidates report spending far below the limits, raising doubts about transparency.

Associated challenge

- Political Party Spending — The "Elephant in the Room"

- Currently, no cap exists on political parties’ expenditures during elections, which can indirectly favor wealthy candidates.

- Experts argue that real reform requires transparency in party finances and internal democratization to achieve genuine equality for all candidates.

- Possible gap between actual and reported costs

- The official expenditures declared by the BJP and Congress for the 2019 election were ₹1,264 crores and ₹820 crores, respectively. However, according to a report by the CMS, ₹50,000 crore was spent by various parties during the 2019 election.

- The report suggests that 35% of this money was spent on campaigns and publicity, while 25% was illegally distributed among voters.

- Unholy nexus between the elected representatives and donors

- Elections across the world democracies have become very expensive.

- Such increased expenditure that is met primarily through large donations creates an unholy nexus between the elected representatives and donors who seek favours.

- Creates an entry barrier into electoral politics

- Expensive elections act as an entry barrier into electoral politics for many well-meaning citizens.

Way forward

- Advocacy for State Funding of Elections

- The Indrajit Gupta Committee (1998) and the Law Commission report (1999) have proposed state funding of elections,

- They suggested that the government should partially cover the election expenses of candidates nominated by recognized political parties.

- However, doubts remain regarding the feasibility and implementation of this measure in the current context.

- Simultaneous Elections as a Solution

- Simultaneous elections are often viewed as a potential solution to the rising costs of elections.

- While this approach may help reduce campaign and publicity expenditures, it faces challenges related to federalism and the need for constitutional amendments.

- Moreover, without effective measures to curb illegal cash distribution to voters, simultaneous elections alone may not significantly impact overall election expenditures.

- Proposed Electoral Reforms

- The Election Commission's 2016 report on proposed electoral reforms outlines practical steps to create a more equitable environment concerning election expenditures:

- Regulating Financial Assistance: Amend the law to ensure that any financial assistance provided by political parties to their candidates falls within the candidates' prescribed expenditure limits.

- Ceiling on Party Expenditures: Establish a ceiling on the total expenditures of political parties, set at no more than the expenditure limit for individual candidates multiplied by the number of candidates from that party contesting the election.

- Expediting Legal Processes: Appoint additional judges in High Courts to facilitate the speedy disposal of election-related cases, serving as a deterrent against violations of expenditure norms.

- The Election Commission's 2016 report on proposed electoral reforms outlines practical steps to create a more equitable environment concerning election expenditures:

- Need for Bipartisan Support

- These reforms require bipartisan political support and prompt implementation to be effective in addressing the challenges associated with election financing in India.

Mains Article

29 Oct 2024

Why in the News?

India is currently grappling with significant challenges in meeting its fertilizer demands due to dependency on imports, especially amidst the ongoing Ukraine and Gaza crises, which could further impact fertilizer availability and prices.

What’s in Today’s Article?

- About Fertilizers (Meaning, Utility, Types)

- Fertilizer Imports (Current Scenario, Trends, Strategic Initiatives, Suggestions, etc.)

About Fertilizers:

- A fertilizer is a chemical product either mined or manufactured material containing one or more essential plant nutrients that are immediately or potentially available in sufficiently good amounts.

- Fertilizers have played an essential role in agricultural production, providing vital nutrients for crops, increasing demands over the years.

- As an agrarian country, India is home to numerous small and marginal farmers and is often plagued by low productivity and low quality.

- Crops are mainly rain-fed and cultivated on a single piece of land over time, decreasing soil fertility in many regions.

- Thereby, increasing quantities of nitrogen fertilizers have been used in the country.

Macro & Micro Elements in Fertilizers:

- Macro Nutrients: Nitrogen (N), Phosphorus (P), Potash (K), Calcium, Sulfur (S), and Magnesium are known as macro-nutrients (required in comparatively larger amounts).

- Micro Nutrients: Iron (Fe), Zinc (Zn), Copper, Boron, Manganese Molybdenum, Chloride, and others are the micro-nutrients (required in a smaller quantity) for the growth and development of crop plants.

- Among the various types, NPK (nitrogen, phosphorus, and potassium) fertilizers are the most common ones, and Urea stands as the most highly consumed fertilizer in India.

- India is the second-largest consumer of fertilizers globally, with an annual consumption of more than 55.0 million metric ton.

Current Fertilizer Import Scenario:

- India’s domestic fertilizer production does not meet its full demand, creating a dependency on imports. As per the 2023 Standing Committee of Parliament report:

- Urea: 20% of the domestic requirement is imported.

- Diammonium Phosphate (DAP): 50-60% of the demand is met through imports.

- Muriate of Potash (MOP): 100% dependency on imports.

- The report stresses a need for self-reliance in fertilizer production to stabilize supplies.

Production and Consumption Trends:

- India’s annual fertilizer consumption in 2021-22 was 579.67 lakh metric tonnes (LMT), with:

- Urea: 341.73 LMT

- DAP: 92.64 LMT

- MOP: 23.93 LMT

- NPK (Nitrogen, Phosphorus, and Potassium): 121.37 LMT

- Domestic production for the year totalled 435. 95 LMT, leaving a shortfall of 143.72 LMT. Notably, MOP is entirely imported due to the lack of local production.

Impact of the Ukraine and Gaza Conflicts:

- Experts, at the Food and Agriculture Organization (FAO), highlighted potential volatility in fertilizer prices due to the Ukraine and Gaza conflicts. This unrest could:

- Affect oil prices, impacting petroleum-based fertilizer production.

- Disrupt imports from Russia and West Asia, two significant suppliers for India’s fertilizer imports.

Financial Burden of Fertilizer Subsidies:

- The Indian government has allocated substantial funds to support fertilizer affordability. In the 2023-24 Budget:

- Total subsidy: ₹1.79 lakh crore.

- Indigenous Urea subsidy: ₹1.04 lakh crore.

- Imported Urea subsidy: ₹31,000 crore.

- Indigenous P&K Fertilizer subsidy: ₹25,500 crore.

- Imported P&K Fertilizer subsidy: ₹18,500 crore.

- These subsidies, while necessary for farmers, impose a heavy financial burden on the government.

Strategic Initiatives for Self-Reliance:

- Experts recommend increasing India’s production capacity and reducing reliance on imports:

- New Urea Plants: Since the 2012 investment policy, six new urea plants have been established, adding 76.2 LMT to India’s production capacity. Currently, 36 urea plants operate, with recent additions like Ramgundam, Gorakhpur, Sindri, and Barauni facilities.

- Shift to Sustainable Fertilizers: Emphasis on nano urea and natural farming could reduce chemical fertilizer usage and dependency.

- Investment in Domestic Production: The Standing Committee suggests fostering a favorable environment for investments from public, cooperative, and private sectors in fertilizer manufacturing.

Policy Recommendations and Future Outlook:

- The Standing Committee recommends:

- Increasing incentives for fertilizer manufacturing within India.

- Encouraging use of nano urea and shifting focus to organic and sustainable farming practices.

- Investing in infrastructure to better utilize existing fertilizers efficiently.

- By expanding production capacities and promoting sustainable agricultural practices, India could gradually reduce its dependency on imported fertilizers, stabilizing the domestic market and insulating it from global disruptions.

Mains Article

29 Oct 2024

Why in News?

The Finance Ministry’s latest monthly economic review points to evidence of a slowdown in urban demand as reflected in the performance of various indicators during the first half of FY25.

It summarises key factors contributing to the shifting economic landscape in India, highlighting challenges and potential growth avenues.

What’s in Today’s Article?

- Performance of the Indian Economy

- Policy Responses and Future Outlook of the Indian Economy

- Conclusion

Performance of the Indian Economy:

- Overview:

- India’s economic growth faces a slowdown in urban demand, with rural resilience offering partial balance.

- While rural areas show increasing consumption, urban centres experience demand softness due to high food inflation, weakened credit growth, and increased household expenses.

- Urban demand challenges:

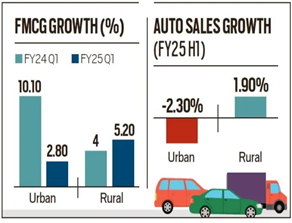

- Softening demand in consumer goods:

- Major fast-moving consumer goods (FMCG) companies, such as Tata Consumer Products and Nestle India, signal a decline in urban demand due to high food inflation, especially in metropolitan regions.

- Auto companies also report demand slowdown, exacerbated by seasonal factors like monsoon rains and election-related spending restrictions.

- Decline in economic indicators:

- GDP: India's Q1 FY25 GDP growth moderated to 6.7%, with projections for further decline in Q2 due to weakened urban investment and consumption.

- Corporate profits: A review of listed companies' Q2 results shows slowing profit growth, largely due to rising input costs. Crisil noted this as the slowest growth in the last 16 quarters.

- Real wages and spending: Urban wages have also stagnated, with growth in salary outlays falling from 1.2% in Q1 to 0.8% in Q2 FY25, indicating reduced consumer spending capacity.

- Inflationary pressures:

- Persistent food inflation has made the Reserve Bank of India (RBI) cautious about rate cuts.

- RBI Governor emphasises a flexible approach to inflation management, avoiding premature easing of monetary policy.

- Rural demand resilience:

- FMCG and auto sales:

- Rural consumption shows positive momentum, reflected in FMCG volume sales growth and rising tractor and three-wheeler sales.

- Nielsen IQ data shows rural FMCG sales rose by 5.2% in Q1 FY25, compared to 4% the previous year.

- Agriculture and wage growth: Real wage growth for agricultural and non-agricultural rural workers supports rising consumption, bolstered by a favourable monsoon season.

- FMCG and auto sales:

- Softening demand in consumer goods:

Policy Responses and Future Outlook of the Indian Economy:

- Government and RBI initiatives:

- Government expenditure:

- Increased government spending post-election season could stabilise growth, with a strong capital expenditure plan expected from September to March.

- Central government expenditure in the first five months of FY25 reached Rs 16.52 lakh crore, down 1.2% from the previous year, indicating room for expansion.

- RBI’s monetary stance: The RBI remains flexible, cautiously monitoring inflation before adjusting rates. RBI continues to support growth by balancing inflation concerns with strategic policy measures.

- Government expenditure:

- Festive demand and external stimuli:

- Festive season: With upcoming festivals, consumer discounts and demand are anticipated to lift sales. This boost may partially offset the urban slowdown.

- Global influences: Potential monetary easing by the US Federal Reserve may encourage capital inflows to India, supporting investment and growth in the coming quarters.

Conclusion:

- India’s economic outlook is mixed, with rural resilience and government spending likely to stabilise growth despite urban demand challenges.

- High inflation and global uncertainties remain key concerns, but fiscal policies and a strategic monetary stance from the RBI provide a foundation for sustainable recovery.

- The evolving economic environment will require continued data-driven adjustments to maintain growth momentum.

Mains Article

29 Oct 2024

Why in news?

The Centre is reportedly preparing to conduct the Census, which was delayed in 2021 due to Covid-19. Although official confirmation is pending, the Census is expected to begin next year.

This exercise is crucial as it ties into two major issues: delimitation of Parliamentary constituencies, stalled for five decades, and the implementation of women’s reservation in Parliament.

India's Census, which has followed a decadal schedule since 1881, missed its 2021 mark for the first time. While the pandemic was largely over by 2022, allowing a Census in 2023 or 2024, the government appears to have postponed it to align with planned constituency reorganisation.

What’s in today’s article?

- Census in India

- Census and delimitation

- Demand for Caste Data in Upcoming Census

Census in India

- About

- Population Census provides basic statistics on state of human resources, demography, culture and economic structure at local, regional and national level.

- Beginning in the year 1872, when the first census was conducted non-synchronously, the census enumeration exercise in India is carried out in every 10 years.

- The first synchronous census was taken under British rule in 1881, by W.C. Plowden, Census Commissioner of India.

- The responsibility of conducting the decadal census rests with the Office of the Registrar General and Census Commissioner of India, Ministry of Home Affairs.

- Legal/Constitutional basis of Census

- Population census is listed in Union List (entry 69) of Seventh Schedule in Indian Constitution.

- Census is conducted under the provisions of the Census Act, 1948.

- Process of census enumeration

- The Census Operations in India have been carried out in two phases:

- Houselisting and Housing Census and

- Population Enumeration.

- The Population Enumeration follows the Housing Census within a gap of six to eight months.

- In Population Enumeration phase each person is enumerated and her/his individual particulars like Age, Marital status, Religion, mother tongue etc.

- The Census Operations in India have been carried out in two phases:

Census and delimitation

- Delimitation and Its Suspension

- Delimitation, mandated by the Constitution, adjusts the number of Parliamentary and Assembly constituencies based on population, ensuring equal representation.

- It ensures a fair division of geographical areas so that all political parties or candidates contesting elections have a level playing field in terms of a number of voters.

- Article 82 and Article 170 of the Constitution empowers the Parliament to readjust the allocation of seats in the Lok Sabha and the Legislative Assemblies of States respectively, after every census.

- However, this process has been suspended since 1976 due to political disagreements.

- Following a 2001 Census, the 2002 delimitation exercise only redrew constituency boundaries without changing their number.

- Southern states oppose delimitation, fearing that changes would reduce their representation despite their success in population control.

- As of the 84th Constitutional Amendment (2001), delimitation is postponed until at least 2026, thus making 2031 the earliest opportunity for it if based on the Census.

- Immediate delimitation might not be possible

- The 84th Constitutional Amendment restricts delimitation based on Census data from the first Census "taken after the year 2026."

- Thus, even if the Census begins in 2025 and completes in 2026, immediate delimitation might not be possible unless the amendment is revised.

- An amendment to the existing provision may be required if delimitation is to proceed in time for the 2029 Lok Sabha elections.

- Challenges of Political Consensus and Southern States’ Concerns

- The suspension of delimitation since 1976 stems from political disagreements, especially with Southern states.

- These states argue that accounting for current population figures would unfairly reduce their Parliamentary representation, penalizing them for successful population control.

- Their support for delimitation may hinge on receiving compensations or other reassurances.

- Additionally, the 128th Constitutional Amendment, passed to reserve 33% of seats in Parliament and State Assemblies for women, requires a delimitation exercise before implementation, further tying delimitation to upcoming political reforms.

- Role of the 16th Finance Commission

- The 16th Finance Commission, due to submit its report next year, will address the distribution of financial resources between the Centre and states, which could impact state-level negotiations regarding delimitation.

Demand for Caste Data in Upcoming Census

- The demand

- There is a growing expectation that the next Census may include caste data, addressing demands from some political parties for a caste census.

- Caste census means inclusion of caste-wise tabulation of India's population in the Census exercise.

- There is a growing expectation that the next Census may include caste data, addressing demands from some political parties for a caste census.

- Background

- Caste was enumerated in British India Censuses (1881-1931).

- Post-Independence, the 1951 Census excluded caste enumeration except for SCs and STs, who continue to be counted.

- Caste data were collected for the 2011 census but the data was never made public.

- In 1961, the GOI recommended states conduct their own surveys for state-specific OBC lists, as there were no central reservations for OBCs at that time.

- Though Census is a Union subject, the Collection of Statistics Act, 2008 allows States and local bodies to gather necessary data, as seen in Karnataka (2015) and Bihar (2023).

Oct. 28, 2024

Mains Article

28 Oct 2024

Context

- India's commitment to combating climate change and reducing emissions is evident in its recent efforts to promote electric vehicles (EVs), specifically electric buses.

- The recent approval of the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) scheme by the Union Cabinet marks a significant step forward.

- Analysing the current state, challenges, and potential solutions for private-sector integration, it is important to explore how India's transition to electric buses can be accelerated to meet ambitious climate goals.

Public Sector-Driven Electric Bus Deployment

- The PM E-DRIVE scheme builds on previous initiatives like the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles in India (FAME) scheme, which provided financial support to public entities for EV adoption.

- Under FAME I and FAME II, over 7,500 electric buses were approved for purchase subsidies, but these subsidies were limited to state transport undertakings, city transport bodies, and municipal corporations.

- As a result, the shift toward electric buses has primarily been driven by the public sector.

- However, public transport buses represent only 7% of India's 24 lakh registered buses, leaving private bus operators—who account for 93% of the bus fleet—largely unsupported.

- This limited approach hampers the potential for large-scale adoption of electric buses, as the transition of private buses is essential for meaningful environmental impact.

Challenges in Transition to Electric Buses for Private Operators in India

- Financing Difficulties and High Upfront Costs

- Financing remains a primary obstacle for private bus operators considering a shift to electric buses.

- Unlike public sector entities, which benefit from government incentives under schemes like FAME, private operators face a high-cost barrier with limited access to subsidies.

- This financing challenge is exacerbated by the high initial costs associated with purchasing electric buses, which are typically more expensive than their diesel counterparts.

- Private bus operators often struggle to secure affordable financing options due to the perceived high-risk profile of electric buses.

- This perception arises from several factors, including uncertainties surrounding the lifespan of EV batteries and a lower perceived resale value, which reduces their effectiveness as collateral.

- Charging Infrastructure Limitations

- Access to reliable and affordable charging infrastructure poses another substantial hurdle for private bus operators.

- The FAME scheme funds charging stations primarily for public transport units, which are typically located within government-operated bus depots.

- Private operators, however, lack access to these facilities and are therefore required to invest independently in charging infrastructure.

- For most private operators, who often operate fleets of fewer than five buses, establishing proprietary charging stations is economically impractical.

- Constructing a charging station involves high capital expenditure for both land and equipment.

- The land required for charging stations—estimated between 70 to 120 square meters—is often expensive, particularly in urban areas where real estate costs are high.

- Operational Constraints and Limited Charging Access

- Even if private operators can access or establish charging stations, operational constraints and limited access make it difficult to integrate electric buses into their fleets effectively.

- For instance, the typical operational range of an electric bus on a single charge—usually between 250 and 300 kilometres—can be a limiting factor for long-distance intercity routes.

- Without accessible, strategically placed charging stations along high-traffic corridors, private operators are restricted in the routes they can cover.

- Perceived High-Risk Profiles and Uncertainty Around Battery Life

- Uncertainty around the lifespan and replacement costs of electric vehicle batteries adds to the challenges private operators face in transitioning to EVs.

- Battery health degrades over time, particularly with frequent high-charge cycles, which may reduce vehicle range and reliability.

- Battery replacement, which is typically necessary after a few years of operation, represents a substantial expense, often accounting for a significant portion of the initial vehicle cost.

- This perceived risk further complicates financing, as financial institutions may hesitate to provide favourable loan terms for vehicles with uncertain long-term value.

- The resale market for electric buses is also underdeveloped in India, making it difficult for operators to offset depreciation costs.

- Regulatory and Policy Gaps

- Current national policies and incentive schemes largely exclude private bus operators, focusing primarily on state and city transport undertakings.

- This policy gap means that private operators have limited support for transitioning to electric buses, resulting in a lopsided growth model that prioritises public sector EV adoption but neglects private sector needs.

- Additionally, regulatory inconsistencies across states can create further complications, as differing rules on permits, tariffs, and land usage can make it challenging for private operators to invest confidently in electric mobility.

Potential Solutions to Drive Private Sector Transition

- Addressing Financial and Infrastructure Challenges

- To accelerate private electric bus adoption, it is essential to address these financing and infrastructure challenges.

- First, offering favourable financing options, such as interest subsidies, longer loan tenures, and credit guarantees, could alleviate the financial burden on private operators.

- These measures, as highlighted by the ICCT report, could reduce investment risks for financiers and make electric buses more accessible to private operators.

- Development of Shared Public Infrastructure

- Secondly, developing shared public charging infrastructure within cities and along high-traffic intercity corridors is crucial.

- State governments, leveraging financial subsidies under the PM E-Drive scheme, can take the lead in establishing accessible charging stations.

- Structuring tenders for charging infrastructure on a design-build-operate-transfer (DBOT) basis and providing additional fiscal incentives could further encourage private investment.

- By ensuring minimum daily energy consumption guarantees, states can make these investments economically viable, especially for small private operators.

- Innovative Business Models to Support EV Transition

- The Battery-as-a-Service (BaaS) model, which separates battery ownership from the vehicle, presents a viable solution to reduce upfront costs.

- By adopting battery swapping and usage-linked leasing, like systems implemented in China and Kenya, private operators can minimise financial strain while benefiting from the cost savings associated with electric buses.

- Platforms such as India’s Vertelo by Macquarie offer solutions tailored to reduce barriers for private sector operators.

- Scaling BaaS could provide significant incentives for private operators, facilitating widespread adoption of electric buses and promoting competitive growth within India’s EV market.

Conclusion

- As India moves forward with the PM E-DRIVE scheme and strives to meet its climate goals, integrating private bus operators into the electric bus ecosystem is imperative.

- The government’s current support for public sector EV adoption is essential, but it must be expanded to create an inclusive framework that encompasses the private sector.

- Addressing financial barriers, developing charging infrastructure, and exploring innovative business models can bridge the gap, enabling a holistic transition to electric buses across India.

Mains Article

28 Oct 2024

Why in News?

The G20 Independent Expert Group has issued a report card assessing the progress made by Multilateral Development Banks (MDBs) in expanding lending capacity and mobilising private capital.

This assessment highlights the gap between current achievements and the ambitious "triple agenda" needed to meet global development and sustainability goals.

The expert group had been set up under the G20 Indian Presidency and had Fifteenth Finance Commission Chairman NK Singh and former US Treasury secretary Lawrence Summers as co-convenors.

What’s in Today’s Article?

- What are Multilateral Development Banks (MDBs)?

- Why is Reforming MDBs Essential?

- Key Recommendations for MDB Reforms

- Way Ahead to Strengthen MDBs

- Conclusion

What are Multilateral Development Banks (MDBs)?

- MDBs are financial institutions providing loans, grants, and technical assistance to foster economic and social development in low- and middle-income countries.

- These include the World Bank Group, Asian Development Bank, African Development Bank, Inter-American Development Bank, etc.

- MDBs have been pivotal in addressing poverty, building infrastructure, and enhancing human capital across developing nations.

- However, evolving global needs now call for reforming MDBs to better support countries in achieving sustainable and inclusive growth.

Why is Reforming MDBs Essential?

- Outdated legal and institutional framework:

- The current frameworks of MDBs, established post-World War II for reconstruction, no longer align with the digital age's complexities and challenges.

- They do not fully reflect the current realities and aspirations of developing nations, particularly those in the Global South.

- Limited private financing engagement:

- MDBs were urged to mobilise $740 billion annually in private financing to meet climate and sustainable development goals (SDGs).

- However, current private sector involvement falls short, with MDBs securing only about $70 billion in private capital in the past year.

- Limited local currency lending: While MDBs have expanded guarantees and risk mitigation tools, local currency lending remains underdeveloped, with few successful examples to date.

Key Recommendations for MDB Reforms:

- Triple mandate for MDBs:

- Eliminating extreme poverty.

- Promoting inclusive growth.

- Financing global public goods with an emphasis on sustainable development and climate goals.

- How to meet this triple mandate? MDBs were advised to triple their financial commitments, establish a "Global Challenges Funding" mechanism, and significantly boost private sector engagement.

- Expanding lending capacity:

- MDBs have made strides in expanding their lending capacities:

- A 33% increase in lending capacity.

- Improved use of balance sheets and guarantee platforms.

- Reforms to the capital adequacy framework to optimise resources.

- Despite this progress, MDBs are still short of the targeted tripling in capacity required to fulfil their expanded mandate.

- MDBs have made strides in expanding their lending capacities:

- Innovations in capital mobilisation:

- MDBs introduced innovative funding mechanisms, including hybrid capital options (non-voting shares) to attract additional financing.

- Although some member states showed interest, uptake has been limited.

- Private sector involvement:

- There is the need to change the MDB cultures to lower perceived risks for private capital.

- Involving private investors, working with rating agencies, and creating an atmosphere that is conducive to investment is the need of the hour.

Way Ahead to Strengthen MDBs:

- Enhancing performance and relevance:

- Current approaches do not maximise MDBs' potential to mobilise resources, foster policy alignment, and support innovation.

- Tailored, flexible solutions and diversified instruments are crucial for the dynamic needs of different countries and sectors.

- Improving governance:

- MDBs' governance structures are often seen as unrepresentative of developing countries.

- Increased transparency, accountability, and responsiveness are essential to MDBs’ credibility and effectiveness.

- Concessional financing: For the world’s poorest countries.

- Climate-related financing: MDBs have substantially increased climate financing, with commitments reaching $75 billion in 2023 - up from $42 billion in 2019. This includes $50 billion for mitigation and $25 billion for adaptation activities.

- Coordination among MDBs: MDBs are working to harmonise procurement practices and have introduced a digital co-financing portal to facilitate large-scale project coordination.

Conclusion:

- The G20 report card underscores both achievements and gaps in MDB reforms.

- While MDBs have enhanced lending capacity and introduced measures for better private sector engagement, significant efforts are still required to meet the ambitious goals of the “triple agenda.”

- With a strong role to play, India’s leadership and commitment to MDB reforms could help shape a more inclusive, responsive, and effective MDB system for the Global South.

Mains Article

28 Oct 2024

Why in the News?

Spain’s Prime Minister Pedro Sanchez is reaching Vadodara, Gujarat where he and Prime Minister Narendra Modi will hold bilateral talks and inaugurate the Final Assembly Line (FAL) plant of the C295 medium-lift tactical transport aircraft for the Indian Air Force.

What’s in Today’s Article?

- India – Spain Bilateral Relationship (Historical Ties, Bilateral Trade, Strategic Significance, Common Groupings, Indian Diaspora)

- News Summary

Historical Ties:

- India and Spain established diplomatic relations in 1956.

- Though limited historical interaction existed prior, both nations’ shared democratic values, commitment to global peace, and respect for multiculturalism have formed a strong foundation for bilateral ties.

- High-level visits, including by heads of state, have helped solidify this relationship over the years.

Bilateral Trade:

- Spain is India’s 6th largest trade partner in the European Union.

- Total Trade (2023): US$ 8.25 billion, a 4.2% increase from the previous year.

- India’s Exports to Spain: US$ 6.33 billion (growth of 5.2%).

- India’s Imports from Spain: US$ 1.92 billion (growth of 1.05%).

- Top Indian Exports: Mineral fuels, chemical products, iron and steel, electrical machinery, apparel, nuclear reactors, marine products, and articles of iron and steel.

- Foreign Direct Investment:

- Spanish FDI in India:

- US$ 3.94 billion (April 2000 - December 2023), with Spain as India’s 16th largest investor.

- Over 280 Spanish companies in India, focusing on metallurgical industries, renewable energy, automotive, ceramics, and infrastructure.

- Major destinations: Maharashtra, Tamil Nadu, Gujarat, Andhra Pradesh, Karnataka.

- Indian FDI in Spain:

- ~US$ 900 million; 80 Indian companies in Spain, primarily in software & IT services, pharmaceuticals, chemicals, and logistics.

- India is among Spain’s top 30 investors globally and top 5 from Asia.

- Spanish FDI in India:

- Trade and Economic Cooperation Framework:

- India-Spain Joint Commission on Economic Cooperation (JCEC): Established in 1972; has met 12 times, with the latest meeting in April 2023 in New Delhi.

- India-Spain CEOs Forum: Established in 2015; first formal meeting held in May 2017 in Madrid.

Strategic Significance and Cooperation:

- The strategic relationship between India and Spain is steadily expanding, encompassing areas like defense, counter-terrorism, and cybersecurity:

- Defense:

- Spain is a key partner in India’s defense modernization, providing expertise in aerospace and naval technology.

- Spanish companies are involved in defense projects, including submarine technology transfer and collaborations for military aircraft.

- Counter-Terrorism:

- India and Spain actively cooperate in counter-terrorism and intelligence sharing, recognizing mutual concerns regarding global terrorism.

- Sustainable Development and Climate Action:

- Both nations are committed to the Paris Agreement and actively collaborate on climate change and sustainable development goals.

- Spain’s expertise in renewable energy aligns with India’s goal of increasing clean energy sources.

Common Groupings and Multilateral Cooperation:

- India and Spain engage collaboratively through several multilateral platforms, including:

- United Nations: Both countries work together on issues of global peace, sustainable development, and humanitarian aid.

- G20: As members of the G20, India and Spain share a commitment to addressing global economic challenges, trade reforms, and climate action.

- International Solar Alliance (ISA): Spain is a member of the ISA, aligning with India’s initiative to promote solar energy and sustainable development.

Indian Diaspora in Spain:

- The Indian community in Spain is relatively small but has been growing in recent years.

- Population: As of 2023, approximately 55,000 Indians reside in Spain, contributing actively to sectors like hospitality, retail, IT, and healthcare.

News Summary:

- Spain’s PM Pedro Sanchez is visiting India from October 28 to 30, marking the first visit by a Spanish PM in 18 years.

- Sanchez will hold bilateral talks with Prime Minister Narendra Modi in Vadodara, Gujarat, where they will inaugurate the Final Assembly Line (FAL) plant for the C295 tactical transport

- It is India's first private military transport aircraft production facility, developed by Tata Advanced System Limited (TASL) in partnership with Airbus Defence and Space.

- Under the $2.5 billion contract, 56 C295 aircraft will be supplied, with the first 16 delivered from Spain and the remaining 40 assembled in Vadodara.

- This plant is expected to produce its first "Made-in-India" C295 in 2026, with all deliveries by 2031.

- The project aims to build a complete industrial ecosystem in aerospace manufacturing in India, with contributions from Bharat Electronics Ltd, Bharat Dynamics Ltd, and private MSMEs.

- Several MoUs are expected to be signed, furthering cooperation in trade, IT, infrastructure, renewable energy, defence, pharma, and tourism.

Mains Article

28 Oct 2024

Why in news?

The Union Minister of Fisheries, Animal Husbandry and Dairying, has launched the 21st Livestock Census in New Delhi.

What’s in today’s article?

- Livestock Census

- 21st Livestock Census

- Findings from the 2019 Livestock Census

Livestock Census

- About

- The livestock census is a comprehensive survey conducted to collect data on various livestock species, including cattle, buffaloes, sheep, goats, pigs, and poultry.

- The most recent census was conducted in 2019.

- Benefits of Livestock Census for India

- Data Collection and Analysis: The census provides essential data on the number and types of livestock, their distribution, and trends over time. This data helps in formulating policies and programs for the livestock sector.

- Planning and Policy Formulation: Accurate livestock data aids the government in developing policies related to livestock health, breeding, and management. This can lead to better resource allocation and targeted interventions.

- Economic Growth: Livestock contributes significantly to the agricultural economy. The census helps identify opportunities for growth and investment in sectors like dairy, meat production, and poultry farming.

- Resource Management: Understanding the livestock population helps in effective resource management, including feed and water resources, land use, and veterinary services.

- Food Security: By assessing livestock numbers and health, the census can inform strategies to enhance food production, improve nutrition, and ensure food security for the population.

- Employment Generation: The livestock sector provides employment opportunities to millions, especially in rural areas. The census helps track employment trends and develop skill development programs.

- Sustainability and Environmental Management: Data from the census can guide sustainable practices in livestock management, helping to minimize environmental impact and promote animal welfare.

- Market Development: The information gathered can assist in market analysis and development, leading to better pricing and market access for farmers.

- Research and Development: The census supports research initiatives in animal genetics, health, and nutrition, fostering innovation in the livestock sector.

- Integration with Other Sectors: Livestock plays a crucial role in the broader agricultural ecosystem. The census helps integrate livestock management with crop production, enhancing overall agricultural productivity.

21st Livestock census

- Overview of the Livestock Census

- Conducted every five years, India’s livestock census counts all domesticated animals, poultry, and stray animals.

- It collects details on species, breed, age, sex, and ownership.

- Starting in 1919, 20 censuses have been completed, with the 21st census scheduled for October 2024 to February 2025, covering 30 crore households with help from around 87,000 enumerators.

- Animals Included in the 21st Census

- The 21st census will document sixteen species, including cattle, buffalo, yak, sheep, goats, pigs, and others, along with 219 indigenous breeds recognized by ICAR-NBAGR.

- Poultry birds, such as chicken, duck, turkey, and emu, will also be counted.

- Objectives of the Livestock Census

- The census supports employment and economic growth in rural areas, as the livestock sector contributes to 4.7% of the nation’s Gross Value Added (GVA) and 30% of the agriculture sector’s GVA.

- Data collected helps in policy development, estimating GVA, and monitoring Sustainable Development Goals (SDGs).

- The Livestock Census will provide data pertaining to Goal 2 (Zero Hunger), and Target 2.5 (to maintain genetic diversity in food and nutrition), specifically Indicator 2.5.2 (The percentage of local livestock breeds that are at risk of extinction) of the SDGs.

- Digitization and New Data Points in the 21st Census

- Following the 2019 digitized census, the 21st census will also use mobile apps for data collection, monitoring, and reporting, along with tracking collection locations via GPS.

- The 21st census will capture several new data points. These include:

- Data on pastoral animals, pastoralists: The census will, for the first time, collect data on the contribution of pastoralists to the livestock sector, their socio-economic status, and livestock holding.

- More details, granular information: The census will find out the proportion of households whose major income comes from the livestock sector. It will also contain data on the gender of stray cattle.

Findings from the 2019 Livestock Census

- The 2019 census recorded a livestock population of 535.78 million, with:

- 192.9 million cattle

- 148.88 million goats

- 109. 85 million buffaloes

- 74.26 million sheep

- 9.06 million pigs

- All other animals together made up only 0.23% of India’s total livestock population.

Mains Article

28 Oct 2024

Why in news?

In August 2024, the Reserve Bank of India (RBI) imposed strict rules on peer-to-peer (P2P) lending platforms. As a result, the industry’s asset under management (AUM) plummeted by 35% — from an estimated ₹10,000 crore to ₹6,500 crore.

The main purpose of P2P platforms is to connect lenders and borrowers, without being directly involved in the loans themselves. There are mixed views on whether P2P platforms can adapt to the changes imposed by RBI. This article explores the sector’s past, present, and possible future.

What’s in today’s article?

- Peer-to-peer (P2P) lending

- Regulation by RBI

- The Uncertain Future of P2P Lending in India

Peer-to-Peer (P2P) Lending

- About

- P2P lending is a method of lending money directly to individuals or businesses without a financial institution as an intermediary.

- This typically occurs through online platforms that connect lenders with borrowers.

- While P2P loans can be either secured or unsecured, most are unsecured personal loans, with secured loans—usually backed by luxury items—being rare.

- P2P lending is valued as an alternative financing option due to its distinct characteristics.

- Working

- Borrower Application: A borrower submits an application on a P2P platform.

- Risk Assessment: The platform evaluates the borrower's creditworthiness, assigns a risk rating, and sets an interest rate.

- Investor Matching: Upon approval, the borrower receives loan offers from investors based on their rating and interest rate.

- Selection: The borrower reviews options and selects a suitable offer.

- Repayment: The borrower makes regular interest payments and repays the principal at the loan’s maturity.

- Platform Fees: The platform charges fees to both borrowers and lenders for its services.

- Advantages

- Higher Returns: P2P lending generally offers investors higher returns than traditional investments.

- Accessible Funding: It provides a funding option for borrowers who may not qualify for traditional bank loans.

- Lower Interest Rates: Due to increased competition and lower fees, P2P loans often feature reduced interest rates.

- Disadvantages of Peer-to-Peer Lending

- Credit Risk: P2P loans carry a higher risk of default since many borrowers have low credit ratings.

- No Government Protection: Lenders are not insured or protected by government guarantees.

- Regulatory Limitations: Some regions restrict or heavily regulate P2P lending, limiting access for certain borrowers and investors.

- Extra charges – Borrowers might encounter additional charges beyond the loan’s interest rate, which can potentially raise the cost of borrowing.

Regulation by RBI

- Early Discussions on Regulating P2P Lending

- In 2016, RBI began considering regulations for P2P lending to address informal money-lending practices.

- With global growth in P2P lending and new platforms emerging in India, the RBI released a discussion paper on whether regulation was needed.

- Concerns included potentially legitimizing P2P lending by regulating it, stifling its growth, and the sector's limited impact on the financial system at the time.

- After consulting stakeholders, the RBI issued guidelines in 2017 that outlined activities for lenders, set eligibility criteria, and mandated transparency on fees and pricing.

- Regulatory Concerns and Clampdown

- P2P platforms started behaving like banks by profiting from the difference between borrower interest rates and lender earnings.

- This led the RBI to intervene, banning practices such as using one lender's funds to replace another's, thus shutting down the secondary market.

- The RBI's regulations mainly targeted popular features like guaranteed returns based on investment terms and easy withdrawal options, and also required a faster settlement process (T+1).

- The RBI also required full fee disclosure and prohibited closed-group matching of lenders and borrowers.

The Uncertain Future of P2P Lending in India

- The outlook for P2P lending in India remains unclear.

- A major P2P platform recently halted new customer registrations, resulting in a 30-35% drop in assets under management (AUM).

- AUM is the total market value of investments that a financial institution, fund manager, or entity manages on behalf of its clients.

- The RBI has been inspecting platforms for compliance, and if secondary market options remain restricted, volumes may decline significantly.

- Some large platforms are even considering relinquishing their licenses.

Oct. 27, 2024

Mains Article

27 Oct 2024

Why in news?

Israel launched what it described as precise and targeted airstrikes on Iran early on October 26 in retaliation to an Iranian attack on Israel earlier this month. This appears to be a major escalation between the two enemy countries.

What’s in today’s article?

- Why did Israel attack Iran?

- Why are Israel and Iran enemies?

- Israel – Iran conflict and Impact on India

Why did Israel attack Iran?

- October 7 Hamas attack

- Iran and Israel, with a long-standing hostile relationship, saw tensions worsen after the October 7 Hamas attacks.

- Iran, which does not recognize Israel's right to exist, backs groups like Hamas and Hezbollah in their fight against Israel.

- Killing of commanders from Iran’s Revolutionary Guard Corps and response of Iran

- On April 1, Israel struck the Iranian consulate in Syria, killing 16 people, including commanders from Iran’s Revolutionary Guard Corps (IRGC).

- Iran responded on April 13 by launching a direct missile and drone attack on Israeli soil. Israel then targeted an Iranian missile defense system in Isfahan.

- Death of Hamas leader in Iran

- The situation intensified on July 31 with the death of Hamas leader Ismail Haniyeh in Tehran, likely by Israeli intelligence agency Mossad.

- On September 27, Israel assassinated Hezbollah leader Hassan Nasrallah in Beirut, also killing Iranian Brigadier General Abbas Nilforoushan.

- On October 1, Iran responded with 200 ballistic missiles attack on Israel, causing minimal damage.

- Israel attacks Iran

- Israel had vowed to hit back after Iran carried out a ballistic missile attack on Israel on 1 October.

- The recent attack by Israel comes against this backdrop.

Why are Israel and Iran enemies?

- Iran's 1979 Islamic Revolution and its opposition to Israel

- Iran and Israel, once allies, became adversaries following Iran's 1979 Islamic Revolution, which established a regime ideologically opposed to Israel.

- Since then, Iran has refused to recognize Israel's right to exist, with its leaders calling for Israel’s destruction.

- Supreme Leader Ayatollah Ali Khamenei has referred to Israel as a "cancerous tumor" that will be "uprooted and destroyed."

- Shadow war between these two countries

- The two countries have engaged in a "shadow war," targeting each other's assets without claiming responsibility.

- Tensions have escalated since the October attacks on Israeli communities by Hamas, a Palestinian group supported by Iran.

- Israel views Iran as an existential threat due to its rhetoric, support of proxy forces like Hezbollah and Hamas, and its alleged pursuit of nuclear weapons, which Iran denies.

Impact on India

- Fears of Protracted Red Sea Disruption

- A direct conflict between Israel and Iran would cause a prolonged disruption of the Red Sea shipping route.

- India is especially vulnerable to these disruptions, as its trade with Europe, the US, Africa, and West Asia—valued at over $400 billion in FY23—relies heavily on the Suez Canal and Red Sea routes.

- The involvement of Hezbollah's allies, such as the Houthi rebels in Yemen, heightens the risk of attacks on ships using this critical trade passage.

- Impact on Indian Petroleum Exports

- In August 2024, India's exports fell by 9%, primarily due to a sharp 38% drop in petroleum product exports, which fell to $5.95 billion from $9.54 billion in August 2023.

- Rising shipping costs and the crisis in the Red Sea have led importers to seek alternative sources, impacting Indian exporters' profitability, particularly standalone refiners.

- European Market Challenges

- Europe, which accounts for 21% of India’s petroleum exports, has been affected by rising shipping costs.

- A Crisil report from February 2024 warned that these additional costs would reduce profit margins for petroleum exports, compounding the challenges faced by Indian exporters.

- India’s overall exports to the European Union increased by 6.8% this year, but sectors like machinery, steel, gems, jewellery, and footwear have faced declines.

- The rising freight costs are expected to further strain Indian industries reliant on high-volume, low-value exports, making it difficult for them to stay competitive.

- Silver lining - Trade Opportunities in West Asia

- Despite the conflict, India's trade with Gulf Cooperation Council (GCC) countries has grown by 17.8% between January and July 2024, according to a Global Trade Research Initiative (GTRI) report.

- India’s exports to Iran also increased by 15.2% during this period, benefiting from the neutrality of regional players such as Saudi Arabia, the UAE, Kuwait, and Qatar, who have stayed out of the conflict.

- Risk to India-Middle East-Europe Economic Corridor (IMEC)

- The ongoing conflict in West Asia could hinder the development of the IMEC, a strategic project announced during the G20 in 2023.

- The IMEC plan comprises an Eastern Corridor connecting India to the Gulf region and a Northern Corridor connecting the Gulf region to Europe.

- It will include a railway and ship-rail transit network, as well as road transport routes.

- The IMEC aims to reduce reliance on the Suez Canal by creating faster trade routes through a rail and ship network connecting India to the Gulf and Europe.

- However, the widening conflict in the region threatens to delay or complicate the corridor’s progress, casting uncertainty over its future.

- The ongoing conflict in West Asia could hinder the development of the IMEC, a strategic project announced during the G20 in 2023.

Mains Article

27 Oct 2024

Why in news?

The Ministry of Electronics and Information Technology (MeitY) issued an advisory urging social media platforms to take responsibility in controlling threats against flights operating from India.

The Ministry highlighted the unrestricted spread of hoax bomb threats due to features like forwarding, resharing, and reposting, which are readily available on social media platforms.

What’s in today’s article?

- Recent bomb threats

- Aviation security architecture

- Handling security threats - Challenges and way forward

- Advisory to curb hoax bomb threats on social media

Recent bomb threats

- Widespread threats disrupted Airlines

- Over the past two weeks, Indian carriers, including Tata group airlines (Air India, Vistara, and Air India Express), Indigo, Alliance Air, and Star Air, have faced a series of hoax threats.

- These incidents have led to emergency measures, flight rerouting, and military fighter jet intercepts, particularly in international airspace when emergency transponder codes were activated.

- Although the threats were hoaxes, they resulted in significant delays and financial losses estimated at ₹13-₹17 lakh per hour for airlines.

- Nature and Source of Threats

- According to the govt, most threats originated on social media. Intelligence agencies are investigating and focusing on tracking IP addresses and VPN usage.

- Despite initial suspicions of hoaxes, no potential threat has been overlooked given the scale of India’s daily 4,000 flight operations.

- Since the start of these incidents, approximately 275 threats have affected around 48,000 flights.

Aviation security architecture

- ICAO’s Aviation Security Guidelines and Directives

- Most aviation security guidelines are derived from the International Civil Aviation Organization’s (ICAO) Annex 17 on Aviation Security.

- These guidelines and Standards and Recommended Practices (SARPs) are part of the Chicago Convention.

- These guidelines mandate global measures against unlawful interference in civil aviation.

- The ICAO Aviation Security Manual (Doc 8973) provides member states with detailed security procedures.

- Annex 17 and Doc 8973 are continually updated to address new threats and advancements in technology, though detailed discussions and specific guidance are restricted.

- Security Agencies and Measures in India

- In India, the Bureau of Civil Aviation Security is responsible for establishing security standards for civilian flights, while the Directorate General of Civil Aviation (DGCA) oversees flight safety.

- Other involved agencies include the Airports Authority of India, Central Industrial Security Force (CISF), National Security Guard (NSG), Intelligence Bureau (IB), Research and Analysis Wing (RAW), Ministry of Home Affairs, and the judiciary.

- Proposed Amendments to Strengthen Aviation Security Laws

- In response to recent security threats, amendments are being considered for the Aircraft Act 1934, Aircraft Rules 1937, and other relevant laws.

- Planned updates include stricter penalties, no-fly list provisions, and expanding legal recourse to address security violations even on the ground.

- Updates to the Suppression of Unlawful Acts against Safety of Civil Aviation Act, 1982 would further empower authorities to handle in-flight and on-ground security threats.

Handling security threats - Challenges and way forward

- Systemic Issues

- Although details about recent Indian cases aren’t fully disclosed, these incidents have revealed systemic issues, including gaps in standardized procedures, guidelines, training, technology limitations, communication, and regulatory enforcement within the aviation security system.

- Recommended Technological Investments and Innovations

- Addressing hoax calls effectively, according to the expert, requires investment in advanced call tracking, AI-powered call analysis, voice stress analysis, and comprehensive threat assessment systems.

- Emerging technologies, such as quantum computing and aviation cybersecurity frameworks, could enhance security further.

- The expert also recommended implementing AI-powered chatbots for preliminary threat assessments and psychological profiling of callers to better understand motivations and threat levels.

- Proposed Strategies for Deterrence and Awareness

- To deter offenders, experts suggested publicly sharing photos of offenders on social media and displaying them at airports as a warning.

- Additionally, the expert recommended establishing a global hoax call database and providing rewards for informers to encourage reporting of hoax threats.

Advisory to curb hoax bomb threats on social media

- About the news

- MeitY has advised all social media platforms to follow the rules under the Information Technology (IT) Rules and Bharatiya Nyay Sanhita (BNS).

- They are asked to make a serious effort to quickly remove any bomb threat posts. If they don’t comply, they could be held legally responsible.

- Legal Framework Under IT Act, 2000 and IT Rules, 2021

- The advisory underscores the Ministry’s reliance on existing legal provisions to compel platforms to act against misinformation that threatens public order.

- The Information Technology Act, 2000, along with the IT (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021, require intermediaries to promptly remove harmful misinformation.

- Previously, the Ministry applied similar provisions to tackle the spread of deepfake videos, citing Rule 3(1)(b) of the IT Rules.

- Rule 3(1)(b)(v) prohibits misinformation and patently false information.

- Potential Consequences for Non-Compliance

- The advisory warned that non-compliant platforms risk losing intermediary liability protections, exposing them to potential legal action as publishers of harmful posts.

- The Ministry noted that legal actions could be pursued under both the IT Act and the Bharatiya Nyaya Sanhita, 2023, if platforms fail to exercise due diligence.

Mains Article

27 Oct 2024

Why in News?

In a recent address, ISRO Chairman S. Somanath outlined India’s goals to increase its share in the global space economy, enhance indigenous technological capabilities, and advance a series of high-impact space missions.

The vision highlights India's roadmap for space exploration and collaboration, aiming to boost India's position in the space industry significantly.

What’s in Today’s Article?

- India’s Space Economy

- Scientific Contributions and Legacy of the Indian Space Research Organisation (ISRO)

- Key Upcoming Missions of the ISRO

- Way Ahead for India’s Space Vision

- Conclusion

India’s Space Economy:

- Overview:

- India currently contributes about 2% to the global space economy, with a goal to increase this share to at least 10% over the next decade.

- However, achieving this milestone requires concerted efforts from both ISRO and other stakeholders, including private enterprises and start-ups, within India’s evolving space ecosystem.

- Participation of the private sector:

- India’s space sector has seen a surge of activity with recent policy reforms and the opening up of the industry to private enterprises.

- The growing enthusiasm among young entrepreneurs and companies, both large and small, has led to a collaborative environment where private players are taking on roles previously managed solely by ISRO.

Scientific Contributions and Legacy of ISRO:

- Chandrayaan:

- India’s lunar missions, particularly Chandrayaan-1 and Chandrayaan-3, have yielded groundbreaking scientific discoveries.

- Chandrayaan-1 confirmed the presence of water on the Moon, while Chandrayaan-3 has advanced scientific understanding through soft-landing technologies and data collection.

- Astrosat and other space observatories:

- India’s first dedicated multi-wavelength space observatory, Astrosat, has facilitated extensive astronomical research, resulting in over 400 scientific papers and more than 30 PhDs.

- The success of this mission has laid a strong foundation for future contributions to space science, including the recently launched Aditya-L1 and XPoSat missions.

Key Upcoming Missions of the ISRO:

- Gaganyaan mission: India’s first manned space mission, Gaganyaan, is scheduled for 2026, marking a significant milestone in India’s human spaceflight program.

- Chandrayaan-4 Sample Return mission: Planned for 2028, Chandrayaan-4 will focus on returning lunar samples, a step forward in understanding the Moon’s geology and resources.

- LUPEX/Chandrayaan-5 mission:

- A collaborative project with Japan’s JAXA, Chandrayaan-5 (formerly Lunar Polar Exploration/ LUPEX) will involve a heavier mission with a 350-kg rover provided by Japan, and the lander by India.

- Expected after 2028, this mission aims to advance lunar science with the eventual goal of a human moon mission by 2040.

- NASA-ISRO Synthetic Aperture Radar (NISAR) mission:

- The India-US joint NISAR mission, which has faced delays, is scheduled for launch in 2025.

- This satellite mission aims to monitor natural resources and hazards using radar imaging.

Way Ahead for India’s Space Vision:

- Reducing dependence on imports:

- Over the past decade, India has significantly reduced its dependence on imported space technologies.

- However, many critical components still come from abroad, underscoring the need to further develop domestic manufacturing capabilities for advanced research and technologies.

- Expanding R&D and manufacturing capabilities:

- ISRO is focused on promoting the indigenisation of research, development, and manufacturing, ensuring that critical items for the space sector can be built within the country.

- This shift is crucial to meeting the demands of upcoming missions and achieving self-sufficiency in space technology.

Conclusion:

- India’s evolving space program under ISRO’s leadership is shaping up to be a significant force in global space exploration.

- With a focus on indigenous technology, private sector engagement, and ambitious missions, India is well on its way to realising its vision of

- Contributing 10% to the global space economy and

- Establishing a robust foundation for long-term space exploration and scientific advancement.

Mains Article

27 Oct 2024

Why in the News?

The Central Government will implement the G20 Pandemic Fund, which is aimed at enhancing the country’s “animal health security”.

What’s in Today’s Article?

- G20 Pandemic Fund (Objectives, Structure, Funding)

- About Zoonotic Diseases (Meaning, Types, Transmission Methods)

- News Summary (Global Health Security Index)

What is G20 Pandemic Fund?

- The G20 Pandemic Fund is a financial initiative established by G20 countries to enhance global preparedness and response to health emergencies, particularly pandemics and zoonotic diseases (diseases transmitted from animals to humans).

- Key Objectives:

- Strengthen Global Health Security: The fund aims to bolster healthcare systems worldwide to prevent, detect, and respond swiftly to pandemics.

- Address Zoonotic Risks: Focuses on zoonotic diseases, which pose significant threats to human health, by investing in animal health and surveillance.

- Support Low and Middle-Income Countries: Provides essential resources and support to vulnerable regions with weaker health infrastructure.

- Structure & Funding:

- Managed by Multiple Agencies: The World Bank oversees the fund, while it collaborates with organizations like the WHO, FAO, and regional development banks.

- Targeted Financial Assistance: Initially launched with over $1.4 billion, the fund mobilizes grants and low-interest loans for eligible countries.

What are Zoonotic Diseases?

- Zoonotic diseases are infections that are transmitted between animals and humans.

- These diseases can result from various pathogens, including viruses, bacteria, parasites, and fungi.

Common Zoonotic Diseases:

- COVID-19: Caused by the SARS-CoV-2 virus, believed to have originated from animals, likely bats, before spreading to humans.

- Rabies: A viral infection primarily spread through bites or scratches from infected animals, especially dogs and bats.

- Avian Influenza (Bird Flu): Transmitted from infected birds to humans through direct contact or contaminated environments.

- Ebola: Originates from fruit bats and is spread through direct contact with bodily fluids of infected animals or humans.

- Salmonellosis: Caused by Salmonella bacteria, commonly transmitted through contaminated food, particularly poultry and eggs.

Transmission Methods:

- Direct Contact: Handling or being bitten by infected animals.

- Indirect Contact: Contact with contaminated surfaces or environments.

- Vector-Borne: Through vectors like ticks or mosquitoes.

- Foodborne: Consuming contaminated meat, eggs, or dairy.

- Airborne: Inhaling pathogens from animal excreta or dander.

News Summary:

- The Union government has launched a $25-million G20 Pandemic Fund to strengthen animal health security, aiming to curb zoonotic diseases—diseases transmitted from animals to humans, like COVID-19.

- This initiative is a collaborative effort with organizations including the Asian Development Bank (ADB), World Bank, and Food and Agriculture Organization (FAO), and is expected to be fully utilized by August 2026.