About:

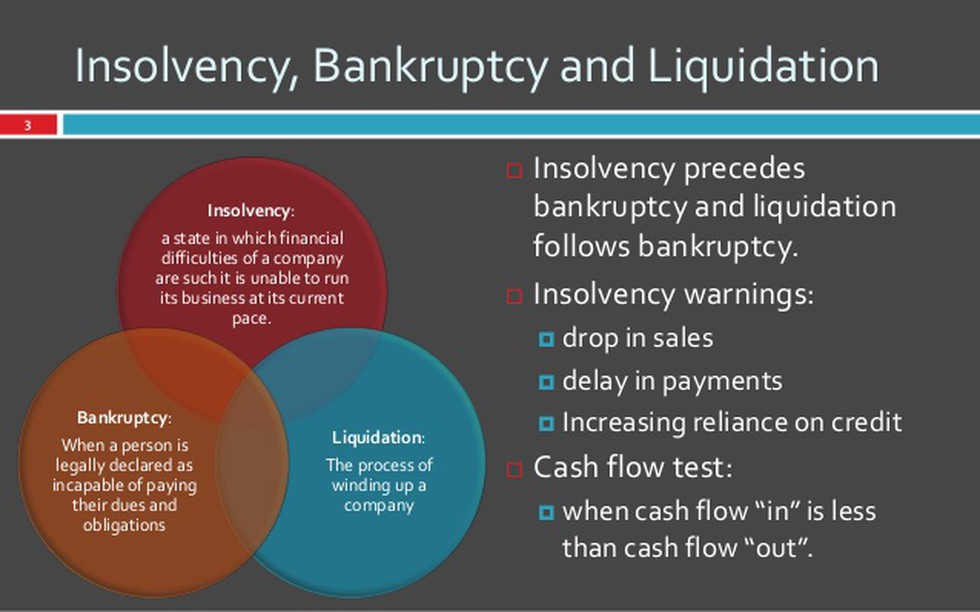

- Insolvency: Insolvency is essentially the state of being that prompts one to file for bankruptcy. An entity – a person, family, or company – becomes insolvent when it cannot pay its lenders back on time.

- Bankruptcy: Bankruptcy is a legal declaration of one’s inability to pay off debts.

Salient features of the Insolvency & Bankruptcy Code (IBC), 2016:

- The Code repeals the Presidency Towns Insolvency Act, 1909 and Provincial Insolvency Act, 1920. In addition, it amends 11 laws, including the Companies Act, 2013, and the Recovery of Debts Due to Banks and Financial Institutions Act, 1993, among others.

- Applies to: The 2016 Code applies to companies and individuals.

- Time-bound resolution for insolvency: The Code creates time-bound processes for insolvency resolution of companies and individuals. These processes will be completed within 180 days. If insolvency cannot be resolved, the assets of the borrowers may be sold to repay creditors.

- Resolution plan (RP): A resolution plan specifies the details of how the debt of a defaulting debtor can be restructured.

Institutional mechanism:

The Code creates various institutions to facilitate resolution of insolvency. These are as follows:

- Insolvency Professionals: These professionals will administer the resolution process, manage the assets of the debtor, and provide information for creditors to assist them in decision making.

- Insolvency Professional Agencies:

- The insolvency professionals will be registered with insolvency professional agencies.

- The agencies conduct examinations to certify the insolvency professionals and enforce a code of conduct for their performance.

- Information Utilities: Information utilities (IUs) will be established to collect, collate and disseminate financial information to facilitate insolvency resolution.

- Adjudicating authorities: The proceedings of the resolution process will be adjudicated by the

- National Companies Law Tribunal (NCLT), for companies; and

- Debt Recovery Tribunal (DRT), for individuals.

- Insolvency and Bankruptcy Board:

- It will be set up to regulate functioning of IPs, IPAs and IUs.

- The Board will consist of representatives of Reserve Bank of India, and the Ministries of Finance, Corporate Affairs and Law.