About:

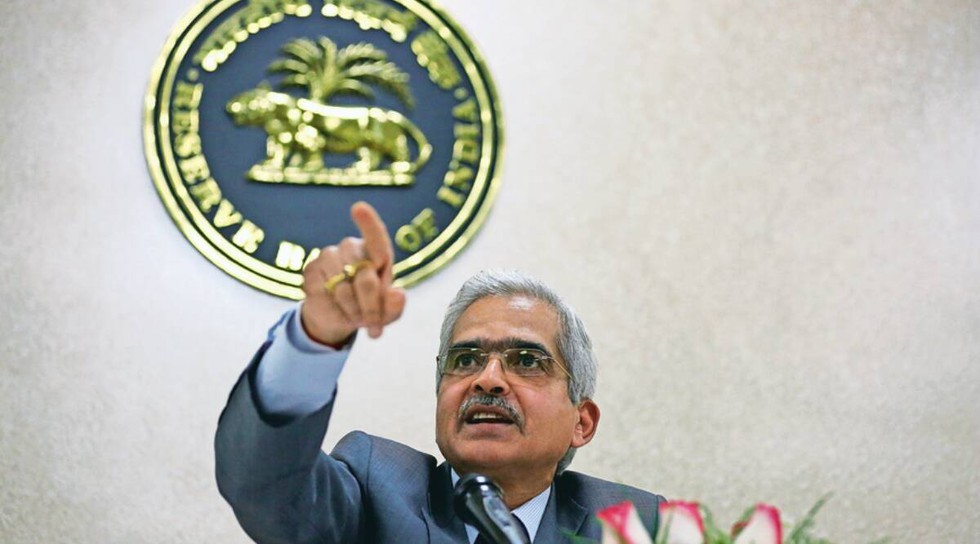

About MPC

The fourth session of the INC to deve...

According to the recently released Gl...

Researchers have uncovered a surprisi...

Researchers recently found microbes t...

The Supreme Court recently stayed the...

Recently, at the Sustainable Finance ...

Recently, the Prime Minister of India...

In Assam’s Diphu Lok Sabha constituen...

With certain spices of Indian brands ...

Recently, KABIL signed a MoU with the...