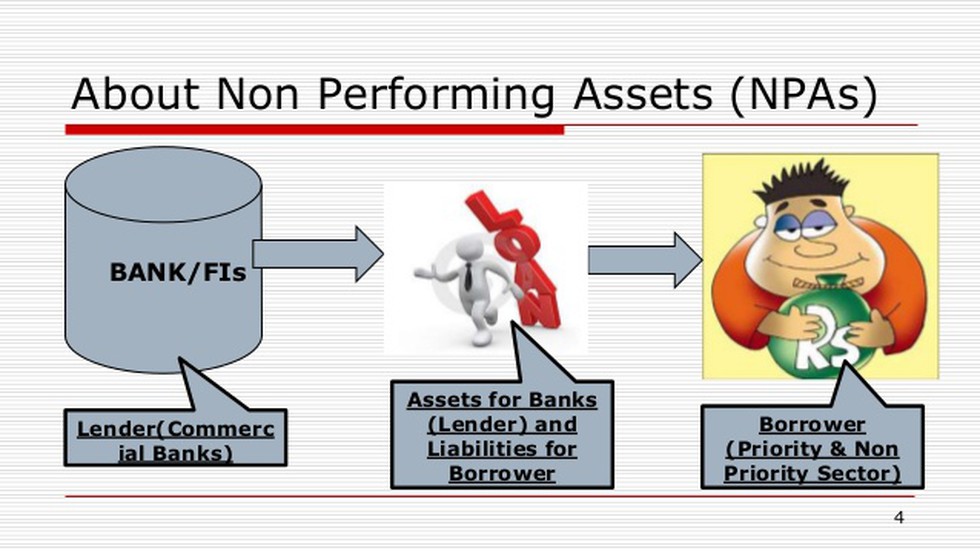

Non-Performing Assets (NPAs):

- Definition: A non-performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

- Types: Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets.

- Substandard assets: Assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

- Lost assets: An asset that is an NPA for a period of more than 36 months, but the amount has not been written off wholly is treated as a lost asset. In other words, such an asset is considered uncollectible.

Present scenario:

- The data shows that gross NPAs of all scheduled commercial banks were at ₹10.36 lakh crore at the end of the March 2018 quarter, and subsequently declined to ₹10.14 lakh crore by the end of the September quarter.

- Public sector banks accounted for 85.9% of all gross NPAs of scheduled commercial banks by September 30, 2018.

- The annualised slippage ratio (i.e. the percentage of fresh NPAs as percentage of standard advances at the beginning of the quarter) has also witnessed a declining trend over the past two quarters, which is again reflective of the improving credit discipline.