About the Overnight Index Swap:

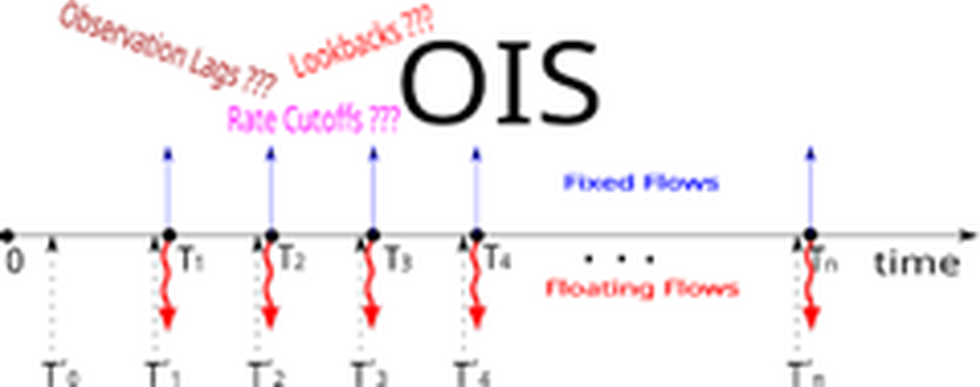

- It is a derivative instrument where returns under a fixed-rate asset are swapped against a predetermined published index of a daily overnight reference rate for an agreed period of time.

- The primary purpose of an OIS is to manage interest rate risk, particularly the risk associated with fluctuations in the overnight lending rate.

- An overnight index swap rate is calculated each day.

- This rate is based on the average interest rate institutions with loans based on the overnight rate have paid for that day.

How does an OIS work?

- These are instruments that allow financial institutions to swap the interest rates they are paying without having to refinance or change the terms of their existing loans.

- Typically, when two financial institutions create an overnight index swap, one of the institutions is swapping an overnight (floating) interest rate, and the other institution is swapping a fixed short-term interest rate.

- To get the swap rolling, both firms would agree to continue servicing their loans, but at the end of a specified time period, whoever ends up paying less interest will make up the difference to the other firm.

What is a derivative?

- It refers to a type of financial contract whose value is dependent on an underlying asset, group of assets, or benchmark.

- Common derivatives include futures contracts, forwards, options, and swaps.