Preferential Allotment Pricing Norms

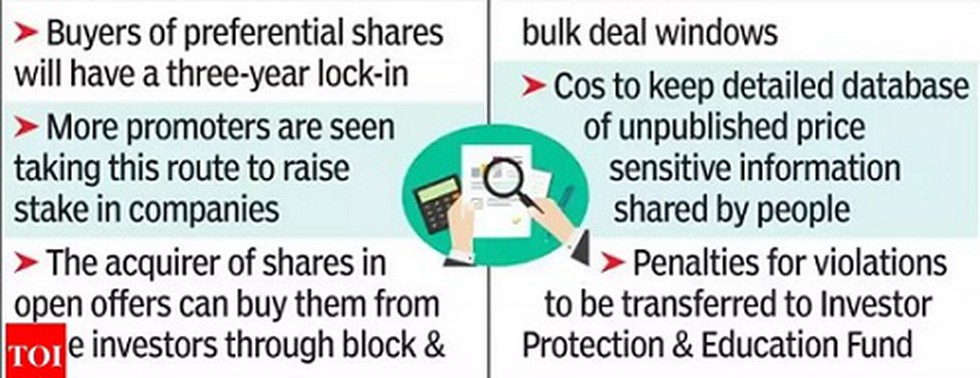

- It also amended the settlement proceeding norms to enable a faster disposal of cases while tweaking the Takeover Regulations as well.

- Companies with frequently traded shares can take into account the average of the weekly high and low over the past 12 weeks or two weeks, whichever is higher, and price the preferential allotment above that mark.

- While the existing pricing mechanism will continue, the relaxed pricing option will be available for all preferential allotments made between July 1 and December 31, 2020.