About:

- Mutual funds: Mutual funds are professionally managed investment vehicles which help investors to grow their money by investing in financial assets such as equities, bonds, gold and other assets.

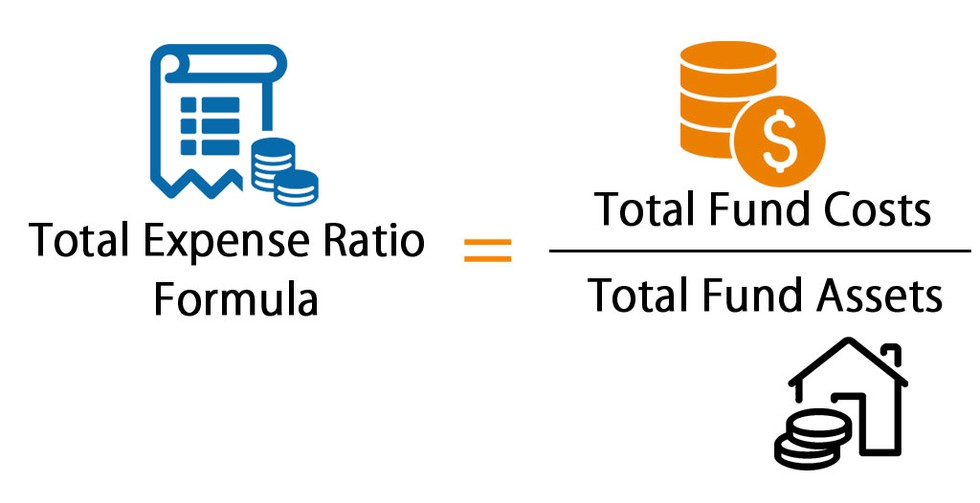

- Total Expense Ratio (TER): Mutual fund companies charge a cost to their investors for managing their schemes. This cost is called the TER which is expressed as a percentage of assets managed.

- In India, the maximum TER that a fund can charge its investors is prescribed by SEBI.

Components of TER:

Mutual funds typically incur two types of expenses –

- Non-recurring expenses during the launch of a fund, which in India, are usually borne by the fund house and not charged to investors.

- Recurring expenses such as the management fee, distributors’ commission, registrar’s fee, trustee fee and marketing expenses. These expenses are total up to the TER, which is expressed as a percentage of assets managed.

Recent decision:

- SEBI has capped the Total expense ratio at 1.05% for open-ended equity schemes with assets under management (AUM) in excess of ₹50,000 crore. Currently, schemes with AUM in excess of ₹300 crore charge 1.75% as total expense ratio.

- to SEBI, the lower expense ratio would lead to investors saving ₹1,300 crore to ₹1,500 crore in commissions.

- Further, SEBI has laid down a range of 1.05% to 2.25% to be charged as expense ratio depending on the AUM of the scheme. Earlier the range was 1.75% to 2.5%.

- However, it has allowed an additional expense ratio of 30 basis points for retail flows from beyond the top 30 cities.