Mains Daily Question

Jan. 17, 2023

Elaborate upon differences between old and new pension schemes and highlight the need for overall reforms in India’s pension architecture. (10 Marks)

Approach:

Introduction: Mention context and poor state finance conditions.

Body: Differentiate between OPS and NPS, broaden it to problems in our pension architecture, and mention suggestions also for reform.

Conclusion: Suggest a way forward for better security for the masses.

Answer:

Recently many states like Punjab, Rajasthan, and Chhattisgarh decided to revert to the old pension scheme attracting criticisms over already precarious state finances with aggregate debt of states reaching a 15-year high of 31.3% of the gross domestic product in FY2021 and FY 2022 as per different state budgets.

Many factors contribute to this situation as per State Finance Audits Reports of the Comptroller and Auditor General. These include

- increasing committed expenditures,

- rising outstanding public debts and liabilities,

- low mobilization of own resources comprising revenue from tax and

- non-tax sources, and high arrears in revenue collection.

In this context, the introduction of the old pension scheme (OPS) is being criticized as it differs from the new pension scheme ( NPS ) significantly.

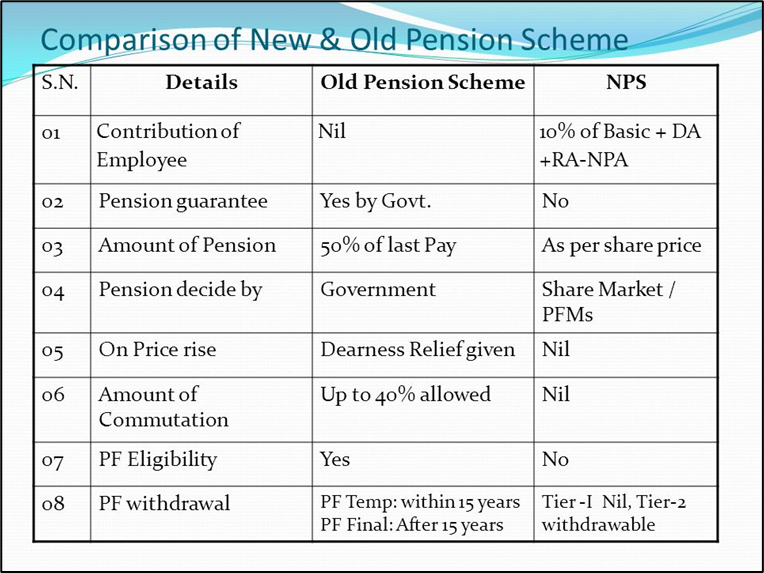

OPS is a defined benefit scheme where the employee gets an assured inflation monthly payment 0f 50% of the last drawn salary which is inflation and wage rate indexed. Whereas NPS introduced in 2004 is a savings scheme with defined contributions from both employees and the government into a fund which is then invested in the market, the benefits are linked to market conditions with risk slightly higher than OPS. NPS was introduced to reduce the fiscal burden of the government.

Need for reforms in the Indian Pension system:

- The Indian pension system has among the lowest ranks in the world(41 out of 44 countries) with a score of 44.4 in the global pension index of 2022 with Brazil and Indonesia having a better score than us.

- High exclusion numbers- most jobs are in the informal sector with limited social security benefits. The government has introduced the Atal pension scheme introduce social security.

- Low amounts of pension to be provided as part of poverty alleviation efforts such as through core of the core schemes to elderly, widows, etc. Such amounts are inadequate for the retirement of people.

- High inequity in the enjoyment of pension benefits with 11.4% elderly drawing defined benefits as government ex-workers cornering 62% of system expense as per a paper in 2021. It is alleged that such a system like OPS earlier was designed by bureaucrats to benefit themselves through taxpayer’s money but it has excluded larger masses.

- The high burden on sub-national governments as states bear more than 60 per cent. Contributory program funds invested in government paper soak up 40 percent of all interest payments of sub-national governments.

Suggestions for reforms in India’s pension architecture:

1) A non-contributory basic pension from public finances to deal explicitly with the poverty-alleviation objective.

2) Doing away with commutation and pension payments for unearned leaves in states where OPS is being implemented, to reduce financial burden.

4) Voluntary and fully funded occupational or personal pension plans with financial assets that can provide some flexibility when compared to mandatory schemes. Example launch of PM Kisan MandhanYojana by the government.

5) A voluntary system outside the pension system with access to a range of financial and non-financial assets and informal support such as family, healthcare, and housing.

Merely fluctuating between OPS and NPS is not a reform. We need efforts to ensure consensus in society to ensure a more inclusive and well-distributed social security system to ensure security for the vast majority of our masses. This helps ensure a dignified life for millions who contributed to the nation-building.