May 31, 2023

Mains Article

31 May 2023

Context

- During 2020-21 and 2021-22, India has become a net exporter of toys, ending a long import dominance.

- However, whether this turnaround represents a sustained rise in investment or a short-term outcome of protectionism and COVID-19 pandemic-related global disruptions is a matter of debate.

Indian Toy Industry

- In 2015-16, the industry had about 15,000 enterprises or establishments (organised and unorganised combined).

- The production stood at ₹1,688 crores using fixed capital of ₹626 crores at current prices and employing 35,000 workers.

- Registered factories (those employing 10 or more workers regularly) accounted for 1% of the number of factories and enterprises, employed 20% of workers, used 63% of fixed capital, and produced 77% of the value of output.

- However, during the one-and-half decades between 2000 and 2016, industry output was halved in real terms (net of inflation) with job losses.

- Domestic market size currently stands at an estimated value of $ 1.5 Bn.

- Labour-intensive toy categories like dolls, soft toys and board games offer significant manufacturing potential in India due to inherent cost competitiveness and growing demand.

- The sector is dominated by small & medium sized manufacturers.

- Over 4,000 toy units in the MSME Sector significantly contribute to both manufacturing and exports to large global & domestic brands.

Indian Toy Industry Share in Global Market

- India’s exports stand at a mere half-a-percentage point.

- Between 2014-19, the Indian toy industry witnessed negative productivity growth.

- Imports accounted for up to 80% of domestic sales until recently. Between 2000 and 2018-19, imports rose by nearly three times as much as exports.

- But in recent years, the Indian toy industry is expanding its global presence, with increased high-value exports to Middle East and African countries.

- The Indian toy industry is among the fastest-growing globally, projected to reach $3 Bn by 2028, growing at a CAGR of 12% between 2022-28.

What explains India's Negligible Share in Global Toy Market?

- Inward-Oriented Industrial Policy

- Asia’s successful industrialising nations promoted toy exports for job creation, starting with Japan about a century ago, China since the 1980s, and currently Vietnam following in their footsteps.

- In contrast, India followed an inward-oriented industrial policy in the Planning-era, which sheltered domestic production by providing a “double protection” by imports tariffs and reservation of the product for exclusive production in the small-scale sector known as the “reservation policy.”

- As a result, Toy manufacturing remained stagnant, archaic, and fragmented, even as imports of modern, safe, and branded toys boomed.

The Export Turnaround and Import Contraction

- There has been a sixfold increase in Indian toy exports in 2021-22 compared to 2013-14.

- Toys have been recognised as one of the champion sectors with significant export potential.

- Toy exports increased from $109 million (₹812 crore) to $177 million (₹1,237 crore) between 2018-19 and 2021-22.

- Imports declined from $371 million (₹2,593 crore) to $110 million (₹819 crore).

Reason Behind Import Contraction

- Increased Custom Duty: Imports contracted as the basic custom duty on toys tripled from 20% to 60% in February, 2020.

- Numerous non-tariff barriers were imposed as well such as production registration orders and safety regulation codes, which contributed to import contraction.

Is the Export Turnaround a sign of Sustained Growth due to govt policies?

- The turnaround in toy exports is based on data from just two recent years, and during the COVID-19 pandemic, it is perhaps too premature to claim policy success.

- The potential for sustaining net exports appears slim as the industry has hardly made sustained investment to boost output and exports.

- The turnaround does not seem to be the outcome of strengthening domestic investment and production on a sustained basis.

- Since around 2000, the industry has shrunk with rising imports, until two years ago.

Government’s Policy Initiatives Impact on the Toy industry

- Impact of “Make in India”

- The annual value of output and fixed investment at constant prices (net of inflation) after peaking in 2007-08, have trended downwards with considerable fluctuations (except for 2019-20).

- Apparently, there is no evidence of ‘Make in India’ positively affecting these indicators on a sustained basis.

- The output of the informal or unorganised sector shrank, though it continues to account for most establishments and employment.

- Industry De-reservation Effect

- In 1997, in the wake of liberal reforms, the reservation policy was abolished.

- New firms entered the organised sector, but only for a while, and productivity growth improved.

- Despite early positive trends, industry de-reservation failed to sustain output, investment, and productivity growth after 2007-08.

Some Other Government Schemes to Strengthen the Toy Industry

- Central Government Schemes

- Scheme For Granting Recognition & Registration to In-House R&D Units

- Remission Of Duties & Taxes on Exported Products (RoDTEP)

- Duty Drawback Scheme

- Export Promotion Capital Goods (EPCG) Scheme

- Custom Bonded Warehouse Scheme

- Increase in basic custom duty (BCD) for Electronic Toys from 5% to 15% to encourage domestic manufacturing

- State Incentives

- Capital subsidy

- Stamp duty exemption

- Interest subsidy

- Tax reimbursement

- Electrical duty exemption

What should be Policymakers’ strategy for a sustainable long-term term industry growth?

- The policymakers should look beyond simplistic binaries; planning versus reforms.

- There is a need to examine the ground reality of industrial locations and clusters to tailor policies and institutions to nurture such industries.

Mains Article

31 May 2023

Why in News?

- Last week, France announced a ban on all short-haul domestic flights.

- A month earlier, the Schiphol airport in Amsterdam, one of the busiest in Europe, banned private jets and small business planes.

- There is a growing clamour in Europe for a bigger crackdown on private aviation sector.

What’s in Today’s Article?

- Context (Aviation Ban in France)

- CO2 Emissions from Aviation Sector (Data, Role of Private Jets, Pollutants involved, etc.)

- Challenges and Solution w.r.t. Emissions from Aviation Sector

Context (Aviation Ban in France):

- France, last week, became the first country in the world to impose a ban on short-haul domestic flights.

- The country brought in a new law, effective from May 23, that bars air travel to destinations that can be covered by up to two-and-a-half hour journey by train.

- There is growing demand for a wider crackdown on private aviation.

- Apart from France, the Netherlands, Austria and Ireland urged the European Union to strengthen regulations to discourage travel by private jets in order to reduce CO2 emissions from aviation industry.

CO2 Emissions from Aviation Industry:

- In 1960, 100 million passengers travelled by air, at the time a relatively expensive mode of transportation available only to a small fraction of the public.

- By 2019, the total annual world-wide passenger count was 4.56 billion.

- In 2021 aviation accounted for over 2% of global energy-related CO2 emissions, having grown faster in recent decades than road, rail or shipping.

- As it stands, the aviation sector produces 900 million CO2 per year, according to International Air Transport Association (IATA).

- By 2050, if nothing is done to reduce the industry’s carbon footprint, that will rise to 1.8 billion tons.

- Reducing this level to gradually achieve net zero emissions in 2050 poses an enormous technological challenge that the IATA estimates will cost companies around USD 1.55 trillion between 2020 and 2050.

Contribution of Private Jets in CO2 Emissions:

- Private jets, usually far more inefficient than large commercial airliners, have always been a big eyesore from the climate perspective.

- In a recent report, it was found that private jets were 5 to 14 times more polluting, per passenger, than commercial planes, and 50 times more polluting than trains.

- It said private planes could emitting about 2 tonnes of carbon dioxide every hour, while an average person in Europe emits about 8.2 tonnes of carbon dioxide equivalent in an entire year.

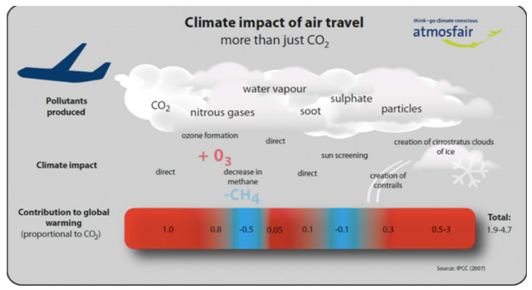

Impact of Emissions from Airplanes:

- CO2 is the largest component of aircraft emissions, accounting for approximately 70 percent of the exhaust.

- After being emitted, 30 percent of a given quantity of the gas is removed from the atmosphere naturally over 30 years, an additional 50 percent disappears within a few hundred years, and the remaining 20 percent stays in the atmosphere for thousands of years.

- Water vapor is also a product of jet fuel consumption, making up about 30 percent of the exhaust.

- With its short lifespan in the atmosphere as part of the water cycle, water vapor from aircraft has a minimal direct warming impact.

- However, its presence in the exhaust plume has an indirect impact by contributing to the formation of contrails.

- All the remaining emissions in the graphic make up less than one percent of the exhaust plume.

What is the Solution to Reduce CO2 Emissions from Aviation Industry?

- IATA says that the main solution lies in the use of sustainable aviation fuels (SAF).

- These fuels – made from biomass, waste oils and could even be made from carbon capture in future – have the advantage that they can be used directly in existing aircraft.

- Such fuel sources can reduce CO2 emissions by 80 percent compared to kerosene over their entire life cycle.

- Two leading plane manufacturing corporations, Airbus and Boeing, have pledged that their fleets will be able to fly 100 percent on SAF by 2030.

Challenges Associated with SAF:

- Currently, SAF accounts for only 0.1 percent of aviation fuel.

- Encouraged by governments, the infrastructure to produce SAF is being set up in the US and Europe, but is still embryonic – and the cheapest fuel that comes out costs four time more than kerosene.

Offset Mechanism for Reducing Emissions from Aviation Industry:

- In 2016, the International Civil Aviation Organisation (ICAO) put in place an offset mechanism to ensure that any increase in emissions over 2020 levels is compensated for by the airline industry through investment in carbon saving projects elsewhere.

- Called Carbon Offsetting and Reduction Scheme for International Aviation, or CORSIA, the offset plan is supposed to run from 2021 to 2035.

- CORSIA is considered a breakthrough, but it is not very ambitious. It only seeks to offset emissions that are over and above 2020 levels. It does not deal with total emissions.

Conclusion:

- Reducing aviation emissions through other means has not proved to be easy.

- Unlike road or rail travel, aviation does not have viable technology alternatives for shifting to cleaner fuels.

- Biofuels have been tried and so have hydrogen fuel cells. Solar powered planes have also made trips.

- But use of these alternative fuels for flying large commercial airliners is still some distance away.

Mains Article

31 May 2023

Why in News?

- The Supreme Court held that the government, when entering into a contract under the President’s name, cannot claim immunity from the legal provisions of that contract under Article 299 of the Constitution.

What’s in Today’s Article?

- What is Article 299 of the Indian Constitution?

- Procedure to be Followed for Making a Contract

- What are the Requirements for Government or State Contracts?

- What was the Case?

- The Apex Court’s Ruling

What is Article 299 of the Indian Constitution?

- Article 298: It grants the Centre and the state governments the power to carry on trade or business, acquire, hold, and dispose of property, and make contracts for any purpose.

- Article 299: It provides that all contracts made in the exercise of the executive power of the Union or of a State shall be

- Expressed to be made by the President or by the Governor of the State.

- Executed on behalf of the President or the Governor by persons in a manner as directed and authorised by them [Article 299 (1)].

Procedure to be Followed for Making a Contract:

- In 1954, the top court held that there must be a definite procedure according to which contracts must be made by agents acting on the government’s behalf; otherwise, public funds may be depleted by illegitimate contracts.

- It implies that contracts not adhering to the manner given in Article 299(1) cannot be enforced by any contracting party.

- However, Article 299 (2) says that neither the President nor the Governor can be personally held liable for such contracts.

What are the Requirements for Government or State Contracts?

- In 1966, the apex court laid down essential requirements for government contracts under Article 299.

- 3 conditions to be met before a binding contract against the government could arise:

- The contract must be expressed to be made by the Governor or the President;

- It must be executed in writing, and

- The execution should be by such persons and in such a manner as the Governor or the President might direct or authorise.

What was the Case?

- The case dealt with an application filed by Glock Asia-Pacific Limited, a pistol manufacturing company, against the Centre regarding the appointment of an arbitrator in a tender-related dispute.

- According to the Arbitration and Conciliation Act, 1996, any person whose relationship with the parties or counsel of the dispute falls under the 7th Schedule (of the Act) will be ineligible to be appointed as an arbitrator.

- The 7th Schedule includes relationships where the arbitrator is an employee, consultant, advisor, or has any other past or present business relationship with a party.

The Apex Court’s Ruling:

- Referring to the 246th Law Commission Report, the court observed that when the party appointing an arbitrator is the State, the duty to appoint an impartial and independent adjudicator is even more onerous.

- Thus, the court rejected the Centre’s reliance on Article 299, saying that Article 299 only lays down the formality that is necessary to bind the government with contractual liability.

- Thus, the substantial law relating to the contractual liability of the Government is to be found in the general laws of the land.

- The court also appointed former SC judge Justice Indu Malhotra “as the Sole Arbitrator to adjudicate upon the disputes” in the case.

Mains Article

31 May 2023

Why in news?

- The Reserve Bank of India (RBI) has conceptualised a lightweight payment and settlements system, which it is calling a “bunker” equivalent of digital payments.

- The central bank has not offered a timeline for the launch of this payments system yet.

What’s in today’s article?

- Payment and settlements system in India

- News Summary

Payment and settlements system in India

- About

- Payment and settlement systems refer to the infrastructure and processes that enable the transfer of funds and the settlement of financial transactions between individuals, businesses, and financial institutions.

- An efficient payment system promotes market efficiency and reduces the cost of exchanging goods and services.

- By the same token, its failure can result in loss of confidence in the financial system and in the very use of money.

- India's payment and settlement system has witnessed remarkable growth, driven by technological advancements, government initiatives, and changing consumer preferences.

- Regulatory framework

- The Reserve Bank of India (RBI) regulates and oversees the payment and settlement systems in the country.

- The Board for Regulation and Supervision of Payment and Settlement Systems (BPSS), chaired by the Governor, RBI, spearheads this responsibility.

- In 2005, RBI created Department of Payment and Settlement Systems (DPSS) to focus exclusively on payment and settlement systems.

- Subsequently, the government enacted the Payment and Settlement Systems Act, 2007 (PSS Act).

- The Reserve Bank of India (RBI) regulates and oversees the payment and settlement systems in the country.

Components of Payment and Settlement Systems

- Paper-based Payments

- Use of paper-based instruments (like cheques, drafts, and the like) accounts for nearly 60% of the volume of total non-cash transactions in the country.

- Electronic Clearing Service (ECS) Credit

- Later in 2008, RBI launched a new service known as National Electronic Clearing Service (NECS).

- National Electronic Funds Transfer (NEFT) System (launched in 2005)

- Available across a longer time window, the NEFT system provides for batch settlements at hourly intervals, thus enabling near real-time transfer of funds.

- Real Time Gross Settlement (RTGS)System (introduced in in 2004)

- RTGS is a funds transfer systems where transfer of money takes place from one bank to another on a real time (no waiting time) and on gross basis.

- Clearing Corporation of India Limited (CCIL)

- CCIL was set up in April 2001 by banks, financial institutions and primary dealers.

- It was established to function as an industry service organisation for clearing and settlement of trades in money market, government securities and foreign exchange markets.

- Immediate Payment Service (IMPS) – Launched in 2010

- IMPS is an interbank electronic funds transfer system that enables instant money transfers 24/7.

- Other Payment Systems

- Pre-paid Payment Systems

- Mobile Banking System

- ATMs / Point of Sale (POS) Terminals / Online Transactions

- Unified Payments Interface (UPI): UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI).

- Mobile Wallets: Mobile wallets, such as Paytm, PhonePe, and Google Pay, have become increasingly popular in India.

- Aadhaar Enabled Payment System (AEPS): AEPS is a biometric-based payment system that leverages the UIDAI Aadhaar database.

News Summary: RBI’s lightweight payment and settlements system

- In a proactive move to address potential disruptions caused by catastrophic events or volatile situations, the RBI has unveiled a new initiative: the Lightweight Payment and Settlement System (LPSS).

- This new system can be operated from anywhere by a bare minimum staff in exigencies such as natural calamities or war.

- The infrastructure for this system will be independent of the technologies that underlie the existing systems of payments such as UPI, NEFT, and RTGS.

Need for such a lightweight payments system

- According to the RBI, existing conventional payments systems such as RTGS, NEFT, and UPI are designed to handle large volumes of transactions while ensuring sustained availability.

- As a result, they are dependent on complex wired networks backed by advanced IT infrastructure.

- However, catastrophic events like natural calamities and war have the potential to render these payment systems temporarily unavailable by disrupting the underlying information and communication infrastructure.

- Therefore, it is prudent to be prepared to face such extreme and volatile situations.

Benefits of such a lightweight payments system

- Could ensure near zero downtime of the payment and settlement system

- In its Annual Report for 2022-23, RBI says that the lightweight and portable payment system is expected to operate on minimalistic hardware and software, and would be made active only on a need basis.

- Hence, such a lightweight and portable payment system could ensure near zero downtime of the payment and settlement system in the country.

- Can keep the liquidity pipeline of the economy alive

- It has potential to keep the liquidity pipeline of the economy alive and intact.

- It can do so by facilitating uninterrupted functioning of essential payment services like bulk payments, interbank payments and provision of cash to participant institutions.

- Can ensure stability of the economy

- The system is expected to process transactions that are critical to ensure the stability of the economy, including government and market related transactions.

- Can enhance public confidence in digital payments

- Having such a resilient system is also likely to act as a bunker equivalent in payment systems.

- Hence, it can enhance public confidence in digital payments and financial market infrastructure even during extreme conditions.

Mains Article

31 May 2023

Why in news?

- Recently, Reserve Bank of India Governor, while addressing bank board, raised concerns over banks using innovative methods for evergreening of loans.

- As per him, banks are covering up the real status of stressed loans of corporates – to project an artificial clean image in cahoots with corporates.

What’s in today’s article?

- Evergreening of loans

- News Summary

Evergreening of loans

- Evergreening of loans refers to a practice used by financial institutions to extend or renew existing loans to borrowers who are struggling to repay their debts.

- It involves granting additional funds or rolling over the outstanding debt, often with modified terms or conditions.

- This is done to create the appearance that the borrower is making timely repayments and maintaining a healthy credit profile.

- The evergreening of loans allows borrowers to maintain the illusion of ongoing financial stability by continuously obtaining new loans to cover existing obligations.

Why do financial institutions engage in evergreening of loans?

- To avoid recognizing non-performing assets (NPA) on their balance sheets

- If an account turns into an NPA, banks are required to make higher provisions which will impact their profitability.

- A loan turns into an NPA, if the interest or instalment remains unpaid even after the due date — and remains unpaid for a period of more than 90 days.

- So, to avoid classifying a loan as an NPA, banks adopt the evergreening of loans.

- If an account turns into an NPA, banks are required to make higher provisions which will impact their profitability.

- To maintain a positive relationship with borrowers

- Some banks have even extended such loans to wilful defaulters to keep them out of the defaulters’ books.

- By providing additional credit, financial institutions can retain clients who might otherwise default on their loans.

Risks associated with evergreening of loans

- Inflates the quality of the institution's loan portfolio

- This practice artificially inflates the quality of the institution's loan portfolio and can mislead investors, regulators, and the public about its financial health.

- Can lead to a cycle of increasing debt

- This approach may be seen as a short-term solution to prevent immediate defaults.

- However, it can lead to a cycle of increasing debt and further financial instability for both borrowers and lenders in the long run.

- Problematic for the overall stability of the financial system

- Evergreening of loans can be problematic for the overall stability of the financial system.

- It can mask the true extent of bad loans in an economy, creating systemic risks and distorting the assessment of creditworthiness.

- Sign of misgovernance

- This is purely misgovernance, so that bad loans are made to look good many a time by additional lending to troubled borrowers.

- It normally happens due to the unholy relationship between bankers and borrowers.

- The CBI had detected several cases of fund diversion by promoters of companies from loans advanced again and again by banks in the last couple of years.

- Contributes to the crowding-out effects

- In India, there is evidence of a practice called indirect evergreening.

- This involves struggling companies borrowing money from weak banks through related parties, but instead of using the funds for productive investments, they increase their debt levels.

- This kind of activity is often overlooked and not easily detected.

- As a result, valuable resources are misallocated, which contributes to the crowding-out effects typically associated with financially vulnerable companies.

How can evergreening be stopped?

- As per the Committee to Review Governance of Boards of Banks in India headed by PJ Nayak, wherever significant evergreening in a bank is detected by the RBI:

- penalties should be levied through cancellations of unvested stock options;

- claw-back of monetary bonuses on officers concerned and on all whole-time directors;

- the Chairman of the audit committee be asked to step down from the board.

- The primary defence against evergreening must however come from the CEO, the audit committee and the board.

- The audit committee, in particular, needs to be particularly vigilant.

- If significant evergreening is detected, it must mean that evergreening is wilful, with support from sections of the senior management of the bank.

- It then becomes necessary to levy penalties and action against the erring officers.

News Summary:

- During the supervision of banks, the RBI noticed certain instances wherein banks were using innovative ways to conceal the real status of stressed loans.

- This was revealed by the RBI Governor in his address to the board of directors of public sector and private lenders.

Evergreening methods used by Banks: as highlighted by the RBI Governor

- Bringing two lenders together to evergreen each other’s loans by sale and buyback of loans or debt instruments;

- Good borrowers being persuaded to enter into structured deals with a stressed borrower to conceal the stress;

- In other words, financially sound and reliable borrowers are encouraged to engage in specific agreements or transactions with borrowers who are facing financial difficulties.

- This is to hide or mask the financial distress of the borrower who is struggling.

- By involving creditworthy borrowers in such arrangements, it creates a façade of stability and financial health for the stressed borrower.

- Use of internal or office accounts to adjust borrower’s repayment obligations;

- Renewal of loans or disbursement of new/additional loans to the stressed borrower or related entities closer to the repayment date of the earlier loans.

May 30, 2023

Mains Article

30 May 2023

Context

- Recently, the CJI led Bench of the Supreme Court recalled its Ritu Chhabaria vs Union of India judgement, which emphasised on the Right to Default Bail/Statutory Bail.

- This can have many implications ranging from bypassing the existing procedures to CJI positioning himself as Master of other SC Judges.

What is a Default/Statutory Bail?

- This is a right to bail that accrues when the police fail to complete investigation within a specified period in respect of a person in judicial custody. This is enshrined in Section 167(2) of the Code of Criminal Procedure (CrPC).

- A Magistrate can order an accused person to be detained in the custody of the police for 15 days or However, the accused cannot be detained for more than:

- 90 days, when an authority is investigating an offense punishable with death, life imprisonment or imprisonment for at least ten years; or

- 60 days, when the authority is investigating any other offense.

- In Narcotic Drugs and Psychotropic Substances Act, the period is 180 days.

- At the end of this period, if the investigation is not complete, the court shall release the person “if he is prepared to and does furnish bail”.

SC’s Judgement (Ritu Chhbaraia case)

- The SC affirmed an undertrial’s right to be released on default bail in the event of the investigation remaining incomplete and proceeding beyond the statutory time limit.

- It held that the right to be released on bail will not be extinguished on the mere filing of a preliminary charge-sheet.

- The court concluded that an accused’s right to seek default bail would be terminated only upon competition of the investigation within the statutory time limit.

Subsequent Recall Judgement

- The Court of the CJI entertained a recall application moved by the Union of India against the Ritu Chhabaria judgment.

- The bench an interim order directing courts to decide bail applications without relying on the decision laid down in Ritu Chhabriafor a short period of time.

Issues Regarding the Recall Judgement

- Stripping the Division Bench’s Order of its Precedential Value

- The Court of the CJI indirectly stayed the decision despite not having any connection with the verdict.

- It amounts to stripping the decision of the Division Bench of its precedential value even if for a short while.

- No Scope of CJI’s Intervention

- The only recourse available to the Union of India was the filing of a review petition, which is usually decided by the same Bench.

- There was no scope of the review petition being entertained by the Court of the CJI.

- No Scope of Recall Application Filing Before a Different Bench: There was no scope for a recall application being filed against a judgment, that too before an altogether different Bench. Doing so amounts to bench fishing or forum shopping.

- Devoid of Constitutional or Legislative Backing

- By entertaining an intra-court appeal, the Court of the CJI has effectively instituted a mechanism that is completely devoid of any legislative or constitutional backing.

- The order is in total disregard of the established procedure, which is a review petition.

What could be Implications of the Recall Judgement?

- The Government can bypass the existing mechanism

- In the near future, if the government is displeased with the order of one Bench, it can simply go before the CJI to get the decision stripped of all its legal sanctity instead of re-convincing the same Bench in a review.

- Expanding Powers of CJI

- The order has the effect of enlarging the powers of the CJI on the judicial side and of creating an unprecedented intra-court appellate mechanism within the SC.

- The instant order has also dulled the bright line prohibiting the Court of the CJI from assuming that it is superior to all other Benches.

CJI’s Roles

- The CJI oversees allocating cases and appointing constitutional benches that deal with critical legal issues. That is why theCJI is known as the Master of Roster.

- Article 145 of the Constitution grants the CJI the authority to assign relevant subjects to the bench of justices.

- Advisory powers allow the CJI to direct and advise the government on certain matters.

- In emergency scenarios, discharges the President's function if the offices of President and Vice President become abruptly empty.

Is CJI Superior to Other SC Judges?

- Within the constitutional scheme, all judges of the SC are equal in terms of their judicial powers.

- However, the CJI enjoys special administrative powers such as constituting Benches and assigning matters and references for reconsideration of a larger Bench.

- Because of the CJI’s role as the ‘Master of the Roster’, he is regarded as ‘first amongst equals’ in relation to companion judges.

- But in any given Bench including the CJI, the vote or power given to the CJI is the same as that given to his companion judges.

- There are various examples of the CJI authoring a minority opinion of the Court.For instance, in the EWS quota dispute the then CJI, Justice U.U. Lalit, along with Justice S. Ravindra Bhat authored the minority opinion of the Court.

Why the expanding powers of CJI are a Cause of Concern?

- Despite the administrative usefulness of the ‘Master of the Roster’ system, the many recorded instances of abuse are a cause for concern.

- For example, 4 senior judges of the SC alleged serious infirmities and irregularities in the administration and assigning of cases for hearing to Benches of the Court (four years ago).

- The powers vested in the CJI by his virtue of being the Master of the Roster are It is impractical to lay any limits on these powers, meant for the smooth administrative functioning of the Court.

Mechanism in Other countries

- Most Commonwealth countries such as the U.K., Australia and Canada follow the same system where all judges have the same power, and CJI is considered as the first among equals.

- Countries such as the U.S., instead have a system where all the judges collectively exercise power and render decisions. Thus, they reflect the collective strength of the Court and not of Benches.

Way Forward - Digitisation of the CJI’ Administrative Functions: The practice of constituting Benches and allocating cases should be completely computerised and left out of the hands of the CJI.

Conclusion

- The legitimacy of the power of Master of the Roster has been debated many times and has been reaffirmed to the extent of administrative decisions for the smooth functioning of the Court.

- It is imperative that the CJI himself refrains from expanding his powers as Master of the Roster.

Mains Article

30 May 2023

Why in news?

- On May 29, the Indian Army commemorated the 75th International Day of UN Peacekeepers.

- On this day, India also announced that it will organize two initiatives later this year for women personnel from South East Asia as part of defence cooperation with ASEAN.

- This announcement follows Indian Defence Minister’s suggestion last year to focus on "women in United Nations Peacekeeping (UNPK) operations" as an important initiative.

What’s in today’s article?

- United Nations Peacekeeping (UNPK) operations

- News Summary

UN Peacekeeping

- The UN Charter gives the Security Council primary responsibility for the maintenance of international peace and security.

- In fulfilling this responsibility, the Council can establish a UN peace operation.

Peacekeeping mandates

- UN peace operations are deployed on the basis of mandates from the United Nations Security Council.

- These mandates differ from situation to situation, depending on the nature of the conflict and the specific challenges it presents.

- Depending on their mandate, peace operations may be required to:

- Deploy to prevent the outbreak of conflict or the spill-over of conflict across borders;

- Stabilize conflict situations after a ceasefire;

- Assist in implementing comprehensive peace agreements;

- Lead states or territories through a transition to stable government, based on democratic principles, good governance and economic development.

Principles

- There are three basic principles that continue to set UN peacekeeping operations apart as a tool for maintaining international peace and security. These are:

- Consent of the parties

- In the absence of such consent, a peacekeeping operation risks becoming a party to the conflict; and being drawn towards enforcement action.

- Impartiality

- Peacekeepers should be impartial in their dealings with the parties to the conflict, but not neutral in the execution of their mandate.

- Non-use of force except in self-defence and defence of the mandate

- Consent of the parties

Successes

- Since 1948, the UN has helped end conflicts and foster reconciliation by conducting successful peacekeeping operations in dozens of countries, including Cambodia, El Salvador, Guatemala, Mozambique, Namibia and Tajikistan.

- UN peacekeeping has also made a real difference in other places with recently completed or on-going operations such as Sierra Leone, Burundi, Côte d’Ivoire, Timor-Leste, Liberia, Haiti and Kosovo.

- In other instances, however, UN peacekeeping have been challenged and found wanting, for instance in Somalia, Rwanda and the former Yugoslavia in the early 1990s.

- Overall, UN Peacekeeping Forces have an impressive record of peacekeeping achievements, including winning the Nobel Peace Prize (1988).

India’s contribution in peacekeeping missions

- Current status

- India is one of the largest troop contributing nation to UNPK.

- Currently, India has around 5,900 troops deployed in 12 U.N. Missions.

- India’s contribution to the peacekeeping budget stands at 0.16%.

- Contribution so far

- India has been actively participating in peacekeeping right from 1950 when it supplied medical personnel and troops to the UN Repatriation Commission in Korea.

- India has contributed approximately 2,75,000 troops to peacekeeping missions so far and 159 Indian Army soldiers have lost their lives across the globe.

- Joint training of U.N. peacekeepers from African countries

- In 2016, India and the U.S. had begun an annual training programme for joint training of U.N. peacekeepers from African countries.

- Centre for United Nations Peacekeeping (CUNPK)

- Indian Army has established a CUNPK in New Delhi to impart training in peacekeeping operations and the Centre trains more than 12,000 troops every year.

- Women deployment

- India has deployed Female Engagement Teams in United Nations Organization Stabilization Mission in the Democratic Republic of the Congo and United Nations Interim Security Force for Abyei.

- This is the second largest women contingent after Liberia.

- India has also deployed Women Military Police in United Nations Disengagement Observer Force and women staff officers and military observers in various missions.

- India has deployed Female Engagement Teams in United Nations Organization Stabilization Mission in the Democratic Republic of the Congo and United Nations Interim Security Force for Abyei.

- Other contributions

- In August 2021, India, in collaboration with the UN launched UNITE AWARE platform.

- It is a technology platform to ensure the safety and security of peacekeepers.

- India has also proposed a 10-point plan, including making those targeting UN peacekeepers more accountable.

- It also suggested to build a memorial wall to honour peacekeepers.

- In August 2021, India, in collaboration with the UN launched UNITE AWARE platform.

News Summary

- To further expand the India-ASEAN ties,the Raksha Mantri had announced initiatives for Women in UN Peace Keeping Operations.

- These proposals were made at the inaugural India-ASEAN Defence Ministers’ Meeting held in November 2022 at Siem Reap, Cambodia, to commemorate the 30th Anniversary of India-ASEAN relations.

- As part of this announcement, India is set to conduct two initiatives for women personnel from South East Asia later this year.

Initiatives under the India-ASEAN Initiative for women in UNPK operations

- Courses for women peacekeepers of ASEAN member-states

- One of the initiatives includes conducting of tailor-made courses for women peacekeepers of ASEAN member-states at the Centre for United Nations Peacekeeping (CUNPK) in India this September.

- The Indian Army has established CUNPK (in 2000) in New Delhi to impart niche training in peacekeeping operations.

- In all 20 peacekeepers, two from each country, would be trained.

- One of the initiatives includes conducting of tailor-made courses for women peacekeepers of ASEAN member-states at the Centre for United Nations Peacekeeping (CUNPK) in India this September.

- Table Top Exercise for women officers from ASEAN

- The other initiative is a ‘Table Top Exercise’ for women officers from ASEAN incorporating facets of UNPK challenges to be conducted in December.

Mains Article

30 May 2023

Why in News?

- A Foucault pendulum that rotates on its axis is suspended from the ceiling of the entrance hall of the Constitution Hall of India's new Parliament building, signifying the integration of the idea of India with the idea of the cosmos.

- Created by the National Council of Science Museum (NCSM, Kolkata), the pendulum is being dubbed as the largest such piece (22 m in height, and 36 kg in weight ) in India.

What’s in Today’s Article?

- What is a Foucault’s Pendulum?

- Working of a Foucault’s Pendulum

- Time to Change Orientation at Different Latitudes

- News Summary Regarding Foucault’s Pendulum at new Parliament Building

What is a Foucault’s Pendulum?

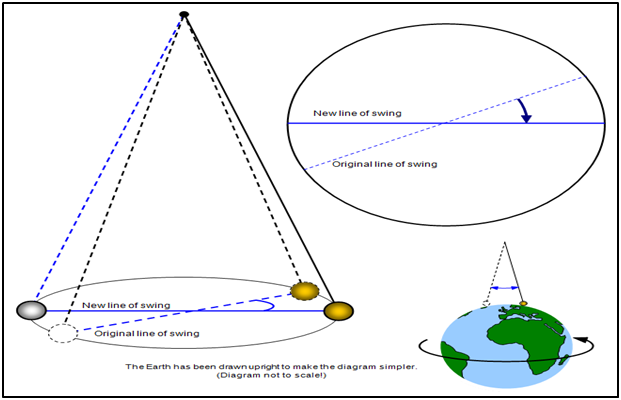

- The original Foucault’s pendulum, named after 19th century French physicist Leon Foucault, is a simple experiment to demonstrate earth’s rotation.

- When Foucault carried out this experiment for the public in 1851, it was the first direct visual evidence of the fact that the earth rotates on its axis.

- The experimental set-up involves a heavy object hung from a height with a string, free to swing in any direction.

- Once set in to-and-fro motion, the pendulum is seen to change its orientation slowly over time.

- For example, if the initial motion imparted to it was in the north-south direction, after a few hours it could be seen moving in the east-west direction.

Working of a Foucault’s Pendulum:

- According to Newton's First Law of motion, every object will remain in uniform motion in a straight line unless compelled to change its state by the action of an external force.

- Thus, when a pendulum is set to swing it will continue to swing in the same direction unless it is pushed or pulled in some other direction.

- The earth, on the other hand, will rotate once every 24 hours underneath the pendulum.

- This means, if one stands to watch the pendulum, s/he would be likely to notice that the line of the pendulum's swing has changed to a different direction.

- This is because observers too are rotating with the earth, but can notice the change in orientation of the pendulum.

Time to Change Orientation at Different Latitudes:

- At the equator, the pendulum is perpendicular to the axis of rotation, and hence it never changes its orientation of the swing.

- At other latitudes, it will, and would return to the original course after fixed time periods.

- At the north and south poles, when the pendulum is aligned with the axis of rotation of the earth, the pendulum’s back-and-forth motion comes back to its original plane in exactly 24 hours.

- At other latitudes (because the pendulum is not aligned to the axis of rotation of the earth), it takes longer for the pendulum to return to its original orientation of swinging.

News Summary Regarding Foucault’s Pendulum at new Parliament Building:

- Pendulum at the new Parliament:

- All the components of the pendulum have been completely made in India.

- The piece, made using gunmetal, has been fixed with an electromagnetic coil to ensure hassle-free movement.

- The suspension system is mounted on the ceiling. There is continuous power supply so there are no obstacles (to the pendulum’s movement).

- At the latitude of the Parliament, it takes 49 hours, 59 minutes, and 18 seconds for the pendulum to complete one rotation.

- Significance: It is a piece reflecting the spirit of Article 51A of the Indian Constitution, which enshrines every citizen “to develop the scientific temper, humanism, and the spirit of inquiry and reform”.

- The first such pendulum: It was installed in 1991 at the Inter-University Centre for Astronomy and Astrophysics (IUCAA) in Pune.

Mains Article

30 May 2023

Why in News?

- The Union Health Ministry has recently urged State Governments to audit hysterectomy trends in public and private hospitals.

- This was done in response to a Supreme Court petition arguing that women from marginalised locations are at risk of unjustified hysterectomies for economic gains and exploitation.

What’s in Today’s Article?

- About Hysterectomy (Meaning, Criteria, Risks, etc.)

- Hysterectomy in India (Data, Challenges, Government Initiatives, etc.)

- News Summary

What is Hysterectomy?

- A hysterectomy is a surgical procedure that removes the uterus (womb).

- After surgery, woman can’t become pregnant and no longer menstruate.

Criteria for Getting a Hysterectomy:

- After caesarean deliveries, hysterectomies are the second-most frequent procedure in women of the reproductive age group.

- Reasons for this surgery include abnormal bleeding, uterine prolapse, fibroids and cancer.

- In some cases, oophorectomy, the removal of ovaries (the primary source of oestrogen), is also frequently performed, which is a form of surgical menopause and linked to several chronic conditions.

- The highest percentage of hysterectomies (51.8%) were to treat excessive menstrual bleeding or pain.

- It's more common for women aged 40 to 50.

Health Risks Associated with Hysterectomy:

- There is evidence about the long-term effects of hysterectomy – both with or without oophorectomy (removal of ovaries).

- A 2022 study found a correlation between hysterectomy and chronic diseases including an increased risk of cardiovascular events, cancers, depression, metabolic disorders, and dementia.

- In India, hysterectomies in women above 45 years of age were associated with hypertension, high cholesterol, diabetes and bone disease.

Hysterectomy in India:

- The average age at which hysterectomies are conducted among Indian women is 34, per community-based studies.

- In comparison, high income countries allow this procedure for women aged above 45.

- Most surgeries happen in private hospitals (33,559 procedures) as opposed to government hospitals (11, 875).

- A majority of these cases are reported among socially and economically disadvantaged women.

Challenges Associated with Hysterectomy in India:

- Wombless Women –

- Also, contractors in unorganised sectors such as the sugar-cane-cutting industry misuse hysterectomy, where ‘wombless women’ are the norm to eliminate the need for menstrual care and hygiene among workers.

- Lack of Awareness –

- The gap thrives in a culture where gynaecological care and disorders — outside of pregnancy — exist in oblivion.

- Some reports show “rasoli” — indicating a tumour or growth— is often cited as a reason for hysterectomies in medical documents.

- These may be benign growths, manageable by conducting investigative tests and undertaking alternative treatments.

What Measures has the Government Taken So Far?

- Union Health Ministry Guidelines –

- The Union Health Ministry in 2022 issued guidelines to prevent unnecessary hysterectomies — listing possible indications of when hysterectomy may be required and alternative clinical treatments for gynaecological issues.

- They recommended setting up district, State-level and national hysterectomy monitoring committees which to collect data on age, mortality, and occupations, among other details.

- In particular, the guidelines emphasise that authorities should report hysterectomies conducted for women less than 40 years of age and incorporate the reason for hysterectomy.

- All States and Union Territories were asked to adopt the Guidelines within three months and report compliance to MoHFW.

- Ayushman Bharat Pradhan Mantri Jan Arogya Yojana –

- The government’s flagship health insurance programme provides health cover of Rs. 5 lakhs for 1,949 procedures— including hysterectomies.

- The government has authorised more than 45,000 hospitals to conduct these operations and also developed two standard treatment guidelines for hysterectomy-related procedures.

- Blacklisting of Certain Hospitals –

- Under the Clinical Establishments (Registration and Regulation) Act, 2010, hospitals and healthcare facilities found to have coerced women into hysterectomies without informed consent can be blacklisted.

- The Centre told the Supreme Court that several hospitals were blacklisted and FIRs were filed against facilities that violated norms.

News Summary:

- A petition was filed in the Supreme Court w.r.t. Hysterectomy.

- The petitionerargued that despite the provisions, private hospitals in Bihar, Chhattisgarh and Rajasthan engaged in unethical practices and unnecessary procedures.

- The petitioner argued that that women from marginalised locations are at risk of unjustified hysterectomies for economic gains and exploitation.

- The Chief Justice of India, Y. Chandrachud, suggested that hysterectomies for those under 40 should be conducted on approval by two certified doctors.

- The Supreme Court, while hearing the petition, gave a three-month deadline to States and Union Territories, directing them to implement the guidelines issued by the Ministry of Health and Family Welfare in 2022.

Mains Article

30 May 2023

Why in news?

- Days before the US govt’s debt default deadline, President Biden and House Speaker McCarthy reached an agreement in principle to raise the nation’s legal debt ceiling.

What’s in today’s article?

- US debt ceiling

- News Summary

U.S. debt ceiling

- Origin of debt ceiling in US

- In 1917, Congress passed the Second Liberty Bond Act, to allow then-President to take out funds for the First World War without waiting for the approvals of absent Congress lawmakers.

- However, the Congress created a limit on borrowing, thus creating a debt ceiling that could only be raised by approval of the Congress (House and Senate).

- This ceiling was created to curtail the President’s spending capacity.

- Debt ceiling in its current form

- The debt ceiling started to take its present-day form in 1939, when separate borrowing caps for bonds were consolidated into one debt ceiling.

- At that time, it was set at $45 billion.

- The U.S. government has hit or come close to hitting the debt ceiling multiple times.

- While the government continues to receive taxation revenue after hitting the debt ceiling, it cannot borrow any more to pay its existing bills.

- The debt ceiling started to take its present-day form in 1939, when separate borrowing caps for bonds were consolidated into one debt ceiling.

Current debt ceiling crisis

- The Democrats-led US government had in January hit its debt ceiling — the amount it is legally allowed to borrow for its expenses.

- With no new money coming in, Treasury Department Secretary had warned that funds would run out by the first week of June 2023.

- Since then, the Republican-dominated House of Representatives and President Biden’s White House have failed to reach a consensus to raise or suspend the debt ceiling.

- This stalemate led to the current debt ceiling crisis in USA.

What will happen if the U.S. defaults?

- If the debt ceiling is not raised once the government reaches the ceiling and runs out of cash, the U.S. would be unable to pay its debt-holders, resulting in a default.

- Domestic payments

- In this case, the government would be unable to pay its bills including military salaries, benefits to retirees, and interest and other payments it owes to bondholders.

- Global financial crisis

- If the government cannot make interest payments to domestic and foreign investors, it could plunge the globe into a financial crisis.

- It would also increase the national debt, in turn causing widespread interest rate hikes for business owners, mortgages, and other sectors.

- A drop in U.S. consumer confidence would translate to shocks in the financial market, tipping the economy into recession.

- More than half of the world’s foreign currency reserves are held in U.S. dollars. Hence, a US default would affect the treasury markets around the world.

- A loss of confidence in the U.S. economy could force investors to sell U.S. Treasury bonds, thus weakening the dollar.

- A sudden decrease in the currency’s value could domino across treasury markets as the value of these reserves drops.

- Downgraded creditworthiness of US

- A U.S. default could lead to another downgrade of U.S. creditworthiness by agencies which in turn would raise the cost of borrowing for the government.

- Impact on economy

- It would result in large-scale job losses, weakening of the dollar, stock sell-offs.

News Summary: US debt ceiling crisis

- President Joe Biden and Republican House Speaker Kevin McCarthy agreed on a deal that can potentially avert the US debt ceiling crisis.

key points of the deal

- A cap and a raise

- Under the deal, the $31.4 trillion debt ceiling will be suspended until January 2025. Till then, the government can keep borrowing to fund itself.

- In return, the White House has agreed to cap non-defence discretionary spending at 2023 levels in 2024, and increase it by 1% the year after.

- Work requirements made stricter

- From the Democrat side, President Biden has agreed to increase work requirements for those who avail of government food stamps.

- Supplemental Nutrition Assistance Program (SNAP) benefits are commonly known as food stamps.

- Able-bodied adults between the ages of 18-49 and without dependents were subject to work requirements to maintain eligibility for SNAP benefits.

- Under the current deal, the age limit will be raised to 54.

- These requirements included actively seeking employment, participating in a suitable employment and training program, or working a minimum number of hours per month.

- From the Democrat side, President Biden has agreed to increase work requirements for those who avail of government food stamps.

- Streamlining energy projects approval

- The government has agreed to the Republican demand of a more streamlined system of approval for energy projects.

- IRS, Covid fund

- Under the deal, the outlay the Biden government had secured for beefing up the Internal Revenue System (IRS) sees a cut.

- Leftover Covid relief fund will be taken back, including that kept aside for tackling disasters.

May 29, 2023

Mains Article

29 May 2023

Context

- As the agriculture sector is highly dependent on climate,the emerging trend in climate change will have serious implications on agriculture and allied sectors.

- As India has the largest workforce (45.6 percent in 2021-22) engaged in agriculture amongst G20 countries, the impact of climate change may be disproportionate for India.

G7 Hiroshima Summit’s Agenda on Climate Change

- At the Hiroshima Summit 2023, the G7 nations stressed that the peak for global Green House Gas (GHG) emissions should be reached by 2025 and committed to an “Acceleration Agenda” for G7 countries to reach net-zero emissions by around 2040.

- The summit urged emerging economies to do so by around 2050. However, China has committed to net zero by 2060 and India by 2070.

Climate Change Reports

- WMO Report

- World Meteorological Organisation (WMO) has forecast that global near-surface temperatures are likely to increase by 1.1°Cto 1.8°C annually from 2023 to 2027.

- It also anticipates that temperatures will exceed 1.5°C above pre-industrial levels for at least one year within this period.

- IMD Report: According to the Indian Meteorological Department (IMD), India experienced its fifth hottest year on record in 2022.

Impact of Emerging Trend in Climate Change

- Glacial retreat in the Himalayas: Rising temperature and rain can cause glacial lake outburst floods. It is evident from the February 2021 incidence of glacial burst from Uttarakhand.

- Flooding, Landslides and Cyclones

- Compounding effects of sea-level rise and intense tropical cyclones lead to flooding in India's various regions. e.g., Mumbai and Konkan region (2021 flood) is prone to sea-level rise and flooding.

- Increasing cyclones (in Gujarat, Maharashtra, Odisha, and West Bengal) in the last 3-4 years are the cause of concern.

- Draughts: Droughts are expected to be more frequent in some areas, especially north-western India, Jharkhand, Orissa, and Chhattisgarh.

- Erratic monsoon

- Monsoon rain will be dominated by aerosols and internal variability, but in the long term, it will increase.

- Erratic monsoon rain caused a devastating loss in the 2021 floods in Maharashtra, Uttarakhand, and Kerala.

- Intense heat stress: Heat extremes are increasing, and marine heatwaves will continue to increase. These are likely to impact India, for example, Andhra and Telangana region are currently affected.

- Drop in Agriculture Yield: Agricultural production will be affected by 2040.According to the World Bank, climate change could push more than 100 million people into extreme poverty by 2030 by disrupting agriculture.

Challenges to Indian Agriculture Sector Due to Climate Change

- A Large Population to Feed: India has to feed the largest population (1.42billion in 2023 and 1.67 billion by 2050),it must do so while contending with the increasing uncertainty of nature.

- Nutritional Challenges: While India’s grain production (330MT in 2022-23) gives some comfort, the nutritional challenge remains.

What can Indian Policymakers do to address these challenges?

- Focus on ARDE (Agricultural Research, Development, Education and Extension).

- Research at ICRIER indicates that investing in Agri R&D yields much greater returns (11.2) compared to every rupee spent on the fertiliser subsidy (0.88), power subsidy (0.79), education (0.97), or roads (1.10).

Importance of Focusing on ARDE

- Can Improve Agricultural Production: Increased emphasis on ARDE can help achieve higher agricultural production even in the face of climate change.

- Critical for Improving Resource Use Efficiency

- ARDE is critical for improving resource use efficiency, especially for natural resources such as soil, water, and air.

- Precision agriculture, such as drip irrigation, can result in large water savings.

- Implementing sensor-based irrigation systems, for example, enables automated control, improving resource use efficiency.

- Can help develop variety of Seeds: ARDE will help in developing new seeds according to emerging trend of climate change. The development of seeds that are more heat resistant is already a reality.

- Can Help Reduce the Carbon Emissions with Higher Outputs

- Focusing on ARDE can accelerate Fertigation and development of nano-fertilisers that not only save on the fertiliser subsidy but also reduce its carbon footprint.

- Implementing innovative farming practices and products will help more efficient use of water and other natural resources, resulting in higher output with fewer inputs, while lowering GHG emissions.

- Research at the Borlaug Institute for South Asia shows that mulching (the process of applying natural or artificial layer of plant residue or other materials on the soil surface) not only contributes to higher soil organic carbon but also saves on water and reduces GHG emissions.

Allocation of ARDE by Sector

- There is a skewed distribution towards the crop husbandry sector, whose relative share has marginally increased from 75 percent to76 per cent between 2008 and2020.

- In contrast, the shares for soil, water conservation, and forestry have declined from 5 percent to 2 percent.

- The shares for animal husbandry, dairy development, and fisheries sectors have decreased from 11 percent to 8 percent, despite the value of livestock having substantially increased in the overall value of Agri-produce.

- This imbalance needs urgent correction, especially because much (54 percent) of the GHG emissions within agriculture come from the livestock sector.

What should the government do to push ARDE?

- Ensure Research Intensity (RI) to be at least 1% of AGVA (Agricultural Gross Value Added). RI is the expenditure on R&D as a percentage of GDP.

- Although, total expenditure has increased from Rs39.6 billion ($0.91 billion) Rs 163 billion ($2.2 billion) since 2005-06, the overall RI in agriculture falls short of the target of1% of the AGVA.

How can RI be kept at least 1% of AGVA?

- Scaling up innovations and experiments under ARDE is critical and that is where larger allocations of funds is required.

- India needs to almost double its budgetary allocations for ARDE.

- The Union government can reduce its fertiliser subsidy, and state governments their power subsidy, and redirect those savings to Agri-R&D, ensuring RI tobeatleast1percent.

Way Forward

- Political will: Going forward the ruling dispensation must have the political courage to bring innovative policies that ensure farmers’ incomes group.

- Realigning Policies Along with Expenditures: Along with the substantial increase in the budgets for ARDE, the government needs to realign not just expenditures but also policies (such as fertiliser subsidy, power subsidy, etc) towards meeting the climate change challenge.

Conclusion

- Livestock has been growing at more than double the rate of the cereal sector, as is horticulture. But our policies and programmes are stuck with the legacy of basic staples like rice and wheat.

- A periodic review of nutritional status across States along with a process to monitor and evaluate programmes could address systemic challenges on the ground.

Mains Article

29 May 2023

Why in News?

- An inter-agency team of UNICEF, WHO and the World Bank has released the Joint Child Malnutrition Estimates (JME) report for 2022.

What’s in Today’s Article?

- About JME Report (Purpose, Key Highlights)

- Way Forward

About Joint Child Malnutrition Estimates (JME) Report:

- JME is an annual report published jointly by UNICEF, WHO and World Bank.

- The report covers measures of child malnutrition used to track progress towards the child nutrition targets of Sustainable Development Goal 2.

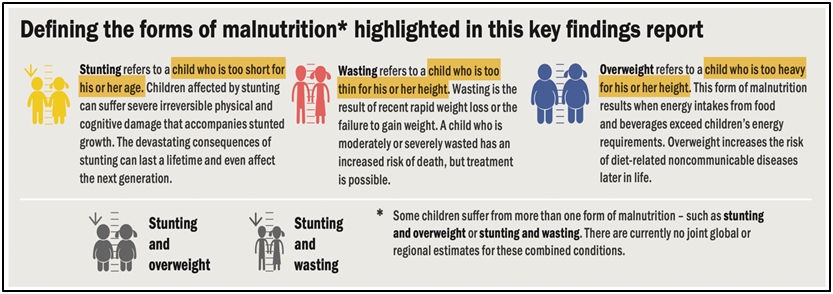

- The report covers child stunting, overweight, underweight, wasting and severe wasting.

Key Highlights of the JME Report 2022:

- Stunting –

- Child stunting refers to a child who is too short for his or her age and is the result of chronic or recurrent malnutrition.

- Globally, stunting declined from a prevalence rate of 26.3% in 2012 to 22.3% in 2022.

- India continues to show a reduction in stunting and recorded 1.6 crore fewer stunted children under five years in 2022 as compared to 2012.

- Stunting among children under five years dropped from a prevalence rate of 41.6% in 2012 to 31.7% in 2022.

- Wasting –

- Child wasting refers to a child who is too thin for his or her height and is the result of recent rapid weight loss or the failure to gain weight.

- The overall prevalence of wasting in 2022 was 18.7% in India.

- India contributes 49% of the global burden of wasting.

- In India, two-thirds of children at 12 or 24 months had wasting at birth or at one month of age. This means two-thirds of the wasting is caused by maternal malnutrition.

- Overweight –

- Childhood overweight occurs when children’s caloric intake from food

and beverages exceeds their energy requirements. - There are now 37 million children under five living with overweight globally, an increase of nearly 4 million since 2000.

- India had an overweight percentage of 2.8 per cent in 2022, compared to 2.2 per cent in 2012.

- Childhood overweight occurs when children’s caloric intake from food

Comments on India:

- Going by the JME data, UNICEF concludes that India has shown promising progress when it comes to stunting.

- According to UNICEF India officials, multi-sectoral responses under Poshan Abhiyaan in 2018 and continued Poshan 2.0 in 2022 seem to be contributing to the positive shift in the indicators.

Way Forward:

- JME released in 2023 reveal insufficient progress to reach the 2025 World Health Assembly (WHA) global nutrition targets and UN-mandated Sustainable Development Goal target 2.2.

- Only about a third of all countries are ‘on track’ to halve the number of children affected by stunting by 2030.

- All forms of malnutrition are preventable.

- To stop malnutrition before it starts, children and their families need access to nutritious diets, essential services and positive practices to set them on the path to survive and thrive.

- But today, these vital pathways to good nutrition are under growing threat, as many countries plunge deep into a global food and nutrition crisis fuelled by poverty, conflict, climate change and the COVID-19 pandemic.

- As the world responds to the crisis, urgent action is critical to protect maternal and child nutrition – especially in the most affected regions – and secure a future where the right to nutrition is a reality for every child.

Mains Article

29 May 2023

Why in News?

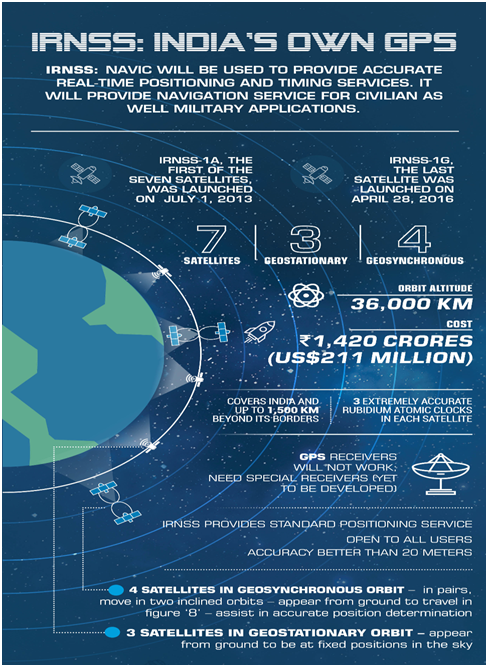

- The Indian Space Research Organisation (ISRO) will launch the first of the 2nd-generation satellites for its navigation constellation - NavIC (Navigation with Indian Constellation).

- The 2,232 kg satellite, the heaviest in the constellation, will be launched by a Geosynchronous Satellite Launch Vehicle (GSLV) rocket.

What’s in Today’s Article?

- About NavIC (Navigation with Indian Constellation)

- What is the Advantage of having a Regional Navigation System?

- Old Satellites of NavIC

- What’s New in the 2nd-Generation NavIC Satellite?

About NavIC (Navigation with Indian Constellation):

- NavIC, also known as the Indian Regional Navigation Satellite System (IRNSS), is an independent stand-alone indigenous navigation satellite system developed by the Indian Space Research Organisation (ISRO).

- NAVIC was approved in 2006 (at a cost of $174 million) and was expected to be completed by 2011, but only become operational in 2018.

- NavIC, which consists of 7 satellites, covering the whole of India's landmass and up to 1,500 km from its boundaries, is conceived with the aim of removing dependence on foreign satellite systems for navigation, particularly for "strategic sectors.".

- Currently, NavIC's application in India is limited in -

- Public vehicle tracking, for providing emergency warning alerts to fishermen venturing into the deep sea where there is no terrestrial network connectivity and

- For tracking and providing information related to natural disasters.

- The next step India is pushing for is to include it in smartphones.

- According to India's draft satellite navigation policy 2021, the government will work toward "expanding the coverage from regional to global" to ensure the availability of NavIC signals in any part of the world.

What is the Advantage of having a Regional Navigation System?

- India is the only country that has a regional satellite-based navigation system.

- There are four global satellite-based navigation systems - the American GPS, the Russian GLONASS, the European Galileo, and the Chinese Beidou.

- Japan has a four-satellite system that can augment GPS signals over the country, similar to India’s GAGAN (GPS Aided GEO Augmented Navigation).

- With fully operational NavIC (with ground stations outside India [Japan, France, and Russia] for better triangulation of signals) open signals will be accurate up to 5 metres and restricted signals will be more accurate (GPS ~20 metres).

- Unlike GPS, NavIC uses satellites in high geo-stationery orbit - the satellites move at a constant speed relative to Earth, so they are always looking over the same region on Earth.

- NavIC signals come to India at a 90-degree angle, making it easier for them to reach devices located even in congested areas, dense forests, or mountains.

Old Satellites of NavIC:

- Each of the 7 satellites currently in the IRNSS constellation, weighed much less (around 1,425 kg at liftoff) and rode the lighter Polar Satellite Launch Vehicle (PSLV) - ISRO’s workhorse launch rocket.

- The last IRNSS satellite, IRNSS-1I was launched in 2018 to replace an older, partially defunct satellite in the constellation.

- IRNSS-1I was ISRO’s 9th satellite for the NavIC constellation, but is considered to be the 8th because the IRNSS-1H launched in 2017 was lost after the heat shield of the payload failed to open on time.

What’s New in the 2nd-Generation NavIC Satellite?

- The 2nd-generation satellite named as NVS-01, the first of ISRO’s NVS series of payloads is heavier.

- The satellite will have a Rubidium atomic clock onboard, a significant technology (which only a handful of countries possess) developed indigenously by Space Application Centre-Ahmedabad.

- A satellite-based positioning system determines the location of objects by accurately measuring the time it takes for a signal to travel to and back from it using the atomic clocks on board.

- Currently, only four IRNSS satellites are able to provide location services. The other satellites can only be used for messaging services.

- The 2nd generation satellites will send signals in a third frequency, L1, besides the L5 and S frequency signals that the existing satellites provide, increasing interoperability with other satellite-based navigation systems.

- The L1 frequency is among the most commonly used in the GPS, and will increase the use of the regional navigation system in wearable devices and personal trackers that use low-power, single-frequency chips.

- The 2nd-generation satellites will also have a longer mission life of more than 12 years (existing satellites - 10 years).

Mains Article

29 May 2023

Why in news?

- In the 75th year of Independence, PM Modi inaugurated the new Parliament building, and installed the ‘Sengol’ near Lok Sabha Speaker’s chair.

What’s in today’s article?

- Old parliament building

- New Parliament building

Old parliament building

- Shift of capital from Calcutta to Delhi

- At the coronation of George V as Emperor of India on December 12, 1911, the monarch decided to transfer the seat of the Government of India from Calcutta to the ancient Capital of Delhi.

- Selection of architect and scope of their work

- In 1913, Edwin Lutyens and Herbert Baker signed on to be the architects for the Imperial City at New Delhi.

- Initially, they were asked to design President’s House and North and South Block only.

- In 1919, the British Parliament passed the Government of India Act which provided for a bicameral legislature for India.

- A new building was needed to accommodate the new houses of the Legislative Council.

- In 1913, Edwin Lutyens and Herbert Baker signed on to be the architects for the Imperial City at New Delhi.

- Construction of Parliament

- The parliament building’s construction took six years – from 1921 to 1927.

- In the 1919 plan for the construction of the Parliament, it was decided to have a council house, comprising:

- Legislative Assembly Chamber (which later became the Lok Sabha),

- Council of States Chamber (which is now the Rajya Sabha) and

- Chamber of Princes (later became Library Hall).

- Architecture

- In 1919, Lutyens and Baker settled on a circular shape for the Parliament.

- They felt it would be reminiscent of the Colosseum, the Roman historical monument.

- It is popularly believed that the circular shape of the Chausath Yogini temple at Mitawli village in Madhya Pradesh’s Morena provided inspiration for the Council House design.

- However, there is no historical evidence to back this up.

- A few Indian elements, such as jaalis (a latticed carving depicting objects like flowers and other patterns) and chhatris (a domed roof atop a pavilion-like structure) were added.

- Goal of the architecture

- The goal of the architecture was to project the strength of British imperialism and rule over India.

- Hence, both the architects agreed to highlight the superiority of European classicism, upon which Indian traditions had to be based.

- Material used

- The circular building has 144 cream sandstone pillars, each measuring 27 feet.

- Foundation and inauguration

- The foundation for the existing Parliament was laid by the Duke of Connaught on February 12, 1921.

- It was inaugurated in January 18, 1927, by then Governor General of India Lord Irwin.

- Sir Bhupendra Nath Mitra, a member of the Governor-General’s Executive Council and in charge of the Department of Industries and Labour, invited Viceroy to inaugurate the building.

What will happen to the old parliament building now?

- The building will not be demolished and will be converted into a ‘Museum of Democracy’ after the new Parliament House becomes operational.

New Parliament building

- In 2019, the central government announced the redevelopment project to give a new identity to the ‘power corridor’ of India.

- This project is known as Central Vista redevelopment project.

- The plan includes:

- the construction of a new parliament,

- Prime minister and vice-president’s residences along with 10 building blocks that will accommodate all government ministries and departments.

- Piloted by the Ministry of Housing and Urban Affairs, the plan aims to change the face of the Lutyens’ Delhi.

- Lutyens’ Delhi shows off India’s iconic buildings such as South and North blocks of Central Secretariat, Parliament House, and Rashtrapati Bhavan.

Need for new Parliament building

- Current building is 96-years-old

- As per the Ministry of Housing and Urban Affairs, the current building is 96-years-old and poses structural safety concerns.

- Narrow seating space for MPs

- The present building was never designed to accommodate a bicameral legislature for a full-fledged democracy.

- The number of Lok Sabha seats is likely to increase significantly from the current 545 after 2026, when the freeze on the total number of seats lifts.

- The Central Hall has seating capacity only for 440 persons.

- When the Joint Sessions are held, the problem of limited seats amplifies.

- Distressed infrastructure:

- The addition of services like water supply and sewer lines, fire fighting equipment, CCTV cameras, etc., have led to seepage of water at several places.

- Fire safety is a major concern at the building.

- Obsolete communication structures:

- Communications infrastructure and technology is antiquated in the existing Parliament, and the acoustics of all the halls need improvement.

- Safety concerns:

- The current Parliament building was built when Delhi was in Seismic Zone-II; currently it is in Seismic Zone-IV. This raises structural safety concerns.

Main features of the new building

- Built-up area of about 65,000 sq m, triangular in shape, and incorporates architectural styles from around India;

- Lok Sabha hall with a capacity of up to 888 seats, and Rajya Sabha hall with a capacity of upto 384 seats;

- The Lok Sabha may accommodate up to 1,272 seats for joint sessions of Parliament.

- The Lok Sabha hall is based on the peacock theme, India’s national bird. The Rajya Sabha is based on the lotus theme, India’s national flower.

- A “Platinum-rated Green Building”, the new Sansad Bhavan will embody India’s commitment towards environmental sustainability.

- The new Parliament is divyang friendly where people with disabilities will be able to move around freely.

Mains Article

29 May 2023

Why in news?

- To mark the inauguration of the new Parliament building, Prime Minister Narendra Modi released a commemorative coin of Rs 75 denomination.

- India has been issuing commemorative coins for several reasons such as paying homage to notable personalities, spreading awareness about government schemes, or remembering key historic events.

- The country released its first commemorative coin in 1964 in honour of Jawaharlal Nehru, who had passed away that year.

What’s in today’s article?

- Minting of coin

- Commemorative coin

- News Summary

Minting of coins

- The government has the power to design and mint coins in various denominations. It has been given this right under the Coinage Act, 2011.

- The government decides on the quantity of coins to be minted on the basis of indents received from the RBI on a yearly basis.

- The role of the RBI is limited to the distribution of coins that are supplied by the central government.

- Coins are minted in four mints owned by the Government of India in Mumbai, Hyderabad, Kolkata and Noida.

Printing of currency

- Two of India’s currency note printing presses are in Nasik and Dewas. These are owned by the Government of India.

- Two other printing presses are in Mysore and Salboni. These are owned by the RBI through its wholly owned subsidiary, Bharatiya Reserve Bank Note Mudran Ltd (BRBNML).

Commemorative coin

- About

- A commemorative coin is a special coin issued to honor and celebrate a particular event, person, or significant milestone.

- These Coins are distinct from regular circulation coins in that they are not intended for everyday transactions but rather serve as collectible items or gifts. These coins are primarily meant for numismatic purposes.

- Minting

- The Government, through the Ministry of Finance, authorizes the issuance of commemorative coins to mark various occasions of national importance.