April 30, 2022

Mains Article

30 Apr 2022

In News:

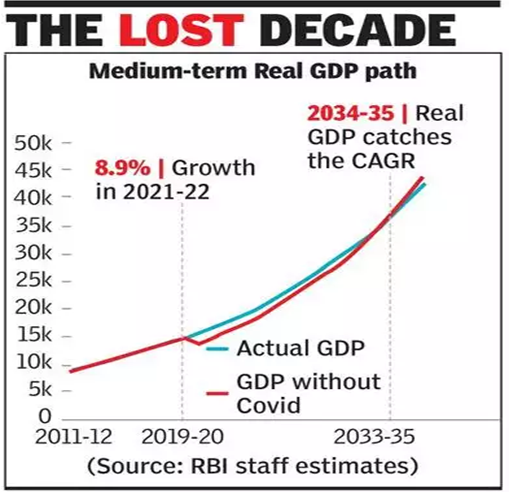

- According to a recent report - Scars of the pandemic - published by the Reserve Bank of India (RBI), the Indian economy is expected to overcome losses arising out of the pandemic (that hit the country in March 2020) only by 2034-35.

- It is RBI’s first detailed analysis of the impact of the pandemic, included in its annual publication on currency and finance.

What’s in today’s article: Highlights of the Report

Highlights of the Report:

- Output losses during pandemic: The output losses for individual years have been calculated to be Rs 19.1 lakh crore, Rs 17.1 lakh crore and Rs 16.4 lakh crore for 2020-21, 2021-22, and 2022-23, respectively (adding up to Rs 52.6 lakh crore).

- Reasons for the loss:

- Stringency of the lockdown as the most cited reason.

- As per the WHO data, India, with 8.5% of the total cumulative Covid cases, ranked second after the US with 15.8% of cases.

- Stringency of the lockdown as the most cited reason.

- Time needed to recover: Taking the actual growth rate of (-) 6.6% for 2020-21, 8.9% for 2021-22 and assuming growth rate of 7.2% for 2022-23 and 7.5% beyond that, India is likely to take another 13 years (by 2034-35) to overcome the losses incurred due to the Covid pandemic.

- The blueprint of reforms:

- Revive and reconstruct: It revolves around seven wheels of economic progress -

- Aggregate demand,

- Aggregate supply,

- Institutions, intermediaries and markets,

- Macroeconomic stability and policy coordination

- Productivity and technological progress

- Structural change

- Sustainability

- Aggregate demand,

- Suggested structural reforms: It includes

- Enhancing access to litigation free low-cost land.

- Raising the quality of labour through public expenditure on education and health and the Skill India Mission.

- Scaling up R&D activities with an emphasis on innovation and technology.

- Creating an enabling environment for start-ups and unicorns.

- Rationalisation of subsidies that promote inefficiencies.

- Encouraging urban agglomerations by improving the housing and physical infrastructure.

- A policy ecosystem for Industrial revolution 4.0 and committed transition to a net-zero emission target.

- Enhancing access to litigation free low-cost land.

- Reforming banking system:

- Capital infusion should not become a substitute for better governance and risk controls.

- The Public Sector Banks (PSBs) should not be dependent on the government for recapitalisation.

- This will be an important precondition to achieve greater privatisation of the sector.

- To increase the competition in the banking sector and to introduce innovation, the RBI’s ‘on tap’ licensing policy for universal and small finance banks may be used effectively.

- Capital infusion should not become a substitute for better governance and risk controls.

- Preconditions for these reforms:

- A feasible range of GDP growth in India (6.5 - 8.5%). Reducing general government debt to below 66% of GDP over the next five years is important to secure India’s medium-term growth prospects.

- Timely rebalancing of monetary and fiscal policies.

- Price stability.

- A feasible range of GDP growth in India (6.5 - 8.5%). Reducing general government debt to below 66% of GDP over the next five years is important to secure India’s medium-term growth prospects.

- How are other countries handling the situation?

- No-Covid policy in China, Hong Kong and Bhutan.

- Relatively open borders and removal of internal restrictions in Denmark and the UK.

- No-Covid policy in China, Hong Kong and Bhutan.

- Challenges ahead:

- The pandemic is not yet over: A fresh wave of Covid has hit China, South Korea and several parts of Europe.

- Ongoing Russia-Ukraine conflict: Exacerbated dangers to global and domestic growth as a result of rise in commodity prices and global supply chain disruptions.

- The pandemic is not yet over: A fresh wave of Covid has hit China, South Korea and several parts of Europe.

- Way ahead for India:

- The capital expenditure push in the next Budget can help achieve sustainable high growth.

- This will also enhance productive capacity, crowding in private investment and strengthening aggregate demand.

- The capital expenditure push in the next Budget can help achieve sustainable high growth.

- Revive and reconstruct: It revolves around seven wheels of economic progress -

Mains Article

30 Apr 2022

In News:

- The Reserve Bank of India (RBI) has raised concerns about bank consolidation, stating that it increases the market power of merged institutions and adversely affects financial inclusion.

What’s in today’s article:

- About Bank Consolidation (Meaning, Advantages, Disadvantages, etc.)

- News Summary (RBI on bank consolidation)

What is Bank Consolidation?

- Bank consolidation is the process by which one banking company takes over or merges with another.

- This convergence leads to a potential expansion for the consolidating banking institution.

Who Recommended Bank Consolidation in India?

- M Narasimham, the 13th Governor of RBI, in his report, known as Narasimham Committee Report, in 1991 first recommended a three-tier banking structure in India:

- Three or four large banks (including State Bank of India) could become international in character.

- Eight to ten national banks with a network of branches throughout the country, engaged in Universal banking.

- Local banks should concentrate on region specific banking.

- For example, Regional Rural Banks (RRBs) should focus on agriculture and rural financing.

- For example, Regional Rural Banks (RRBs) should focus on agriculture and rural financing.

- Three or four large banks (including State Bank of India) could become international in character.

Potential Advantages of Bank Consolidation:

- Become Globally Competitive:

- As the banking system goes to following global guidelines of Basel III Norms, such mergers will enable banks to be able to face competition.

- As of now, no Indian bank counts in the list of G-SIBs (Globally Systemically Important Banks).

- Consolidation of banks will consequently form a few strong banks to form a pillar of the economy.

- As the banking system goes to following global guidelines of Basel III Norms, such mergers will enable banks to be able to face competition.

- Addressing the challenge of Non-Performing Assets (NPAs):

- With increasing stress in the banking sector from NPAs, small banks and NBFCs are not in the potential to lend more loans.

- Post-merger, big banks can better deal with non-performing assets and may not have to stop giving more loans.

- With increasing stress in the banking sector from NPAs, small banks and NBFCs are not in the potential to lend more loans.

- Improved Efficiency:

- With multiple banks opening in some regions, there is some inefficiency in the economy in terms of the duplicity of work and physical capital.

- It can be combated with mergers, thereby, creating economies of scale in operations.

- With multiple banks opening in some regions, there is some inefficiency in the economy in terms of the duplicity of work and physical capital.

- Boosts Investor Confidence:

- In terms of investment flows, investor confidence for strong banks is likely to be higher than that of weak ones.

- The paucity of investments is a current issue faced by medium and weak banks.

- Strong banks have the bandwidth to attract investments.

- In terms of investment flows, investor confidence for strong banks is likely to be higher than that of weak ones.

Potential Disadvantages of Consolidation:

- HR related issues:

- Smooth integration of operations always poses a risk, especially with the prospect of resistance from staff and unions in the entities being merged.

- There are issues like cultural fit, redeployment of staff, and fewer career opportunities for many in a merged entity.

- Smooth integration of operations always poses a risk, especially with the prospect of resistance from staff and unions in the entities being merged.

- Fewer options for customers:

- It could also reflect in fewer options for customers; an easing of the personal touch which many of the midsize and smaller banks have.

- Another concern could be deterioration of services and disruption in the near term as the merger process gets under way.

- It could also reflect in fewer options for customers; an easing of the personal touch which many of the midsize and smaller banks have.

- Too big to fail:

- Yet another worry is the possible creation of what is known as systematically important institutions, or those too big to fail, leading to the prospect of bailouts in the future, which could hurt the government and financial stability.

- Yet another worry is the possible creation of what is known as systematically important institutions, or those too big to fail, leading to the prospect of bailouts in the future, which could hurt the government and financial stability.

- The swelling of combined bad loans with some of these mergers is also an issue.

Can Consolidation alone make a difference to the state of Indian banks?

- Governance of these banks has been an major issue, which has dragged down many.

- Former RBI Governor Y V Reddy, in his D T Lakdawala memorial lecture, had said that the idea of consolidation of banks will solve the problem of public sector banks is not correct.

- According to him, if the problem is structural and of governance, it does not matter whether the banks are large or small.

News Summary:

- Recently, the Reserve Bank of India (RBI) released a report titled ‘Currency and Finance’ (RCF) for the year 2021-22.

- In the report, the RBI has raised concerns about bank consolidation, stating that it increases the market power of merged institutions and adversely affects financial inclusion.

What did the report say?

- According to the report, consolidation could result in less competition by giving fewer choices to the customer and may also result in the non-competitive pricing of products.

- Mergers helped strengthen the capital buffers of banks, but it is difficult to isolate the impact of mergers from other forces acting concomitantly.

- Referring to the mega consolidation among public sector banks (PSBs) where 10 merged into four, the RBI said that factors like government ownership, similar pay structure for staff and common core banking solutions made the merger process simpler.

- In April 2020, 10 Public Sector Banks were amalgamated into 4 banks.

- In April 2020, 10 Public Sector Banks were amalgamated into 4 banks.

- Noting that the government has infused in Rs 2.9 lakh crore in the last five years into public sector banks, the RBI said this has helped the PSBs improve their capital adequacy ratio to 14.3% in December 2021 from 11.8% in March 2016.

- However, the RBI has cautioned that the capital infusion should not become a substitute for better governance and risk controls.

Mains Article

30 Apr 2022

In News:

- An energy crisis is emerging across India, as low coal supplies across the majority of thermal power plants have triggered blackouts in several urban and rural areas.

- The situation has become worse by the fact that domestic demand for power has increased manifold as a result of an abnormally early and record-breaking heatwave and dry weather.

What’s in today’s article:

- Distribution of coal reserves across India (Classification of coal, coal reserves in India)

- The statistics related to power in India

- The phenomenon of heatwave

- News Summary

Distribution of Coal reserves across India:

- Classification of Coal (on the basis of carbon content and time period):

- On the basis of carbon content:

- Anthracite (80 - 95% carbon content, found in small quantities in J&K).

- Bituminous (60 - 80% of carbon content and is found in Jharkhand, West Bengal, Odisha, Chhattisgarh and Madhya Pradesh).

- Lignite (40-55% carbon content, high moisture content and is found in Rajasthan, Lakhimpur (Assam) and Tamil Nadu).

- Peat (less than 40% carbon content and it is in the first stage of transformation from organic matter (wood) to coal).

- Anthracite (80 - 95% carbon content, found in small quantities in J&K).

- On the basis of a time period:

- Gondwana coal (around 98% of India's total coal reserves). This coal was formed about 250 million years ago.

- Tertiary coal- is of younger age. It was formed from 15 to 60 million years ago.

- Gondwana coal (around 98% of India's total coal reserves). This coal was formed about 250 million years ago.

- On the basis of carbon content:

- Coal reserves in India (State-wise):

- Jharkhand:

- With estimated 83.15 billion tonnes of reserves which is more than 26% of India’s total reserves, Jharkhand ranks first.

- The state’s main coal-mining centres are Jharia (India’s oldest and richest coalfield), Bokaro, Auranga, Giridh, Dhanbad, Ramgarh, Karanpur and Hutar.

- With estimated 83.15 billion tonnes of reserves which is more than 26% of India’s total reserves, Jharkhand ranks first.

- Odisha: Second on the list for coal reserves is the state of Odisha (over 24% of the country’s total reserves and about 15% of India’s total coal production). Talchar is Odisha's biggest coalfield.

- Chattisgarh: Chhattisgarh has the third largest coal reserve in India and carries about 17% of the total coal reserves. However, the state has the first rank in the production of coal. Coalfields of the state include Korba, Hasdo-Arand, Chirmiri, Jhimli, and Johilla.

- Others are West Bengal (about 11% of the total coal reserves of India), Madhya Pradesh (about 8%), Andhra Pradesh (7%), Maharashtra, Rajasthan, Gujarat, Tamil Nadu, Jammu and Kashmir.

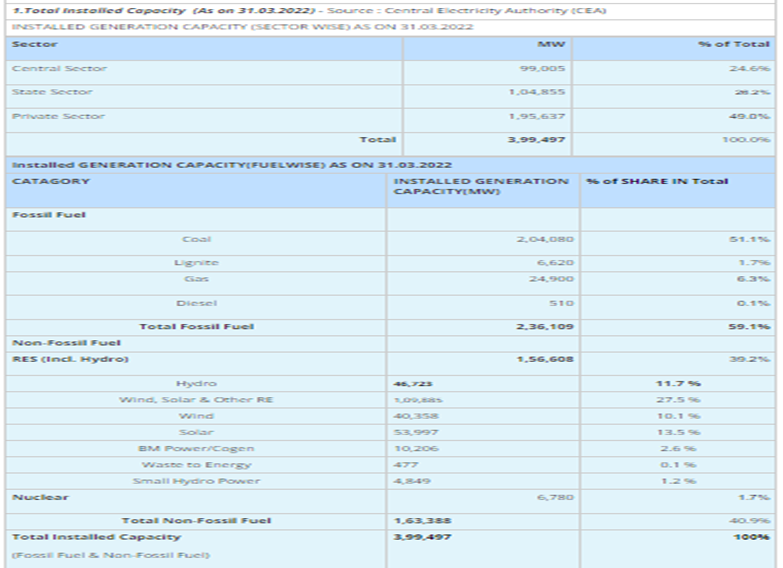

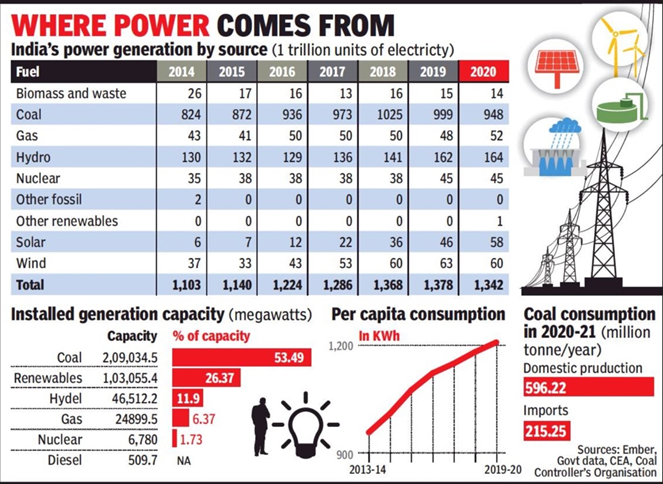

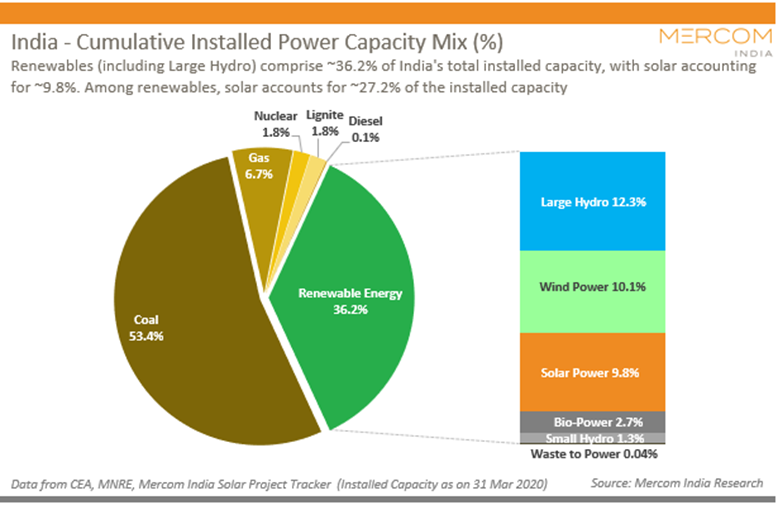

The statistics related to power in India:

Heat wave:

- About the phenomenon:

- Qualitatively, a heat wave is a condition of air temperature which becomes fatal to the human body when exposed.

- Quantitatively, it is defined based on the temperature thresholds over a region in terms of actual temperature or its departure from normal.

- Qualitatively, a heat wave is a condition of air temperature which becomes fatal to the human body when exposed.

- Criteria for declaring heat waves:

- Heat wave is considered if the maximum temperature of a station reaches at least 40 degrees Celsius or more for Plains and at least 30 degree Celsius or more for Hilly regions.

- Based on Departure from Normal:

- Heat Wave: Departure from normal is 4.5 - 6.4 degree Celsius.

- Severe Heat Wave: Departure from normal is > 6.4 degree Celsius.

- Heat Wave: Departure from normal is 4.5 - 6.4 degree Celsius.

- Based on Actual Maximum Temperature:

- Heat Wave: When actual maximum temperature ≥ 45 degree Celsius.

- Severe Heat Wave: When actual maximum temperature ≥ 47 degree Celsius.

- Heat Wave: When actual maximum temperature ≥ 45 degree Celsius.

- Criteria for coastal stations: When maximum temperature departure is 4.5 degree Celsius or more from normal, Heat Wave may be described provided actual maximum temperature is 37 degree Celsius or more.

- How does the India Meteorological Department (IMD) monitor the Heat wave?

- IMD has a big network of surface observatories to measure various meteorological parameters like Temperature, Relative humidity, pressure, wind speed and direction

- Based on daily maximum temperature station data, IMD declares a heat wave over the region as per its definition.

- IMD has a big network of surface observatories to measure various meteorological parameters like Temperature, Relative humidity, pressure, wind speed and direction

- Based on Departure from Normal:

- Heat wave is considered if the maximum temperature of a station reaches at least 40 degrees Celsius or more for Plains and at least 30 degree Celsius or more for Hilly regions.

News Summary

- According to the Ministry of Power, the peak power demand in the country touched an all-time high of 207,111 MW recently, amid a severe heatwave spell across India, the hottest since 1901 (when records first started being kept).

- However, electricity production has declined as coal supplies have become critically low in many states that rely largely on coal-fired plants for power generation, including Haryana, Bihar, Jharkhand, Rajasthan, Madhya Pradesh, Gujarat, etc.

- The dry weather exacerbated the problems by depleting river water levels, reducing hydropower production.

- As the shortages fuelled fears of major blackouts, many governments implemented methods such as selective power cuts in rural areas to meet demand in urban and industrial areas.

Mains Article

30 Apr 2022

In News:

- Indian Administrative Service (IAS) officer Shah Faesal, who resigned from the service in 2019, has recently been reinstated.

- Shah Faesal’s resignation, in January 2019, had not been accepted by the Central government pending investigation into some of his posts on social media.

What’s in today’s article:

- Rules for IAS Officer’s Resignation (Resignation v/s VRS, Concerned authority, Accept/Reject the resignation, Withdrawal of resignation, etc.)

- News Summary

What rules apply when an IAS officer chooses to resign?

- A resignation is a formal intimation in writing by an officer of his/her intention or a proposal to leave the IAS, either immediately or at a specified date in the future.

- Guidelines of the Department of Personnel and Training (DoPT) say that a resignation has to be clear and unconditional.

- DoPT is the cadre controlling department for the IAS.

- DoPT is the cadre controlling department for the IAS.

- The resignation of an officer of any of the three All-India Services — IAS, the Indian Police Service (IPS) and Indian Forest Service — is governed by the All India Services (Death-cum-Retirement Benefits) Rules, 1958.

Difference between Resignation & VRS:

- Resignation from service is entirely different from accepting the government’s Voluntary Retirement Scheme (VRS).

- Those who take VRS are entitled to pension and other benefits, whereas those who resign are not.

- Rule 5 of the DCRB Rules says, “No retirement benefits may be granted to a person who has been dismissed or removed from the Service or who has resigned from the Service.”

To whom must the resignation of an IAS officer be submitted?

- An officer serving in a cadre (state) must submit his/her resignation to the chief secretary of the state.

- An officer who is on central deputation is required to submit his/her resignation to the secretary of the concerned Ministry or Department.

- The Ministry/Department then forwards the officer’s resignation to the concerned state cadre, along with its comments or recommendations.

What happens after the resignation is submitted?

- The state checks to see if any dues are outstanding against the officer, as well as the vigilance status of the officer or whether any cases of corruption etc. are pending against him/her.

- In case there is such a case, the resignation is normally rejected.

- In case there is such a case, the resignation is normally rejected.

- Before forwarding the resignation to the central government, the concerned state is supposed to send information on the issues of dues and vigilance status, along with its recommendation.

- The resignation of the officer is considered by the competent authority, i.e., the central government, only after the recommendation of the concerned cadre has been received.

- The competent authorities are:

- For IAS - Minister of State at the Department of Personnel & Training (DoPT),

- For IPS - Minister for Home Affairs, and

- For IFoS - the Minister for Environment, Forest and Climate Change in respect of the Forest Service.

- For IAS - Minister of State at the Department of Personnel & Training (DoPT),

On what grounds a resignation is accepted or rejected?

- The general rule is that the resignation of an officer should be accepted — except in certain circumstances.

- In some cases, resignations have been rejected because disciplinary cases were pending against officers. In such cases, concurrence of the Central Vigilance Commission (CVC) is obtained.

- The government also checks whether the concerned officer had executed any bond to serve the government for a specified number of years on account of having received specialised training, a fellowship, or scholarship for studies.

Can an Officer withdraw a resignation that has already been submitted?

- Rule 5(1A)(i) of the amended DCRB Rules says the central government may permit an officer to withdraw his/her resignation “in the public interest”.

- The guidelines say that if an officer who has submitted his/her resignation sends an intimation in writing withdrawing it before its acceptance by the competent authority, the resignation will be deemed to have been automatically withdrawn.

News Summary:

- IAS officer Shah Faesal, who hails from Jammu & Kashmir, resigned on January 9, 2019, but his resignation was not processed.

- However, he had applied for withdrawal of his resignation later on.

- The Home Ministry, which is the cadre controlling authority for the Arunachal Pradesh-Goa-Mizoram and Union Territory (AGMUT) cadre, had asked for an opinion of the Jammu and Kashmir administration about his plea for withdrawal of resignation.

- After getting reports from all quarters besides the DoPT, it was decided to accept his plea and was subsequently reinstated earlier this month.

- Since his resignation itself was not accepted, his request for the withdrawal of resignation was accepted.

April 29, 2022

Mains Article

29 Apr 2022

In News:

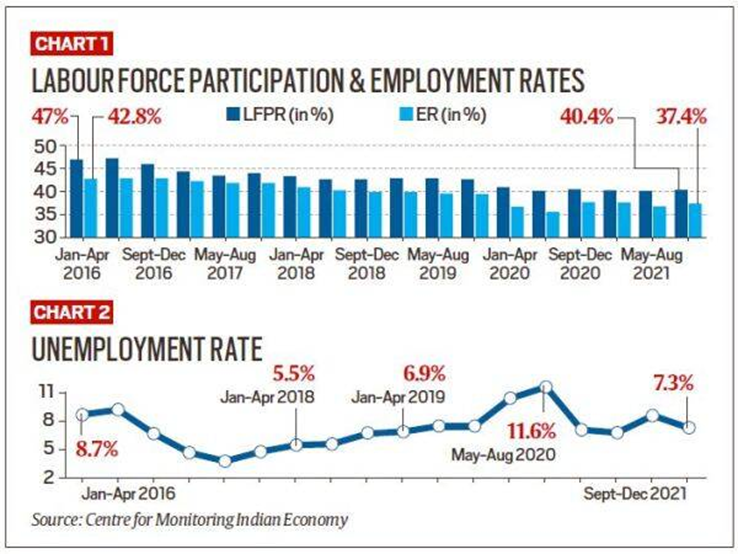

- Data from the Centre for Monitoring Indian Economy (CMIE) shows that India’s labour force participation rate (LFPR) has fallen to just 40% from an already low 47% in 2016.

- This suggests not only that more than half of India’s population in the working-age group (15 years and older) is deciding to sit out of the job market, but also that this proportion of people is increasing.

What’s in today’s article:

- About LFPR (Meaning, Formula, Significance, Under-reporting, Why is it low, etc.)

- Reasons for low female LFPR in India

- Central government’s response to CMIE report

What is LFPR?

- According to the CMIE, the labour force consists of persons who are of age 15 years or older, and belong to either of the following two categories:

- Employed

- Unemployed and are willing to work and are actively looking for a job

- Employed

- There is a crucial commonality between the two categories — they both have people “demanding” jobs. This demand is what Labour Force Participation Rate (LFPR) refers to.

- While those in category 1 succeed in getting a job, those in category 2 fail to do so.

- Essentially, LFPR is the number of people ages 15 and older who are employed or actively seeking employment, divided by the total non-institutionalized, civilian working-age population.

- LFPR represents the demand for jobs in an economy.

- LFPR represents the demand for jobs in an economy.

- On the other hand, Unemployment Rate (UER), which is routinely quoted in the news, is nothing but the number of unemployed (category 2) as a proportion of the labour force.

Significance of LFPR in India:

- Typically, it is expected that the LFPR will remain largely stable.

- As such, any analysis of unemployment in an economy can be done just by looking at the UER. But, in India, the LFPR is not only lower than in the rest of the world but also falling.

- This, in turn, affects the UER because LFPR is the base (the denominator) on which UER is calculated.

- The world over, LFPR is around 60%. In India, it has been sliding over the last 10 years and has shrunk from 47% in 2016 to just 40% as of December 2021.

- This shrinkage implies that merely looking at UER will under-report the stress of unemployment in India.

How is it under-reported?

- Imagine that there are just 100 people in the working-age group but only 60 ask for jobs — that is, the LFPR is 60% — and of these 60 people, 6 did not get a job.

- This would imply a UER of 10%.

- This would imply a UER of 10%.

- Now imagine a scenario when the LFPR has fallen to 40% and, as such, only 40 people are demanding work. And of these 40, only 2 people fail to get a job.

- The UER would have fallen to 5% and it might appear that the economy is doing better on the jobs front but the truth is starkly different.

- The UER would have fallen to 5% and it might appear that the economy is doing better on the jobs front but the truth is starkly different.

- The truth is that beyond the 2 who are unemployed, a total of 20 people have stopped demanding work. Typically, this happens when people in the working-age get disheartened from not finding work.

- In India’s case, every time the LFPR falls, the UER also falls — because fewer people are now demanding jobs — giving the incorrect impression to policymakers that the situation has improved.

What is the correct way to assess India’s Unemployment Stress?

- When LFPR is falling as steadily and as sharply as it has done in India’s case, it is better to track another variable: the Employment Rate (ER).

- The ER refers to the total number of employed people as a percentage of the working-age population.

- The ER refers to the total number of employed people as a percentage of the working-age population.

- By using the working-age population as the base and looking at the number of people with jobs (instead of those without them), the ER captures the fall in LFPR to better represent the stress in the labour market.

- In December 2021, India had 107.9 crore people in the working age group and of these, only 40.4 crore had a job (an ER of 37.4%).

- Compare this with December 2016 when India had 95.9 crore in the working-age group and 41.2 crore with jobs (ER 43%).

- Compare this with December 2016 when India had 95.9 crore in the working-age group and 41.2 crore with jobs (ER 43%).

- In five years, while the total working-age population has gone up by 12 crore, the number of people with jobs has gone down by 80 lakh.

Why is India’s LFPR Low?

- The main reason for India’s LFPR being low is the abysmally low level of female LFPR.

- According to CMIE data, as of December 2021, while the male LFPR was 67.4%, the female LFPR was as low as 9.4%.

Reasons for the fall in women’s LFPR in India:

- Occupational Segregation:

- Between 1977 and 2017, India’s economy witnessed a surge in the contribution of services (39 percent to 53 percent) and industry (33 percent to 27 percent) to GDP.

- The proportion of rural men employed in agriculture fell from 80.6 percent to 53.2 percent, but rural women only decreased from 88.1 percent to 71.7 percent.

- Between 1994-2010, women received less than 19 percent of new employment opportunities generated in India’s 10 fastest-growing occupations.

- Between 1977 and 2017, India’s economy witnessed a surge in the contribution of services (39 percent to 53 percent) and industry (33 percent to 27 percent) to GDP.

- Increased Mechanisation:

- In agriculture, as the use of seed drillers, harvesters, threshers and husking equipment increased, men displaced women.

- In textiles, power looms, button stitching machines and textile machinery phased out women’s labour.

- Nearly 12 million Indian women could lose their jobs by 2030 owing to automation, according to a McKinsey Global Institute report.

- In agriculture, as the use of seed drillers, harvesters, threshers and husking equipment increased, men displaced women.

- Income Effect:

- With increasing household incomes, especially over the last three decades, the need for a “second income” reduced.

- Consequently, families withdrew women from labour as a signal of prosperity.

- This “income effect” can explain approximately 9 percent of the total decline in the female labour force participation rate between 2005 to 2010.

- With increasing household incomes, especially over the last three decades, the need for a “second income” reduced.

- Gender gaps in Higher Education & Skill Training:

- Tertiary-level female enrolment rose from 2 percent in 1971 to only 30 percent in 2019 (World Bank data).

- As of 2018-19, only 2 percent of working-age women received formal vocational training, of which 47 percent did not join the labour force (NSSO, 2018-19).

- Consequently, women holds only 17 percent of cloud computing, 20 percent of engineering, and 24 percent of data/artificial intelligence jobs (WEF, 2020).

- Tertiary-level female enrolment rose from 2 percent in 1971 to only 30 percent in 2019 (World Bank data).

- Social Norms:

- Unpaid care work continues to be a women’s responsibility, with women spending on average five hours per day on domestic work, vs. 30 minutes for men (NSSO, 2019).

- Women face inordinate mobility restrictions such that only 54 percent can go to a nearby market alone (NFHS, 2015-16).

- Women regularly sacrifice wages, career progression, and education opportunities to meet family responsibilities, safety considerations, and other restrictions.

- Unpaid care work continues to be a women’s responsibility, with women spending on average five hours per day on domestic work, vs. 30 minutes for men (NSSO, 2019).

Way Forward:

- To chart a gender-sensitive socio-economic recovery post-COVID-19, the government, the private sector, media, and the social sector need to work together to:

- Improve working conditions,

- Reduce wage gaps,

- Increase opportunities for women across sectors, and change mindsets.

- Improve working conditions,

- State governments may establish gender-based employment targets for urban public works.

- Central or state governments can consider introducing wage subsidies to incentivise hiring women in micro, small and medium enterprises.

Government’s Response to CMIE’s Findings:

- Responding to the report, the Union Labour and Employment Ministry said it was “factually incorrect” to infer that half the working age population had dropped out of the labour force as a large proportion was pursuing education or engaged in unpaid activities such as caregiving.

- According to the Education Ministry, more than 10 crore people were enrolled in secondary, higher secondary, higher or technical education in 2019-2020 and 49% of that was women.

- Fall in Unemployment Rate:

- It added that the Ministry of Statistics and Programme Implementation’s Periodic Labour Force Survey had shown an increase in the labour force participation rate.

- The LFPR increased from 49.8% in 2017-2018 to 53.5% in 2019-2020 and a decrease of unemployment rate from 6% to 4.8%.

- It said the Economic Survey 2021-2022 had indicated an increase of 4.75 crore in employment in 2019-2020 from 2018-2019.

- It added that the Ministry of Statistics and Programme Implementation’s Periodic Labour Force Survey had shown an increase in the labour force participation rate.

Mains Article

29 Apr 2022

In News:

- Union Minister of Communications, Shri Ashwini Vaishnaw, recently said that the commercial rollout of 5G services could be expected from August-September 2022 onwards.

What’s in today’s article:

- Evolution of Wireless Tech (Journey from 1G to 5G Network)

- Advantages of 5G Technology (Low latency, high speed, etc.)

- Challenges of 5G rollout in India (Major Telecom reforms introduced in 2021)

- News Summary

Evolution of Wireless Technology:

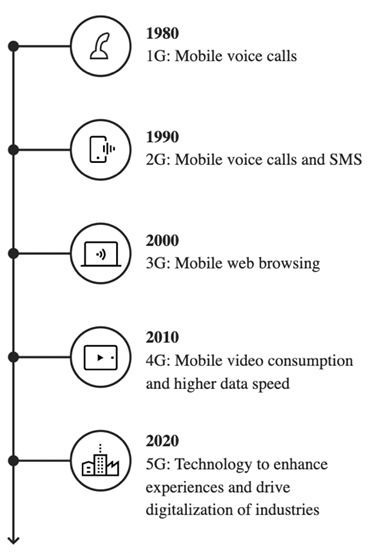

- 5G is the fifth generation of wireless technology.

- To understand 5G, it is important to understand what came before it.

- To understand 5G, it is important to understand what came before it.

- Broadly, the first generation of mobile technology, 1G, was about voice – the ability to use a phone in a car.

- The advent of 2G introduced a short-messaging service.

- 3G technology provided the core network speeds needed to launch smartphones.

- 4G, with its high data-transfer rates, gave videos with minimal buffering and gave rise to many of the connected devices and services.

Advantages of 5G Technology:

- Greater Speed in Transmissions:

- Speed in transmissions can approach 15 or 20 GBPS (Gigabytes Per Second).

- In comparison, 4G offers maximum real-world download speeds up to around 100 MBPS.

- Speed in transmissions can approach 15 or 20 GBPS (Gigabytes Per Second).

- Lower Latency:

- Latency is the time that elapses since we give an order on our device until the action occurs.

- In 5G the latency will be ten times less than in 4G, being able to perform remote actions in real time.

- Latency is the time that elapses since we give an order on our device until the action occurs.

- Greater Number of Connected Devices:

- All connected devices will have access to instant connections to the internet, which in real time will exchange information with each other. This will favour the IOT (Internet of Things).

- The Internet of Things describes the network of physical objects—“things”—that are embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the internet.

- It is anticipated that a common home will have a hundred connected devices sending and receiving information in real time.

- The Internet of Things describes the network of physical objects—“things”—that are embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the internet.

- All connected devices will have access to instant connections to the internet, which in real time will exchange information with each other. This will favour the IOT (Internet of Things).

Challenges for 5G Roll-out in India:

- Procedural Delays:

- India’s telecom sector is greatly affected by the procedural delays and their multiple issues.

- Companies who faced loss in 2G spectrum scam have clearly left a lesson for other telecom companies sceptical about investing in India in any future telecom projects.

- 5G implementation in India will not be a reality until there is a dedicated regulatory body which will develop the roadmap for 5G in India.

- India’s telecom sector is greatly affected by the procedural delays and their multiple issues.

- Affordability of Spectrum:

- Many countries around the world may already roll out 5G connectivity to its users but, in India, the 5G spectrum is yet to be allocated.

- The country’s 5G ecosystem is underdeveloped and has yet to be matured.

- The cost of the spectrum is exorbitant and inappropriate for telecom companies, that is why India’s debt-ridden operators are still reeling under the pressure to keep existing 4G network costs low.

- Many countries around the world may already roll out 5G connectivity to its users but, in India, the 5G spectrum is yet to be allocated.

- Last-mile Connectivity:

- Catering to last-mile broadband connectivity in Tier-II, Tier-III cities and rural homes are challenging since India lacks optical fiber infrastructure and Greenfield deployment which has immensely affected last-mile connectivity.

- Under BharatNet Project of the Union government, the plan is to connect all 2.5 lakh gram panchayats across the country to broadband internet.

- However, as of February 2022, only about 1.72 lakh of the initially targeted 2.5 lakh gram panchayats had been connected to the central grid under the project.

- Catering to last-mile broadband connectivity in Tier-II, Tier-III cities and rural homes are challenging since India lacks optical fiber infrastructure and Greenfield deployment which has immensely affected last-mile connectivity.

- Affordable 5G Devices:

- On the consumer front, affordable 5G devices are yet to take their place in the market.

- The biggest roadblock in India’s 5G electronics manufacturing industry is that it lacks the world-class ‘semiconductor fabricating unit’ which is the notable denominator for device affordability.

- On the consumer front, affordable 5G devices are yet to take their place in the market.

- Network & Security Privacy:

- Even in the early 80s era, 1G networks saw wireless channels for illegal cloning and masquerading.

- As networks and applications evolve further, threats such as semantic information (info which is in some sense meaningful to the user’s system) attacks often target the location data of users.

- On the other hand, data collection is another major concern for 5G users as practically all mobile applications demand user’s personal information during or before installation.

- Even in the early 80s era, 1G networks saw wireless channels for illegal cloning and masquerading.

Recent Telecom Reforms:

- In September 2021, the Union Cabinet approved a set of structural and procedural reforms to address the short-term liquidity needs as well as long-term issues of telecom companies. Major reforms that have been announced are:

- AGR (Adjusted Gross Revenue):

- AGR definition rationalised and, unlike earlier, non-telecom revenue will be excluded.

- AGR definition rationalised and, unlike earlier, non-telecom revenue will be excluded.

- Moratorium on Dues:

- A much needed moratorium has been announced on statutory dues of the telecom sector for four years.

- This will improve the cash flow which can be used in more productive areas.

- A much needed moratorium has been announced on statutory dues of the telecom sector for four years.

- Spectrum Usage Charges:

- Spectrum usage charges will be rationalized and there will be now an annual compounding of rates rather than a monthly one.

- Penalty on payment of licence fees, spectrum user charges and all kinds of charges have been completely scrapped.

- Spectrum usage charges will be rationalized and there will be now an annual compounding of rates rather than a monthly one.

- Foreign Direct Investment:

- In a major boost for the sector, the government has increased the FDI in the sector under automatic route from 49% to 100%.

- In a major boost for the sector, the government has increased the FDI in the sector under automatic route from 49% to 100%.

- Licence Raj scrapped:

- Customs notification of 1953 has been done away with. It will allow telecom operators to easily import equipment.

- Customs notification of 1953 has been done away with. It will allow telecom operators to easily import equipment.

- Spectrum sharing:

- Spectrum sharing has been allowed; telecom operator can share where they deem beneficial.

- Spectrum sharing has been allowed; telecom operator can share where they deem beneficial.

- AGR (Adjusted Gross Revenue):

Significance:

- The telecom reforms announced by the government are the beginning of a new era for the sector as well as for boosting investment in the industry that is reeling under debt burden.

- These reforms will help bring alive the digital aspirations of 1.3 billion people and accelerate India's journey to be a digitally powered economy.

News Summary:

- The government is confident of resolving issues related to high spectrum pricing with the industry, Telecom Minister Shri Ashwini Vaishnaw said recently.

- He added that everything was “more or less” on track for auction of spectrum, including 5G airwaves, by June 2022.

- He said the main issue was the industry’s demand for a further reduction in spectrum prices, which would be “deliberated in a logical and systematic manner.”

- In all, more than 1,00,000 MHz of airwaves have been recommended to be put up for auction.

- The total spectrum on offer at reserve price is valued at around Rs. 5 lakh crore for 20 years.

Mains Article

29 Apr 2022

In News:

- A new Global Security Initiative has been put forward by Chinese President Xi Jinping.

- This initiative will look to counter the S. Indo-Pacific strategy and the Quad – the India, U.S., Australia, Japan grouping.

What’s in Today’s Article:

- QUAD – About, Objective, evolution, naval exercise, first summit, advantages, challenges, QUAD is not anti-China

- News Summary

IN Focus: Quad

About

- The grouping of four democracies –India, Australia, US and Japan– is known as the quadrilateral security dialogue or quad.

- The aim of this grouping is to ensure a free and open international order based on the rule of law in the Indo- Pacific.

Objectives of the Quad

- The group’s primary objectives include

- maritime security,

- combating the Covid-19 crisis, especially vis-à-vis vaccine diplomacy,

- addressing the risks of climate change,

- creating an ecosystem for investment in the region and

- boosting technological innovation.

- maritime security,

Evolution

- Following the Indian Ocean tsunami, India, Japan, Australia, and the US created an informal alliance to collaborate on disaster relief efforts.

- Quad as a formal group was first mooted by Japanese Prime Minister Shinzo Abe in However, due to Chinese resistance and reluctance shown by India, it could not move ahead.

- Later, during the 2017 ASEAN Summits, all four former members re-joined negotiations to revive the quadrilateral alliance.

- The Quad was upgraded to the ministerial level in September 2019.

Naval Exercise

- In November 2020, the navies of Australia, India, Japan and the United States held their biggest naval drills, known as Malabar exercise.

- It was the first time since 2007 that all members of Quad participated in a joint military drill.

First-ever summit of QUAD leaders

- In March 2021, the first-ever summit of QUAD leaders took place

- 1st in-person Quad Summit took place in September 2021 in US.

- 1st in-person Quad Summit took place in September 2021 in US.

- It was participated by the PMs/Presidents of all the member countries. The summit was hosted by US.

Advantages:

- Greater cooperation among democratic nations in changed scenario

- Since the tsunami, climate change has grown more perilous, new technologies have revolutionized our daily lives, geopolitics have become ever more complex, and a pandemic has devastated the world.

- Since the tsunami, climate change has grown more perilous, new technologies have revolutionized our daily lives, geopolitics have become ever more complex, and a pandemic has devastated the world.

- Free, open, resilient and inclusive Indo-Pacific

- Quad countries are striving to ensure that the Indo-Pacific is accessible and dynamic, governed by international law.

- It wants to create an environment in which all countries are able to make their own political choices, free from coercion.

- Quad countries are striving to ensure that the Indo-Pacific is accessible and dynamic, governed by international law.

Challenges:

- Assertiveness of China

- Chinese officials have likened the group to a “mini-NATO” and said its activities are aimed at targeting third parties.

- Beijing sees Quad as part of a strategy to encircle China and has pressured countries like Bangladesh to avoid cooperating with the group.

- Chinese officials have likened the group to a “mini-NATO” and said its activities are aimed at targeting third parties.

- China as a Trading partner

- Beijing has emerged as the most important trading partner of the Indian Ocean region.

- Beijing has emerged as the most important trading partner of the Indian Ocean region.

- Approach of Member Countries

- While USA is quite vocal in naming the aggressive China, other members show restraint and avoid naming China directly.

- There is difference in the approach as well. E.g., USA looks the Indo-Pacific region militarily. On the other hand, India views this region diplomatically.

- While USA is quite vocal in naming the aggressive China, other members show restraint and avoid naming China directly.

- Different Areas of Prioritisation

- The way that the four different Quad members view their interests in the Indo-Pacific leads them to prioritise different areas.

- For instance, for the US, South China Sea and East China Sea are vital. Same goes for Japan. And for Australia, it also includes the Western Pacific.

- But for India, the Quad is about the Indian Ocean and South China Sea is a secondary theatre.

- The way that the four different Quad members view their interests in the Indo-Pacific leads them to prioritise different areas.

- ASEAN

- As of now there are no signs that the ASEAN is willing to take a united stand on many issues so far raised by Quad.

- It would be difficult for the Quad to execute any effective policy minus the cooperation from the ASEAN countries.

- As of now there are no signs that the ASEAN is willing to take a united stand on many issues so far raised by Quad.

- RCEP

- Japan and Australia joined the Regional Comprehensive Economic Partnership (RCEP).

- This is an indication of their desire to do business with China even as they seek to deter its growing clout in the region.

- Japan and Australia joined the Regional Comprehensive Economic Partnership (RCEP).

Quad is not anti-China

- There was no direct reference to China or military security in the joint statement released after first virtual ministerial meeting.

- Experts believe that the Quad will refrain from addressing the military threat posed by China and instead focus on its economic and technological influence.

- The Quad had decided to establish working groups on vaccine development and critical technologies.

- This can be viewed as an attempt to create a democratic, inclusive blueprint that will encourage other states to work with the Quad.

News Summary

- While speaking at the Boao Forum in China, President Xi Jinping has proposed a Global Security Initiative.

Aim of this initiative

- As per the Chinese President, Global Security Initiative will stay committed to the vision of common, comprehensive, cooperative and sustainable security.

- It would oppose unilateralism, and say no to group politics and bloc confrontation.

- This initiative would oppose the wanton use of unilateral sanctions and long-arm jurisdiction.

Key Principles

- Build an Asian security model

- This initiative would build an Asian security model of mutual respect, openness and integration.

- It would oppose the destruction of the international order under the banner of so-called rules.

- It will also oppose the dragging of the world under the cloud of the new cold war.

- This initiative would build an Asian security model of mutual respect, openness and integration.

- Oppose Indo-Pacific strategy of US

- This initiative will oppose the use of the Indo-Pacific strategy to divide the region and create a new Cold War, and the use of military alliances to put together an Asian version of NATO.

- This initiative will oppose the use of the Indo-Pacific strategy to divide the region and create a new Cold War, and the use of military alliances to put together an Asian version of NATO.

Mains Article

29 Apr 2022

In News:

- Prime Minister Narendra Modi said the centre is keen on completely lifting the controversial Armed Forces (Special Powers) Act of 1958 from the northeast.

What’s in Today’s Article:

- AFSPA – About, states where AFSPA is in effect, disturbed area, controversial provisions, various judgements, way forward

- News Summary

In Focus: Armed Forces (Special Powers) Act, 1958 [AFSPA]

About AFSPA:

- The Armed Forces (Special Powers) Act was enacted in 1958 to bring under control what the government of India considered disturbed areas.

- AFSPA can be implemented in an area after it has been declared as disturbed.

- AFSPA can be implemented in an area after it has been declared as disturbed.

- Under its provisions, the armed forces have been empowered to:

- Open fire; enter and search without warrant, and arrest any person who has committed a cognisable offence.

- Open fire; enter and search without warrant, and arrest any person who has committed a cognisable offence.

- Prosecution of the officer on duty needs prior permission of the Central Government.

States where AFSPA is in effect

- States under AFSPA includes:

- Jammu & Kashmir, Assam, Nagaland, Manipur (excluding seven assembly constituencies of Imphal),

- Arunachal Pradesh (only the Tirap, Changlang and Longding districts plus a 20-km belt bordering Assam)

- It was completely lifted from Meghalaya in April 2018. It was repealed in Tripura in 2015.

- Jammu & Kashmir, Assam, Nagaland, Manipur (excluding seven assembly constituencies of Imphal),

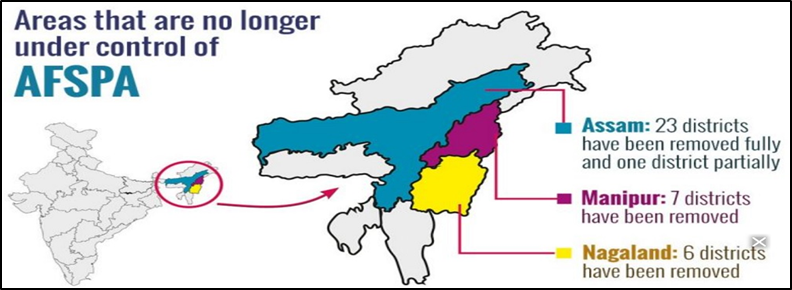

- From April 1, 2022, AFSPA has partially been withdrawn from parts of three Northeast states— Assam, Nagaland and Manipur.

Disturbed Area:

- The state or central government considers those areas as ‘disturbed’

- By reason of differences or disputes between members of different religious, racial, language or regional groups or castes or communities.

- By reason of differences or disputes between members of different religious, racial, language or regional groups or castes or communities.

- Once declared ‘disturbed’, the region has to maintain status quo for a minimum of three months, according to The Disturbed Areas (Special Courts) Act, 1976.

- The state governments can suggest whether the Act is required to be enforced or not.

- But under Section (3) of the Act, their opinion can still be overruled by the governor or the centre.

Controversial provisions

- Section 3 – It empowers the Centre to declare any area as Disturb Area without taking consent of the concerned state.

- Section 4 – Accords certain power to an authorised officer which also includes power to open fire at any individual even if it results in death.

- Under this section, the officer has also been given the power to (a) arrest without a warrant; and (b) seize and search any premise without any warrant

- Under this section, the officer has also been given the power to (a) arrest without a warrant; and (b) seize and search any premise without any warrant

- Section 7 – It mandates prior executive permission from central or state authorities for prosecution of a member of the security forces.

Various Judgements and Committee reports on AFSPA:

- In the Naga People’s Movement of Human Rights v. Union of India case, the Supreme Court upheld the constitutionality of the law.

- However, the judgment made some notable conclusions such as:

- Although Central Government is empowered to declare an area disturbed on its own, it is desirable that it consults the state before making such declaration.

- The act is not conferring any arbitrary powers to declare an area as a ‘disturbed area’

- The declaration should be for a limited duration and there should be periodic review at 6 months.

- The officers should use minimal force necessary for effective action.

- Although Central Government is empowered to declare an area disturbed on its own, it is desirable that it consults the state before making such declaration.

- In 1997, the Apex Court also laid down a number of dos and don’ts for AFSPA. These are:

- Any person arrested and taken into custody should be handed over to the nearest police station with the least possible delay.

- The property seized during the course of a search conducted must also be handed over to the officer-in-charge of the nearest police station.

- The provisions of the CrPC governing search and seizure have to be followed during the course of search and seizure conducted under AFSPA.

- A complaint containing an allegation about misuse or abuse of the powers conferred under this Act shall be thoroughly inquired into.

- Any person arrested and taken into custody should be handed over to the nearest police station with the least possible delay.

- However, the judgment made some notable conclusions such as:

- Santosh Hegde Committee

- The Committee, constituted by SC, reported the use of disproportionate force and intrusion of security forces in areas which are not notified as disturbed areas.

- The Commission even went to the extent of saying that AFSPA was an impediment to achieving peace in regions such as Jammu and Kashmir and the northeast.

- B P Jeevan Reddy Committee

- Justice B P Jeevan Reddy committee was appointed in 2004 to review the provisions of the act in the north eastern states.

- This committee recommended that the AFSPA should be repealed and its appropriate provisions should be included in the Unlawful Activities (Prevention) Act (UAPA).

- Further, the powers of the army / paramilitary officers should be clearly demarcated.

- Moreover, the committee recommended that grievance cells should be created in each district where such law is in force.

- The report was endorsed by the 2nd ARC report

- Justice B P Jeevan Reddy committee was appointed in 2004 to review the provisions of the act in the north eastern states.

Why is the law controversial?

- AFSPA has often been criticised as a draconian Act for

- The unbridled power it gives to the armed forces and

- The impunity that security personnel enjoy for their actions taken under the law.

- The unbridled power it gives to the armed forces and

- Under AFSPA, the armed forces may shoot to kill or destroy a building on mere suspicion.

- Irom Sharmila, known as the Iron lady of Manipur, has been a towering figure who is well-known for her 16-year-long hunger strike against AFSPA.

Way Forward:

- Frequent misuse of AFSPA by security forces has led to the widespread resentment against this act.

- However, the annulment of the law would seriously affect the governance in the insurgency-affected states.

- However, the annulment of the law would seriously affect the governance in the insurgency-affected states.

- Hence, the need of the hour is to provide certain safeguards so as to prevent its misuse. This can include steps like:

- Establishing grievance cells in each district where such law is in force,

- Ensuring accountability of the officer in charge,

- Investigations by independent and impartial authorities are few steps in this regard.

- Establishing grievance cells in each district where such law is in force,

News Summary

- PM Modi said efforts were on to improve the law-and-order situation for the controversial AFSPA to be completely lifted from the northeast.

- He said this while addressing a Peace, Unity and Development rally in Assam.

Key Highlights of the speech

- Peace a necessary condition for removal of AFSPA

- He said, from April 1, 2022, the AFSPA could be withdrawn partially from Assam, Manipur and Nagaland due to peaceful conditions since 2014.

- The Bodo Accord opened the doors for permanent peace

- The Bodo Accord opened the doors for permanent peace

- The central government removed AFSPA from many areas due to better administration and the return of peace.

- The incidents of violence dropped by 75% in the last eight years.

- The incidents of violence dropped by 75% in the last eight years.

- This is the reason that AFSPA was removed from Tripura and then Meghalaya.

- He said, from April 1, 2022, the AFSPA could be withdrawn partially from Assam, Manipur and Nagaland due to peaceful conditions since 2014.

- The 400th anniversary of Lachit Borphukan

- He noted the coincidence of the Azadi ka Amrit Mahotsav and the 400th anniversary of Lachit Borphukan.

- Lachit Borphukan was the 17th century Ahom general who stopped the Mughals from capturing Assam.

- He noted the coincidence of the Azadi ka Amrit Mahotsav and the 400th anniversary of Lachit Borphukan.

- Cancer care hub

- PM inaugurated seven advanced cancer hospitals under the Assam Cancer Care Foundation.

- There will be 17 such centres across Assam to serve patients from the other north-eastern States and neighbouring countries such as Bhutan.

- According to a government study in 2021, the northeast is the “cancer capital” of India.

- Arunachal Pradesh’s Papum Pare district and Mizoram’s Aizawl district recording the highest incidence of new cases among females and males respectively.

- Arunachal Pradesh’s Papum Pare district and Mizoram’s Aizawl district recording the highest incidence of new cases among females and males respectively.

- PM inaugurated seven advanced cancer hospitals under the Assam Cancer Care Foundation.

April 28, 2022

Mains Article

28 Apr 2022

In News:

- The Tamil Nadu Assembly recently passed two Bills that seek to transfer the Governor’s power in appointing Vice-Chancellors (VC) of 13 state universities to the state government.

What’s in today’s article:

- About VC (Role, Appointment)

- About Bills passed by TN Assembly (Provisions, Similar examples, Supreme Court’s Observations, UGC’s Role)

About Vice-Chancellor:

- Vice chancellors lead the university's academic and administrative departments.

- They may serve on several university councils, assist with policy development and academic planning, prepare budgets, and maintain the institution's positive image.

- As per the University Grants Commission (UGC) Guidelines, the Visitor/Chancellor shall appoint the Vice Chancellor out of the panel of names recommended by the search-cum-selection committee.

- The Governor of the state is the honorary chancellor of all State owned universities.

- The Governor of the state is the honorary chancellor of all State owned universities.

About the Bills passed by Tamil Nadu Assembly:

- The Tamil Nadu Universities Laws (Amendment) Act, 2022, substitutes the expression “chancellor” in the original Act with “government” with regards to both appointment and removal of VCs.

- A separate bill to amend the Chennai University Act, 1923 [Chennai University (Amendment) Act, 2022], with similar intent, was passed by the House.

- Currently, the Governor, in his capacity as the Chancellor of state universities, has the power to pick a VC from the shortlisted names.

- Currently, the Governor, in his capacity as the Chancellor of state universities, has the power to pick a VC from the shortlisted names.

- The Bills also seek to empower the state government to have the final word on the removal of VCs, if needed.

- Removal will be carried out based on inquiries by a retired High Court judge or a bureaucrat who has served at least as a Chief Secretary

Such Bills by other States in recent times:

- Maharashtra:

- In December 2021, the Maharashtra Assembly passed a Bill amending the Maharashtra Public Universities Act, 2016.

- Under the original Act, the Maharashtra government had no say in appointment of VCs. If the changes take effect, the Governor will be given two names to choose from by the state government.

- In December 2021, the Maharashtra Assembly passed a Bill amending the Maharashtra Public Universities Act, 2016.

- West Bengal:

- In 2019, the West Bengal government took away the Governor’s authority in appointing VCs to state universities.

- It has also hinted at removing the Governor as the Chancellor of the universities.

- In 2019, the West Bengal government took away the Governor’s authority in appointing VCs to state universities.

- Gujarat:

- In Gujarat, only the chief minister has the power to appoint a VC since 1949.

- The Gujarat University Act, 1949 states that “the vice-chancellor shall be appointed by the state government from amongst three persons recommended by a (search-cum-selection) committee”.

- However, last month the Supreme Court set aside the VC appointment of Gujarat’s SP University by the state government.

- In Gujarat, only the chief minister has the power to appoint a VC since 1949.

- Telangana:

- The Telangana Universities Act, 1991 states that the search committee shall “submit a panel of three persons to the Government in alphabetical order and the Government shall appoint the Vice-Chancellor from out of the said panel”.

- The Telangana Universities Act, 1991 states that the search committee shall “submit a panel of three persons to the Government in alphabetical order and the Government shall appoint the Vice-Chancellor from out of the said panel”.

Supreme Court’s Observation:

- In March 2022, while setting aside the appointment of the Vice-Chancellor of Gujarat’s SP University by the state government, the Supreme Court made some key observations.

- The court said “any appointment as a Vice Chancellor contrary to the provisions of the UGC Regulations can be said to be in violation of the statutory provisions, warranting a writ of quo warranto”.

- It said every subordinate legislation of the UGC, in this case the one on minimum standards on appointments, flows from the parent UGC Act, 1956.

- In case of any conflict between state legislation and central legislation, central legislation shall prevail by applying the rule/principle of repugnancy as enunciated in Article 254 of the Constitution as the subject ‘education’ is in the Concurrent List of the Seventh Schedule of the Constitution.

- Under Article 254, If any legislation enacted by the state legislature is repugnant to the legislation enacted by the Parliament, then the state legislation will be declared void, and the legislation enacted by the Parliament will prevail over the former.

- Under Article 254, If any legislation enacted by the state legislature is repugnant to the legislation enacted by the Parliament, then the state legislation will be declared void, and the legislation enacted by the Parliament will prevail over the former.

- The court said “any appointment as a Vice Chancellor contrary to the provisions of the UGC Regulations can be said to be in violation of the statutory provisions, warranting a writ of quo warranto”.

Role of University Grants Commission:

- Although Education comes under the Concurrent List, but entry 66 of the Union List — “coordination and determination of standards in institutions for higher education or research and scientific and technical institutions” — gives the Centre substantial authority over higher education.

- According to the UGC Regulations, 2018, the “Visitor/Chancellor” — mostly the Governor in states — shall appoint the VC out of the panel of names recommended by search-cum-selection committees.

- Higher educational institutions, particularly those that get UGC funds, are mandated to follow its regulations.

- These are usually followed without friction in the case of central universities, but are sometimes resisted by the states in the case of state universities.

Mains Article

28 Apr 2022

In News:

- With prices sky-rocketing due to the ongoing Ukraine-Russia conflict, the Union Cabinet has recently approved a subsidy of more than Rs 60,000 crore for non-urea fertilisers for the first six months of this financial year.

What’s in today’s article:

- About Fertilizers (Meaning, Use, Types)

- How Subsidy Works (Mechanism, Government Schemes, Beneficiaries, Way Forward)

- News Summary

About Fertilizers:

- A fertilizer is a chemical product either mined or manufactured material containing one or more essential plant nutrients that are immediately or potentially available in sufficiently good amounts.

- Fertilizers have played an essential role in agricultural production, providing vital nutrients for crops, thereby increasing their demands over the years.

- As an agrarian country, India is home to numerous small and marginal farmers and is often plagued by low productivity and low quality.

- Crops are mainly rain-fed and cultivated on a single piece of land over time, decreasing soil fertility in many regions.

- Thereby, increasing quantities of nitrogen fertilizers have been used in the country.

Macro & Micro Elements in Fertilizers:

- Macro Nutrients: Nitrogen (N), Phosphorus (P), Potash (K), Calcium, Sulfur (S), and Magnesium are known as macro-nutrients (required in comparatively larger amounts).

- Micro Nutrients: Iron (Fe), Zinc (Zn), Copper, Boron, Manganese Molybdenum, Chloride, and others are the micro-nutrients (required in a smaller quantity) for the growth and development of crop plants.

- Among the various types, NPK (nitrogen, phosphorus, and potassium) fertilizers are the most common ones, and Urea stands as the most highly consumed fertilizer in India.

- India is the second-largest consumer of fertilizers globally, with an annual consumption of more than 55.0 million metric ton.

About Fertilizer Subsidy:

- Farmers buy fertilisers at MRPs (maximum retail price) below their normal supply-and-demand-based market rates or what it costs to produce/import them.

- The MRP of neem-coated urea, for instance, is fixed by the government at Rs 5,922.22 per tonne, whereas its average cost-plus price payable to domestic manufacturers and importers comes to around Rs 17,000 -Rs 23,000 per tonne, respectively.

- The difference, which varies according to plant-wise production cost and import price, is footed by the Centre as subsidy.

- The MRPs of non-urea fertilisers are decontrolled or fixed by the companies. However, the Centre pays a flat per-tonne subsidy on these nutrients to ensure reasonable prices.

How is the Subsidy Paid & Who gets it?

- The subsidy goes to fertiliser companies, although its ultimate beneficiary is the farmer who pays MRPs less than the market-determined rates.

- Under the Direct-Benefit Transfer (DBT) system, subsidy payment to the companies would happen only after actual sales to farmers by retailers.

- Each retailer now has a point-of-sale (PoS) machine linked to the Department of Fertilisers’ e-Urvarak DBT portal.

- Anybody buying subsidised fertilisers is required to furnish his/her Aadhaar unique identity or Kisan Credit Card number.

- Only upon the sale getting registered on the e-Urvarak platform can a company claim subsidy.

Government Schemes/Initiatives:

- Nutrient Based Subsidy Scheme, 2010:

- Under the scheme, a fixed rate of subsidy based on the weight (Rs per kg basis) is announced for nutrients namely Nitrogen (N), Phosphate (P), Potash (K) and Sulphur (S) by the government on an annual basis.

- It aims at ensuring the balanced use of fertilizers, improving agricultural productivity, promoting the growth of the indigenous fertilizers industry and also reducing the burden of Subsidy.

- Urea is not covered under the scheme and due to delay in NBS subsidy payments, Fertilizer companies focus more on Urea than other fertilizers. Hence, the ideal ratio of NPK is disrupted

- Under the scheme, a fixed rate of subsidy based on the weight (Rs per kg basis) is announced for nutrients namely Nitrogen (N), Phosphate (P), Potash (K) and Sulphur (S) by the government on an annual basis.

- New Investment Policy 2012:

- The Government had notified New Investment Policy – 2012 in January, 2013 with the main objective to facilitate fresh investment, make India self-reliant and reduce import dependency in urea sector.

- The Government had notified New Investment Policy – 2012 in January, 2013 with the main objective to facilitate fresh investment, make India self-reliant and reduce import dependency in urea sector.

- Neem-coated Urea 2015:

- Urea that is coated with neem tree seed oil is called neem-coated urea.

- The Department of Fertilizers has made it mandatory for all the domestic producers to produce 100% urea as Neem Coated Urea (NCU).

- Benefits of NCU include:

- Slow down the process of nitrification of urea

- Enhance the yield

- Decrease urea requirement, hence save money

- Slow down the process of nitrification of urea

- Urea that is coated with neem tree seed oil is called neem-coated urea.

- New Urea Policy 2015:

- The New Urea Policy was released in May 2015.

- The Policy seeks to:

- Increase indigenous urea production,

- Promote energy efficiency in urea production, and

- Reduce subsidy burden on the Central government.

- Increase indigenous urea production,

- The New Urea Policy was released in May 2015.

- Gas Pooling in Fertilizers:

- Currently, there are 30 urea producing units in the country, out of which 27 units are gas based and 3 units are Naphtha based.

- Gas Pooling mechanism was introduced by the Government in 2015.

- It is intended to supply gas at uniform delivered price to all fertilizer plants on the gas grid for production of urea through a pooling mechanism.

- Currently, there are 30 urea producing units in the country, out of which 27 units are gas based and 3 units are Naphtha based.

Way Forward:

- The Central government should consider paying farmers a flat per-acre cash subsidy that they can use to purchase any fertiliser.

- The amount could vary, depending on the number of crops grown and whether the land is irrigated or not.

- This is a sustainable solution to prevent diversion and also encourage judicious application of fertilisers, with the right nutrient (macro and micro) combination based on proper soil testing and crop-specific requirements.

News Summary:

- With prices sky-rocketing due to the ongoing Ukraine-Russia conflict, the Union Cabinet has recently approved a subsidy of more than Rs 60,000 crore for non-urea fertilisers for the first six months of this financial year.

- This is almost 45.23% more than the Budget Estimates for non-urea fertilisers for the entire FY-23.

- This is almost 45.23% more than the Budget Estimates for non-urea fertilisers for the entire FY-23.

- This will enable companies to continue selling the vital soil nutrients at affordable rates to farmers.

Mains Article

28 Apr 2022

In News:

- The Central government is planning to revamp the Civil Registration System (CRS) to enable the registration of birth and death in real-time.

What’s in Today’s Article:

- Civil Registration System – About, Recent initiatives to strengthen CRS, Proposed amendment to the Registration of Births and Deaths Act, 1969

- News Summary

In Focus: Civil Registration System (CRS) in India

About

- With the enactment of the Registration of Births and Death Act (RBD Act) in 1969, the registration of births, deaths and still births have become mandatory in India.

- The Registrar General, India (RGI) at the Central Government level coordinates and unifies the activities of registration throughout the country.

- The Chief Registrar is mandated to publish a statistical report on the registered births and deaths during the year.

- The Chief Registrar is mandated to publish a statistical report on the registered births and deaths during the year.

- However, implementation of the statute is vested with the State Governments.

- The registration of births and deaths in the country is done by the functionaries appointed by the State Governments.

- The registration of births and deaths in the country is done by the functionaries appointed by the State Governments.

Recent initiatives to strengthen CRS

- Uniform Software Application for Registration of Births and Deaths

- A software application for online and offline registration of birth and death has been developed.

- The application that is presently available in English is being customized in 13 Indian languages.

- A software application for online and offline registration of birth and death has been developed.

- Database of Institutions

- A nationwide database of medical Institutions has been prepared.

- The plan is to electronically monitor the registration of events occurring in these institutions through an ICT enabled platform.

- A nationwide database of medical Institutions has been prepared.

- Application to Monitor Institutional Events

- An SMS based application called "Event Monitoring System for Registration" has been developed and is currently under pilot testing.

- An SMS based application called "Event Monitoring System for Registration" has been developed and is currently under pilot testing.

- Data digitization

- Project to keep old records in easy to retrieve digital form has been started.

- This will help in storage of registers in electronic format and allow easy access to the records.

- Project to keep old records in easy to retrieve digital form has been started.

- National Population Register

- The Civil Registration System has been linked to the NPR.

- The Civil Registration System has been linked to the NPR.

Proposed amendment to the Registration of Births and Deaths Act, 1969

- The RGI that functions under the MHA has proposed amendment to the Registration of Births and Deaths Act, 1969.

- This amendment will enable it to maintain the database of registered birth and deaths at the national level.

- According to the proposed amendment, the database may be used to update the Population Register, Electoral Register, Aadhar, Ration Card, Passport and Driving License databases.

News Summary

- According to the 2020-21 annual report of the Ministry of Home Affairs (MHA), the government is planning to automate the Civil Registration System (CRS).

- This will enable the registration of birth and death in real-time with minimum human interface.

Key Highlights of the report

- Challenges faced by CRS in current form

- The CRS system is facing challenges in terms of timelines, efficiency and uniformity, leading to delayed and under-coverage of birth and death.

- The CRS system is facing challenges in terms of timelines, efficiency and uniformity, leading to delayed and under-coverage of birth and death.

- Need to introduce transformational changes in CRS

- For providing prompt service delivery to the public, the Government of India has decided to introduce transformational changes in the CRS.

- This will be done through an IT enabled backbone which will enable registration of birth and death in real-time basis with minimum human interface.

- For providing prompt service delivery to the public, the Government of India has decided to introduce transformational changes in the CRS.

- Changes will be related to the automation of the processes

- The report said the changes would be in terms of automating the process delivery points so that the service delivery was time-bound, uniform and free from discretion.

- The changes would be sustainable, scalable and independent of the location.

- The report said the changes would be in terms of automating the process delivery points so that the service delivery was time-bound, uniform and free from discretion.

- Need to update the NPR again

- The CRS is linked to the National Population Register (NPR), which already has a database of 119 crore residents.

- The report said there was a need to update the NPR again to incorporate the changes due to birth, death and migration.

- NPR was first collated in 2010 and updated in 2015 with Aadhaar, mobile and ration card numbers.

- The NPR was to be updated with the decennial Census exercise that has been postponed indefinitely due to the COVID-19 pandemic.

- NPR was first collated in 2010 and updated in 2015 with Aadhaar, mobile and ration card numbers.

- The CRS is linked to the National Population Register (NPR), which already has a database of 119 crore residents.

- Registered births and deaths had witnessed a steady increase

- The report noted that the proportion of total registered births and deaths had witnessed a steady increase over the years.

- The registration level of births has increased to 89.3% in 2018 from 81.3% in 2009.

- On the other hand, the registration level of deaths has increased from 66.9% in 2009 to 86.0% in 2018.

- The registration level of births has increased to 89.3% in 2018 from 81.3% in 2009.

- It pointed out, adding that the level of total registration of deaths was lower than that of births in most of the States.

- This may partly be attributed to non-reporting of domiciliary deaths and deaths of females and infants.

- This may partly be attributed to non-reporting of domiciliary deaths and deaths of females and infants.

- The report noted that the proportion of total registered births and deaths had witnessed a steady increase over the years.

Mains Article

28 Apr 2022

In News:

- The Central government told the Supreme Court that Delhi, the nation’s capital and a sprawling metropolis, should be under its control.